The stock market

Wall Street’s rollercoaster ride continued throughout May with three weeks of volatility, including the major indices hitting a 52-week low on May 20.

On that date, the S&P 500 registered an interday decline of almost 21% since its January high, and the Dow fell for the eighth consecutive week, its longest weekly losing streak since 1923.

But May’s swoon was salvaged by a strong finish the last week of the month, with the S&P 500 rallying by nearly 8.5% through June 1, 2022.

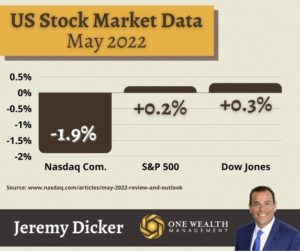

For the month, the three major indices performed as follows:

S&P 500 0.2%

Dow Jones Industrials 0.3%

Nasdaq Composite -1.9%

Despite late May’s rally, stocks remain significantly off their record highs.

S&P 500 -14.2% below record high

Dow Jones Industrials -10.7% below record high

Nasdaq Composite -25.5% below record high

Best and worst performing sectors in May

Returns for Global Industry Classification Standard (GICS) sectors through May 2022 include:

- Energy 15.8%

- Utilities 4.3%

- Financials 2.7%

- Communications 1.8%

- Healthcare 1.4%

- Basic Materials 1.1%

- Industrials -0.5%

- Technology -0.9%

- Staples -4.6%

- Consumer Disc. -4.9%

- REITs -5.2%

Biggest winners and losers

Year-to-date in 2022 (up to June 1), many of the top stock risers are from the energy sector, which is predictable in our economic and geopolitical climate. Of the top-10 stocks for percentage increases through June 1, nine of them are oil, gas, mining, or energy firms.

- Occidental Petroleum (OXY) 139.1%

- Marathon Oil (MRO) 91.4%

- Coterra Energy (CTRA) 80.7%

- Halliburton (HAL) 77.1%

- APA (APA) 74.8%

Meanwhile, the stocks with the sharpest decreases in 2022 so far are a mixed bag of entertainment, payment servicing, and retail firms, including:

- Netflix (NFLX) -67.2%

- Etsy (ETSY) -62.9%

- Align Technologies (ALGN) -57.8%

- PayPal (PYPL) -54.8%

- Under Armour (UAA) -50.1%

A short list of the most popular and iconic firms that have also seen sharp decreases through 2022 includes:

- Apple (AAPL) -16.2%

- Microsoft (MSFT) -19.2%

- Alphabet (GOOGL) -21.5%

- Amazon (AMZN) -27.9%

- Tesla (TSLA) -28.2%

While it’s not a stock, one of the biggest losers in 2022 so far has been cryptocurrency, with Bitcoin down 17.5% during the month of May and sinking more than 50% since its November 2021 high.

Inflation

Note: The next Consumer Price Index report is scheduled to be released on June 10, 2022, encapsulating May’s data.

Last month, U.S. inflation waned for the first time since August of 2021. However, it was not all positive news as prices still increased – albeit at a slower pace.

For the 12-month period ending in April 2022, the Consumer Price Index (CPI), a widely used inflation metric, increased by 8.3%.

That represented a drop from 8.5% in March, the highest measure of inflation in more than 40 years.

Month-to-month, the CPI increased “only” 0.3% March to April 2022, following up on monthly increases of 1.2%, 0.8%, 0.8%, 0.6%, 0.6%, 0.7%, and 0.9% spanning back to November of 2021.

Employment

According to ADP’s national employment report released June 2, nonfarm private payrolls increased by 128,000 from April to May (on a seasonally adjusted basis).

That comes in lower than ADP’s April reporting of 202,000 new jobs, and 249,000 new jobs in March.

Within this month’s payroll increases, small businesses actually lost 91,000 jobs, while mid-sized businesses gained 97,000 employees and large firms added 122,000 workers.

The goods-producing sector and service sector added the most new jobs with +24,000 and +104,000, respectively. Information (-2,000) and construction (-2,000) were two sectors that lost momentum from April to May.

Price Watch

All inflation is not created equal and certain goods and services have seen meteoric spikes in cost compared to others.

Gleaned from April’s inflationary data (again, updated May data is set to be released June 10), we see that over a 12-month span, the biggest price increases occurred with:

- Air travel +33.3% (the largest increase since December 1980)

- Energy prices +30.3%

- Grocery store prices +10.8% (the largest increase since November 1980)

- Food (including eating out) +9.4% (the largest increase since April 1981)

- Housing costs (including rent) +5.1%

Rate hikes and the Fed

On May 4, the Federal Reserve rolled out a 50bp rate hike as part of their effort to stall inflationary growth, which was to be fully expected. They’ve also dropped plenty of breadcrumbs that we can anticipate another 50bp rate increase at their June 14-15 meeting, with Wall Street factoring in the risk of several more rate increases throughout the year.

Coupled with rate increases, the Fed looks to curb inflation by reducing its $8.9 trillion balance sheet starting in June.

Fed Chairman Jerome Powell is on record that there may be “some pain” in reducing inflation and stabilizing the economy, with their target a “softish” landing where inflation recedes to 2% while the labor market remains strong but we avoid the hard stop of a recession.

GDP and economic growth

Through the first three months of 2022 (Q1), the U.S. economy contracted by 1.5%. That registers slightly lower than the estimated 1.4% negative GDP growth for Q1 2022.

That negative GDP growth follows up a stellar Q4 2021 in which the economy expanded by 6.9%.

2022’s auspicious GDP numbers reflect a sharp decline in private inventory investments (led by declines in motor vehicle wholesale trade), exports, and the weening-off of federal government stimulus spending (as well as state and local spending) during the pandemic.

For Q1 2022, personal consumption expenditures (PCE), nonresidential fixed investments, and residential fixed investments all showed positive growth.

Notable Quote

“Volatility is not synonymous of risk but – for those who truly understand it – for wealth.”

-Francois Rochon,

President, Giverny Capital