Part of planning for your future involves making educated decisions about managing your wealth and savings. Our Financial Services Representatives have the knowledge to guide you through the increasingly complex roadmap of investments that are available to you in today’s growing financial market.

An investment is an up-front commitment of capital to purchase financial products with the intention of generating future profit based on interest or appreciation of the capital invested. Most investments also contain the risk that investors may lose part or all of their investment. Investors should be aware of the risk/return potential of any investment products they consider for purchase, as typically the greater the return potential of a given investment, the greater the risk potential. Investors should also consider their own comfort with risk, the length of time they have to invest, the fees charged by the investments they are considering, and their ultimate goal for the investment when making investment decisions.

The financial market offers a wide variety of different investment products for investors to purchase—from relatively straightforward investment types (securities) like stocks, bonds and short-term/cash-equivalent investments to portfolios that combine these investment types within various products, such as mutual funds, annuities and variable life insurance policies.

Investors may choose different investment products to meet a variety of needs, including retirement and estate planning, education financing and for funding purchases of all sizes. Financial Services Representatives can help select appropriate investment products based on an investor’s goal for the investment, individual profile (comfort with risk, length of time to invest) and a product’s fees and tax considerations (many investment products have built-in tax advantages).

Your Financial Services Representative can help you develop a plan for your investments that takes these key factors into consideration.

There are three basic types of investments (called asset classes):

Bonds

Bonds are instruments of debt that represent loans issued by the government or a company. Investors who purchase bonds receive from the issuer a stated rate of interest and the promise of repayment of the principal amount when the bond reaches its stated maturity date. Interest-rate movements up or down typically have the greatest impact on bond prices.

Stocks

Stocks are instruments of equity and represent shares of ownership in a company. They rise and fall with investor perception of the company’s potential or other stock market factors, such as the outlook for the company’s industry, the political climate or the strength of the economy.

Short-term/cash-equivalents

Short-term/cash-equivalents are low- or no-risk investments that generally have lower expected yields than stocks, bonds and other investments – cash-equivalents may not yield enough to keep up with the rate of inflation. Cash-equivalent investments include the following:

- Certificate of Deposit (CD)s represent fixed, interest-bearing time-deposits with a bank or other FDIC-insured institution.

- Money Market Accounts represent portfolio-based investments that derive their value and generate interest by purchasing a variety of short-term debt instruments, including Treasury bills, CDs, bankers acceptances and commercial paper.

Alternative Investments & Private Equity

Why Alternatives?

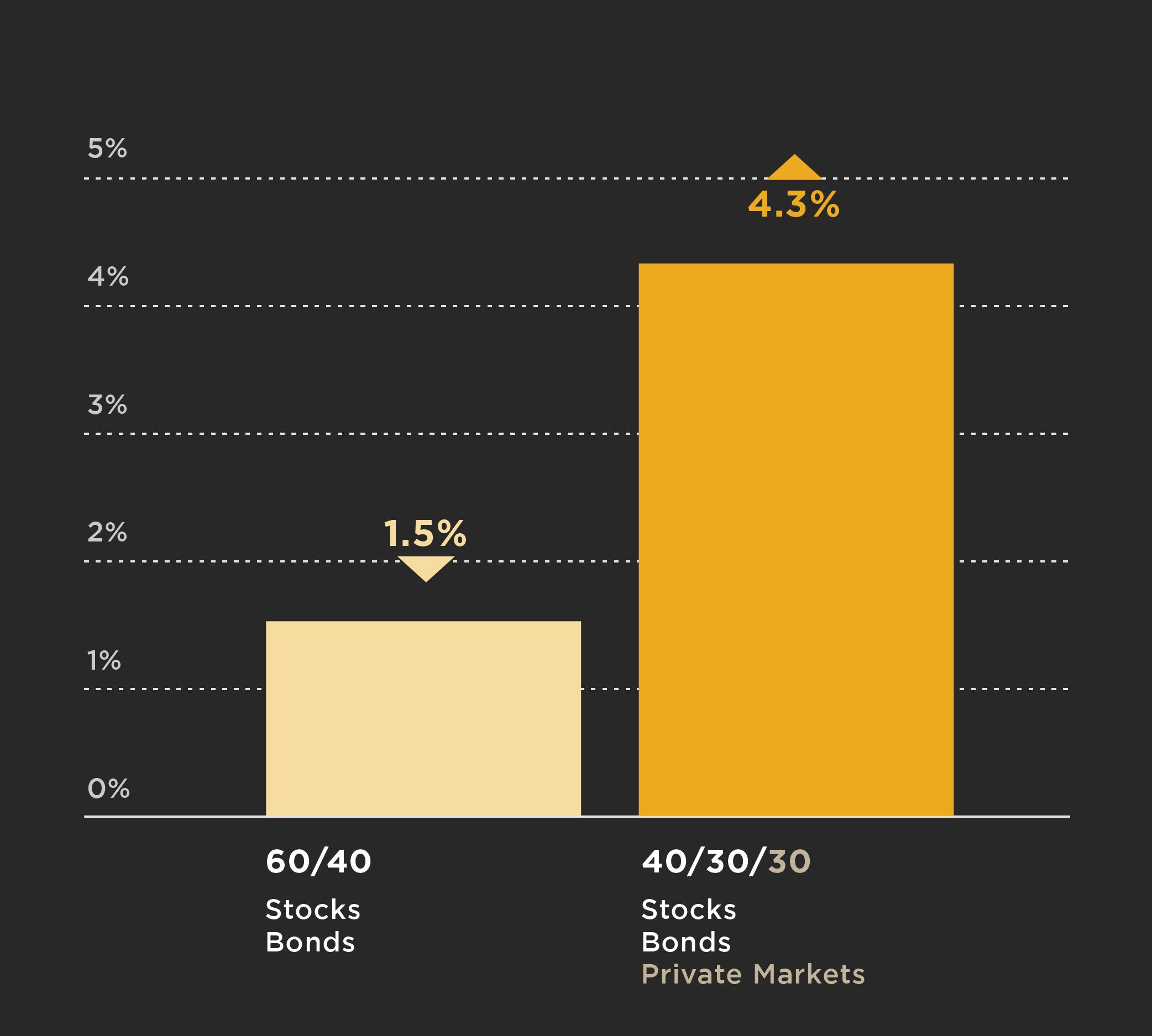

Historically, a traditional portfolio construction of 60% equities and 40% bonds has performed well for investors. The conventional portfolio approach may not always be adequate in generating stable growth and steady cash flows needed to meet one’s financial goals.

An alternative portfolio approach composed of private funds has helped bolster risk-adjusted returns, enhance portfolio diversification, and reduce correlation in market drawdowns.

- Buyout

- Hybrid

- SPVs

- Growth Equity

- Real Estate

- VC

- Direct Lending

- Opportunistic/Special Situations

- Distressed Credit

- Specialty Finance

- Global Macro

- Distressed Securities

- Activist

- Event-Driven

- Multi-Strategy

- Managed Futures

- Long Biased

- Equity Market Neutral

- L/S Equity

- Relative Value Arb.

- Credit

Historical Returns During High Inflation

Source:

KKR, May 2022. “Regime Change: Enhancing the ‘Traditional’ Portfolio.”

Portfolio returns and volatility modeled using annual total returns from 1928 to 2021 for the S&P500, from 1978 to 2021 for Real Estate, from 2004 to 2021 for Infrastructure, from 1928 to 2021 for Bonds, and from 1987 to 2021 for Private Credit. Assumes continuous rebalancing of the portfolios. US equities modeled using the SP500 Index. Bonds modeled using a mix of 50% US T.Bond and 50% Baa Corp Bond annual returns, computed historically by Professor Damodaran (NYU Stern). Real Estate modeled using the NCREIF Property Levered Index. Private Infrastructure modeled using the Burgiss Infrastructure Index. Private Credit modeled using the Burgiss Private Credit All Index. Past performance is not indicative of future results.

ESG Responsible Investing

There’s more to responsible investing than avoiding certain types of stocks. If you’re looking to achieve a positive impact on society while you grow your portfolio, you’re in luck. By embracing Environmental, Social, and Governance considerations, you can align your investments with your values.

ESG Responsible Investing

There’s more to responsible investing than avoiding certain types of stocks. If you’re looking to achieve a positive impact on society while you grow your portfolio, you’re in luck. By embracing Environmental, Social, and Governance considerations, you can align your investments with your values.

Environment

- Sustainability Plans

- Conservation Projects

- Carbon Reduction

- Water Scarcity Plans

- Waste & Wastewater Projects

- Renewable Energy

Governance

- Financial Disclosure Practice

- Regulatory/Compliance

- Pension Management

- Other Post-Employment Benefits

- Budget Management

- Museums

Social

- Student Lending

- Clean Air/Water

- Mass Transit

- Healthcare

- Education

Investing is also about taking steps to protect your financial future. Investors should develop a plan that addresses specific short- and long-term goals and that can be maintained and adjusted, as appropriate.

On the road to financial independence, you don’t have to go it alone and risk making the wrong projections. If you don’t have expertise in financial products and planning, a Financial Services Representative can help you make educated decisions and develop a plan.

Investors should consider the investment objectives, risks, charges, and expenses of mutual funds carefully before investing. This and other information are contained in the fund’s prospectus, which may be obtained from your investment professional. Please read it before you invest. Investments in mutual funds are subject to risk, including possible loss of the principal amount invested. All investments contain risk and may lose value. Investing in the bond market is subject to certain risks including market, interest rate, issuer, credit, and inflation risk. Equities may decline in value due to both real and perceived general market, economic, and industry conditions. CD rates are subject to change and availability and may be liquidated in the secondary market subject to market conditions. Generally, CDs may not be withdrawn prior to maturity. CDs are FDIC insured up to $250,000 per depositor per insured depository institution. Past performance is not a guarantee of future results.

Annuities

People are living longer and that means more time and savings will be spent in retirement. If you need a tax-deferred investment to provide a guaranteed1 stream of income for life or a specified number of years, it might be worth considering an annuity. An annuity is a contract between an insurance company and an annuity owner. In exchange for a purchase payment, or series of payments, the insurance company guarantees1 to pay a stream of income in the future.

There are two types of annuities—Immediate and Deferred.

Immediate Annuities

An immediate annuity is usually purchased with a single premium and begins a stream of income within the first 12 months from the date of issue. You decide when payments will begin within that period and how long to receive income. There are two types of immediate annuities: fixed and variable.

- Immediate Fixed Annuity An immediate fixed annuity provides a guaranteed and predictable stream of income during the payout period.

- Immediate Fixed and Variable Annuity An immediate fixed and variable annuity provides a guaranteed stream of income. The variable income payments fluctuate based on the performance of the variable investment choices selected. A fixed account is also usually offered as an investment choice within this type of contract.

Deferred Annuities

A deferred annuity is specifically designed to help accumulate assets for retirement. It also offers the ability to turn those assets into a guaranteed stream of income at some point in the future. You decide when payments begin and how long to receive income. There are basically two types of deferred annuities: fixed and variable.

- Deferred Fixed Annuity

A deferred fixed annuity earns interest during the contract’s accumulation period. The interest rates are set by the issuing company and are guaranteed not to be lower than the minimum guaranteed interest rate shown in the contract. A contract’s accumulated assets can be converted into a guaranteed stream of income for the future. - Deferred Variable Annuity

A deferred variable annuity offers variable investment choices (and usually a fixed account) in which the contract owner can invest. During the accumulation period, the investment return and value of the annuity will fluctuate in accordance with the investments selected. A contract’s accumulated assets can be converted into a guaranteed stream of income for the future.

Variable annuities and their underlying variable investment options are sold by prospectus only. Investors should consider the investment objectives, risks, charges and expenses carefully before investing. This and other information are contained in the prospectus or summary prospectus, if available, which may be obtained from your investment professional. Please read it before you invest or send money.

1Guarantees are based on the claims-paying ability of the issuing company and do not apply to the investment performance or safety of the amounts held in the variable investment options.

Variable annuities are long term investment vehicles designed to help investors save for retirement and involve certain contract limitations, fees, expenses and risks, including possible loss of the principal amount invested. The investment return and principal value may fluctuate so that the investment, when redeemed, may be worth more or less than original cost. As with many investments, there are fees, expenses and risks associated with these contracts. All guarantees including the death benefit payments are dependent upon the claims paying ability of the issuing company and do not apply to the investment performance of the underlying funds in the variable annuity. Assets in the underlying funds are subject to market risks and may fluctuate in value.

Withdrawals of taxable amounts will be subject to ordinary income tax and possible mandatory federal income tax withholding. If taken prior to age 59½, a 10% IRS penalty may also apply. Withdrawals affect the variable annuity’s death benefit, cash surrender value and any living benefit and may also be subject to a contingent deferred sales charge.

529 College Savings Plans

If you find yourself intimidated by the ever-rising price of higher education, then a 529 college savings plan might be a key component in saving for a college education. A 529 college savings plan is a tax-advantaged way to save for college and pay for higher education expenses. Unlike some other savings vehicles, a 529 college savings plan may allow you to make sizeable contributions. The funds may generally be used for any qualified college or higher education expense, including tuition, room, board, fees, books, supplies, and equipment. Tax benefits are subject to certain restrictions and vary by state.

Money in a 529 college savings plan grows tax deferred, therefore you may be able to withdraw earnings without having to pay federal and state income taxes — depending on the plan and where you live — as long as it’s used to pay for qualified, higher-education expenses.1 If the money from 529 college savings plans is used for other purposes, the earnings portion of a withdrawal is subject to ordinary federal income tax, an additional 10% federal tax penalty on any earnings, and any applicable state income taxes. 529 college savings plans may also affect a student’s eligibility for financial aid.

Types of 529 Plans

Although many details of 529 college savings plans vary by state, they generally come in two forms:

- College savings plans — allow you to invest your money in an account to pay for the student’s higher education expenses. Students can use the funds for qualified expenses at accredited institutions in the U.S. and abroad.

- Prepaid tuition plans — allow you to lock in tuition rates at eligible colleges or universities with a lump-sum investment or monthly payments. In other words, since you are paying in advance, you are avoiding potential tuition inflation down the road.

Gift Tax and Estate Tax Benefits

529 plans are partially exempt from the gift tax. You can contribute up to $15,000 ($30,000 for married couples) annually2 per beneficiary, or up to $75,000 ($150,000 for married couples) over a five-year period, without triggering the gift tax.3

Keep in mind that your gifts are excluded from your estate, so investing in a 529 Plan can be a smart strategy to reduce your estate tax.

Scholarship Withdrawals

Funds may be withdrawn without the 10% federal penalty, up to a scholarship amount, if the beneficiary receives a scholarship or in the event of the death or disability of the beneficiary. Ordinary federal and state income taxes would be owed on any investment earnings included in gross income.

1 A federal 10% penalty may be imposed on the earnings portion of a non-qualified withdrawal in addition to ordinary income tax.

2 Annual exemption amounts are subject to revision by the Internal Revenue Service.

3 If the Account Owner utilizes the special five-year lump sum exclusion and dies within five years of the funding date, the portion of the contribution allocable to the years remaining in the five-year period (beginning with the year after the Account Owner’s death) would be included in the account owner’s estate for Federal estate tax purposes. Clients should consult their tax advisor.

Investments in 529 college savings plans are not deposits or obligations of any bank, are not guaranteed by any bank, are not insured by the FDIC or any other agency, and involve investment risks, including the possible loss of the principal amount invested.

Conditions, such as contribution limits, vary by plan and by state. 529 college savings plans are subject to market risk and volatility. Accounts may lose or gain value. Diversification does not assure a profit or protect against loss.

Investors should consider the investment objectives, risks, charges and expenses of a 529 plan carefully before investing. This and other information are contained in the Program Description, which may be obtained from your investment professional. Please read it before you invest.

A 529 plan is a tax-advantaged savings plan, issued and operated by a state or educational institution that helps families save for college. Investments in 529 plans are not insured by the FDIC or any other government agency and are not deposits or other obligations of any depository institution. Investments are not guaranteed and are subject to investment risks, including loss of the principal amount invested. Tax implications vary significantly from state to state. If you or the designated beneficiary is not a resident of the state offering a 529 plan, you may want to consider, before investing, whether your state or the designated beneficiary’s home state offers its residents a plan with state tax advantages or other benefits. Guardian, its subsidiaries, agents, and employees do not provide tax, legal, or accounting advice. Consult your tax, legal, or accounting professional regarding your individual situation.

The information provided is not written or intended as tax or legal advice and may not be relied on for purposes of avoiding any Federal tax penalties. We are not authorized to give tax or legal advice. Individuals are encouraged to seek advice from their own tax or legal counsel.