Stocks hit choppy waters.

September was a month characterized by volatility on Wall Street, although a U.S. stock swoon wasn’t all-together unexpected after a record run of gains.

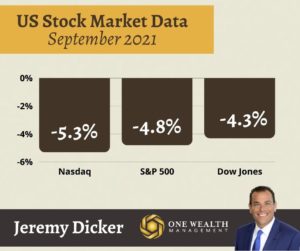

In fact, it was the worst month for the S&P 500 since March of 2020 – the epicenter of a stock selloff due to the Coronavirus pandemic. Through September, the S&P 500 fell 4.8%, the Dow Jones dropped 4.3%, and the Nasdaq sank 5.3%.

But all was not lost since, for Q3, the S&P still posted a slight positive gain of 0.2%, its sixth straight quarter and 7th straight month of gains, despite September’s volatility.

The Fed holds the line.

From Wall Street to Main Street, all eyes are on the Fed, who have repeatedly signaled a gradual easing of pandemic-era stimulus measures, possibly coming as soon as November of this year. For now, the Fed is holding the line, voting to keep the federal funds rate at 0%-0.25%, as well as no change to their aggressive bond-buying program.

However, according to Fed Chairman Jerome Powell, the Fed is closely monitoring two key metrics as a bellwether of rate increases: price stability and maximum sustainable employment.

Per Chairman, those two indicators are “in tension” lately, with inflation outpacing expectations but the employment market showing room to continue growing. And while the Fed largely views inflation as transitory, they also see a full rebound for the labor market in coming months.

Consumer confidence sinks.

U.S. consumer confidence hit a 7-month low in September, with the consumer confidence index sinking to 109.3, down from a reading of 115.2 in August. That’s the third consecutive month of decline and down from a June peak of 128.9.

Employment strong (and getting stronger).

Q4 is set up for stronger employment gains, and an expected full recovery and normalization in the job market by mid-2022. We’re looking for approximately 650,000 job gains through Q4 of 2021, driving the unemployment rate down from the current 5.4% rate to the mid-4% range by year’s end.

Inflation trends in the right direction.

September’s inflation data is yet to be released, but analysts forecast a 5.2% increase in the Consumer Price Index (CPI), which would continue the trend of a slight easing or leveling of inflation. In August, we saw a 5.3% increase, down from 5.4% in July and June.

But there are concerns of inflationary pressure based on increasing global supply chain disruptions and a less-than-full recovery based on COVID Delta-variant worries.

Spending & personal income nudge higher.

Per the most recent data, U.S. personal income rose 0.2% month-over-month throughout August, an uninspiring-yet-expected increase over July’s 1.1% rise.

Consumer spending grew 0.8% in August, slightly surpassing estimates and reversing the -0.1% decline in July.

Savings as a percentage of personal income fell to 9.4% to close out August.

When it came to consumer spending, the Core PCE price index rose 0.3% last month, climbing to 3.6% for 2021 thus far. The PCE Price Index rose even more, an increase of 0.4% month-over-month, for a 4.3% increase year-over-year.

The big winner.

The world got some unexpectedly good news on the COVID-19 front to start October with Merck pharmaceutics announcing positive results from late-stage trials of its oral antiviral pill that may reduce hospitalizations and deaths from Covid by 50%.

With late-stage trials completed, Merck reported that it would seek Emergency Use Authorization in the U.S. Upon the news, shared of MRK climbed 9%, reversing a negative trend by other biotech stocks and the healthcare sector as a whole.

Looking ahead.

Will September’s stock market volatility spill over into October or kick off a robust Q4, as is the historical precedent? Quite possibly, we may see both, as the news about inflation, debt ceilings, COVID-19 recovery, and supply chain issues will cause whiplash on Wall Street despite a near-imminent positive outcome.

Watch the U.S. Federal Reserve, Treasury yields, and employment as key indicators of how the Fed handles rate tapering.

We fully expect the labor market to continue strong growth, and the PCE, the Fed’s favorite measure of inflation, to remain above the 2% target rate through 2021 and into the spring of 2022.

We believe that the core Personal Consumption Expenditures Index (PCE), the Federal Reserve’s preferred inflation measure in considering interest rate targets, will remain above the Fed’s 2% inflation target until the spring of 2022.