March stock market recap

Wall Street rebounded soundly in March after seeing negative returns in February. For the month of March, the three major indexes showed positive returns.

March 2022:

Dow Jones Industrial Average +2.3%

Nasdaq Composite +3.4%

S&P 500 Index +3.6%

Stock market in the red for Q1

Finishing well into the red, Q1 of 2022 marked the worst quarter for the stock market since Q1 of 2020, two years ago, when the S&P 500 sank 20%.

Stock market recap for the first quarter of 2022:

Dow Jones Industrial Average -4.6%

Nasdaq -9.1%

S&P 500 -5.0%

Market corrections

According to Yardeni Research, stock market corrections take place once every two years on average. (A correction is simply defined as a market drop of more than 10% but less than 20%.)

Since 1980, there have been 13 corrections if we look at the S&P 500. The average decline has been 14.8%, and the average length of those corrections was 92 days. However, during that same period, the S&P 500 fell by 20% or more only five times.

Of bulls and bears…

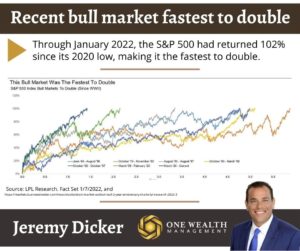

We’ve now marked two full years since the S&P 500 sank 34% during March of 2020 into the COVID bear market – the fastest in history. But since then, the market has roared back, one of the fastest-growing bull markets on record.

By the end of January of this year, the two-year bull market was the seventh to double (since WWII) and the fastest to hit 100% returns, slightly ahead of the 2009 bull market (about 95% two-year returns).

Inflation and the “R-word”

Inflation rose 7.1% in February, driving food and energy prices to their highest level in more than 40 years.

We won’t see the latest inflation data for March 2022 until April 10, but analysts expect much of the same. Despite the first signs of easing inflationary pressure when the Fed raised interest rates by a quarter-point mid-March (and we’re sure to see many more rate hikes to come), analysts have upped their expectation of inflation leading us into a recession.

According to the latest CNBC Fed Survey, the probability of a recession in the next 12 months is now 33%, up 10% from the same poll on February 1.

Jobs and unemployment

Non-farm payrolls grew by 431,000 during March, following up on a strong +750,000 revised number for February. However, although March’s increase in employment was significant, it did fall slightly short of the +490,000 expectations by economists. The March jobs report marked 15 straight months of expansion throughout the U.S. workforce.

Still, with 431,000 new jobs, the unemployment rate fell to 3.6% by the end of March, slightly lower than the anticipated 3.7% and on a continued downward trend compared to February’s 3.8% unemployment rate.

We’re now approaching the historically low 3.5% unemployment rate we saw in February 2020. However, participation in the labor market now sits at 62.4%, a slight uptick from February but a full percentage point lower than pre-pandemic highs.

April has been kind to the stock market

Looking back at 70 years of data, there is a precedent for the stock market overcoming March’s volatility and putting up a good showing in April.

According to LPL Financial chief market strategist Ryan Detrick, the stock market has closed in the green every April since 2006 save for 2012.

“The good news is stocks really appear to love April,” said Detrick.

On average, April is the best average month for the market if we go back to 1950, as well as putting up the year’s best gains in 15 of the last 16 years.

Of course, this is just an anecdotal, after-the-fact observation and not a prediction of future performance.

An eye on the Fed

At its mid-March meeting, the Fed raised their benchmark short-term interest rate by a quarter-point as expected, looking to start slowing the fast-moving train of inflation.

When surveyed, top analysts predict an average of 4.7 times the Fed will raise rates this year, and some see as many as 6 rate hikes coming.

We do know that another rate hike is almost certain to come in May, and most predict a half-point bump. In fact, the markets are now pricing in a 75% probability that the Fed will raise its short-term rate from the current 0.25% to 0.5% range to 0.75% to 1% when the central bank concludes its meeting on May 4.

Half-point increases are not typical, as the last time the central bank took such drastic measures was May 2000, right as the dot.com/tech bubble reached its apex. Prior to that, it was 1995 when the Fed last raised rates by half a point.

Fed usually prefers to slowly raise rates by a quarter-point at a time, hoping to slow inflation but not at the risk of stalling economic growth or pushing the economy into a recession.

As we’ve said in the past, the Fed is walking a tightrope between soaring inflation, a strong job market, and the specter of recession if they act too abruptly. They’re also responding to circumstances beyond their control, like the war in Ukraine, supply chain shortages, and the shift in global oil distribution and pricing.

An inverted yield curve

A yield curve inversion takes place when short-term rates rise above the level of long-term rates, which we saw several times in weeks past with 2-year and 10-year Treasury notes. The concern is that if history is any guide, a yield curve inversion signals warnings of a coming recession.

However, the curve was not inverted for the important 3-month Treasury notes, which still sit safely above 10-year yields, and economists also offer a buffer that this time may be different due to an unprecedented confluence of circumstances.

Mortgage rates and the housing market

As the Fed raised its short-term benchmark rate, the mortgage markets reacted accordingly, pricing in higher costs and risk. Consumers are bearing the brunt of those rate hikes, with mortgage rates climbing significantly.

This week, the U.S. average for a 30-year fixed mortgage is 4.67% according to Freddie Mac, which is up a remarkable 1.49% since this time last year.

However, rates are rising from a valley of all-time lows over the last two years, and the housing market hasn’t missed a beat. Pent-up buyer demand and low housing supply are still driving hot metro markets across the country, and home prices are expected to show strong positive gains by year’s end. If anything, rising mortgage rates will cool demand enough to bring more balance and a sense of normalcy to our hot housing market.