Stock Market

July saw a reversal of fortune in the stock market, which posted its best month since 2020.

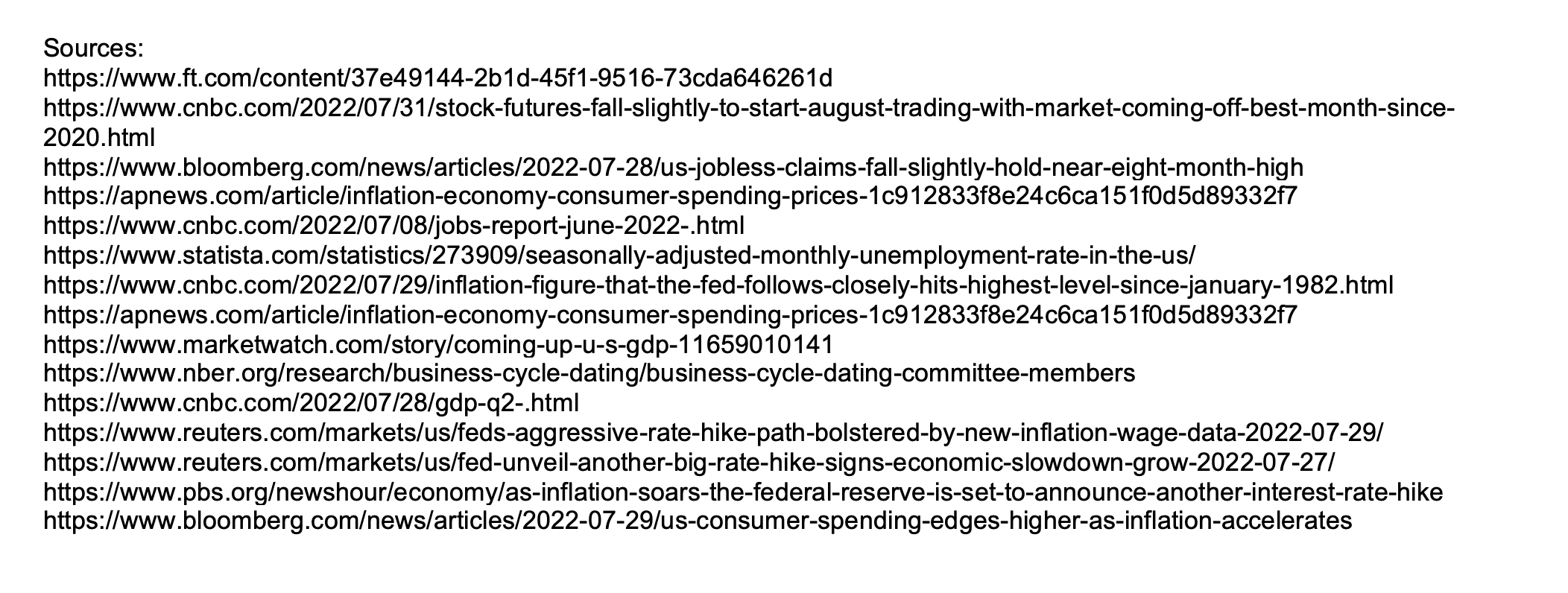

For July, the major stock indices performed as follows:

Dow Jones +6.73%

S&P 500 +9.11%

Nasdaq Composite +12.35%

Some context to those notable gains:

- That was the S&P 500’s biggest increase since November 2020,

- The Nasdaq’s biggest monthly gain since April 2020,

- And the Dow’s biggest monthly gain since November of 2020 as well.

- In July, 86% of stocks in the S&P 500 saw increases.

- July’s gains for the Nasdaq broke a three-month losing streak.

Big winners

Amazon stock ended the month with a bang, increasing 10.4% the last Friday and trading day of July. For the month, that brings Amazon stock 27.1% higher.

The energy sector was a big winner in July, with oil giants Chevron and ExxonMobil reporting record quarterly profits on the last Friday of the month as well.

Inflation

It’s been widely reported that the Consumer Price Index – a common measure of inflation – rose by 9.1% from May to June, the highest rate of acceleration in nearly 41 years.

However, the Fed and government agencies more closely monitor a different measure of inflation, the Personal Consumption Expenditures Index, or PCE. The PCE is a more accurate measure of price changes for goods and services across all households, while the CPI focuses on out-of-pocket costs for predominantly urban households.

PCE generally reveals a lower measure of inflation than CPI, with less weight placed on rents, for example.

In June, the PCE rose 6.8%, which was the largest year-over-year gain since January 1982 – more than 40 years. According to government analysis, much of that sharp increase was due to energy and food costs – the same categories driving CPI gains.

While we aren’t privy to July’s inflation numbers yet, we do know that gas prices have fallen since mid-June, down to $4.26 from a national average of over $5 according to AAA. Other commodities have fallen in cost as well.

For both PCE and CPI, July’s numbers are due out closer to the middle of the month so we’ll be sure to keep you posted.

Jobs & Employment

The Bureau of Labor Statistics’ latest numbers show the unemployment rate holding steady at 3.6%, the same level as the previous month. Job growth kept up its torrid pace in June, with 372,000 new nonfarm payrolls rushing past the 250,000 estimated increase.

In the week ending July 23rd, Labor Department data showed only a slight drop of 5,000 initial jobless applications to 256,000, the first reduction in four weeks.

When the next jobs report is released (July 8th), economists expect to see more of the same – solid job growth as employment remains a strong pillar of the economy.

Fed chief Jerome Powell still characterizes our labor market as “extremely tight,” referring to historically low unemployment and a near-record number of job openings.

However, according to Bloomberg, layoffs are up 90,000 since mid-March. Overall, jobless claims are at the highest levels since November, with the technology and housing sectors shedding the most employees and instituting hiring freezes.

The Federal Reserve’s latest rate hike will surely weaken a tight labor market in months to come as the economy cools and businesses hit pause on plans for hiring.

GDP

According to advanced estimates, Gross Domestic Product (GDP) fell 0.9% at an annualized pace in Q2 of 2022.

Economists had anticipated 0.3% GDP growth in Q2, so the 0.9% decline is a sharp drop-off.

It’s also notable because it follows a 1.6% decline in Q1 of 2022, marking two straight quarters of negative economic growth. (More on what that means for a recession later.)

Q2’s economic decline was caused by myriad factors, including slower spending, declines in business investment, smaller increases in inventory, sharp drops in government spending, and more.

Fed Rate Hikes

The US Central Bank raised its benchmark rate again in July, this time with an emphatic three-quarter-point hike for the second straight time. That brings the key interbank lending rate to a range of 2.25 percent – 2.5 percent after four rate increases since March.

That’s also the quickest contraction of US monetary policy since the 1980s, when then Fed Chair Paul Volcker was tasked with taming double-digit inflation.

More rate hikes are surely to come, although it remains to be seen whether the Fed feels they can increase them by just a quarter or half-point in the future. Analysts are betting on a half-point increase when the Fed meets again September 20-21, gauging the chance of another three-quarter point increase at only one-in-three.

Fed officials have expressed that a range of 3.25 percent to 3.5 percent by year’s end would be ideal.

Recession watch

From Wall Street to Main Street to Pennsylvania Avenue, everyone seems to be in a tug of war over whether our economy is in a recession or not.

We do know this: with a 0.9% GDP decline in Q2 2022 (according to advanced estimates) and a 1.6% decline in Q1 on the books, we’ve seen two straight quarters of negative economic growth.

That qualifies for the broadest and most simplified definition of a recession, and it was the first two quarters of back-to-back GDP declines since the Great Recession in 2007-2009.

But the true and technical announcement that we’re in a recession comes only from the National Bureau of Economic Research, which will be analyzing the data for months or longer before making the official ruling on a recession.

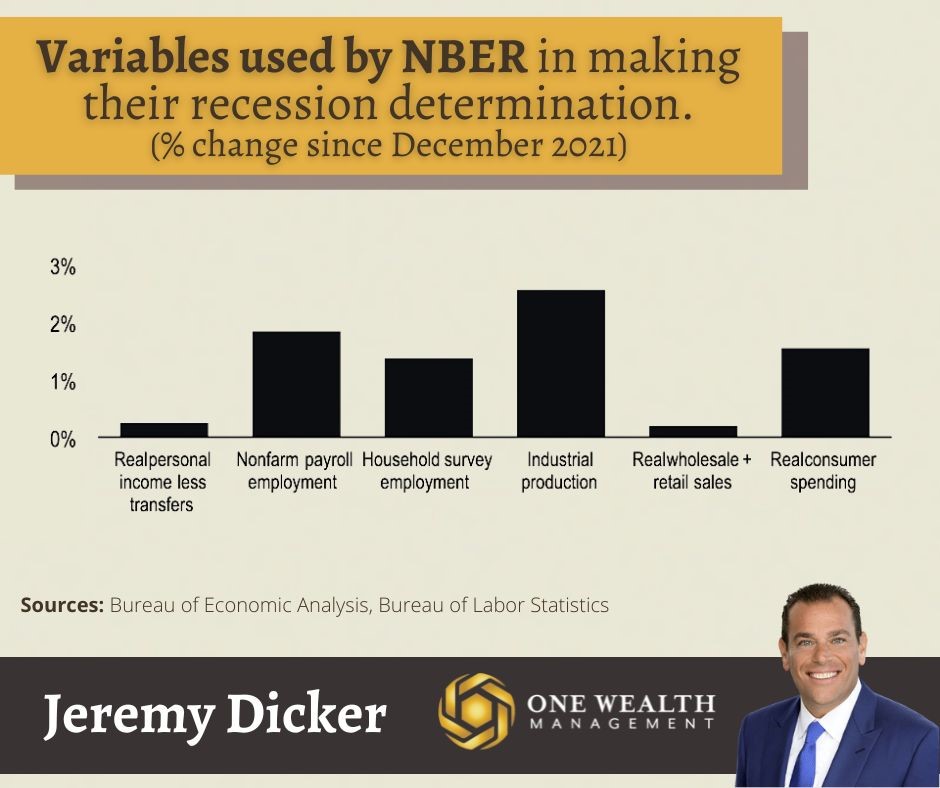

In fact, the NBER closely watches six factors to judge before declaring our economy is officially in a recession.

They are:

· Real personal income less transfers.

· Nonfarm payroll employment.

· Household survey employment.

· Industrial production.

· Real wholesale and retail sales.

· Real consumer spending.

Interestingly, all six variables have expanded since December 2021!

Consumer Spending

After falling in May, US consumer spending dropped in June (the latest available data set). Americans spent 0.1% more on goods and services in June after seeing those expenditures fall 0.3% the month earlier. Likewise, US consumer spending on merchandise increased in June as well.

The Personal Consumption Expenditures Price Index (CPI) – the Federal Reserve metric used when analyzing inflation, rose 1% from May to June, leaving it up 6.8% since June 2021.

What does that mean? Americans’ paychecks aren’t keeping up with price increases due to inflation, so household spending is higher on food, gas, energy bills, rent, credit cards, and other necessities.

That leaves little left over for discretionary spending or even savings, as the US saving rate dropped to 5.1% in June, the lowest level since 2009.

Notable Quotes

“I do not think the US is currently in a recession. It doesn’t make sense that the US would be in recession.”

-Jerome Powell, Fed Chair, referring to unemployment and jobs data at the recent Fed policy meeting.

“At this point, arguing about whether the economy is in a recession seems little more than quibbling over semantics. The economy has clearly slowed.”

Richard Moody, Chief Economist of Regions Financial.