April 2022 stock market recap.

For April, the three major stock indexes registered:

S&P 500 -8.8 percent

Down Jones -4.9 percent

Nasdaq -13.3 percent

Year-to-date in 2022, the big three indexes registered:

S&P 500 -13.3 percent

Dow Jones -9.3 percent

Nasdaq -21.2 percent

Market measures.

The S&P 500 is off to its worst start to a year since 1939, while the tech-heavy Nasdaq is off to its most auspicious beginning since 1971, and the DOW Jones Industrial Average is showing losses not experienced since the COVID year of 2020.

In April, the Nasdaq had its worst monthly performance since 2008.

Amazon stock fell by 14% on one day alone to close out the month on Friday, April 28th, its biggest losing day since 2006. Apple shares fell 3.7% that same day, too.

But the biggest loser in April wasn’t just the stock market, but crypto-king Bitcoin, which dropped 17.8% for the month.

The Fed raises rates.

On Wednesday, The Fed raised interest rates by a half-point as they look to squash inflation. Hiking their short-term benchmark rate by a full half-point, while fully anticipated, is still the largest rate increase of its kind in more than 20 years.

It sets a far more aggressive tone as naming inflation public enemy number one, following a quarter-point increase in March.

The Fed has also signaled that we should expect another half-point increase at their meeting in June, a move that some see as too much, too late, dashing hopes for a soft landing and threatening to push the U.S. economy into recession.

Inflation watch.

While April’s official Consumer Price Index numbers won’t be released until May 11th, we do know that inflation registered 8.5% in March for the previous 12 months.

Price increases were led by the energy sector (+32%), food (+8.8%), new vehicles (+12.5%), and shelter (+5%).

While that’s the highest mark in more than 40 years, since 1981, there is hope that inflation has already peaked and will start its merciful decline, despite the war in Ukraine, supply chain bottlenecks, China’s struggle with Covid shutdowns, and U.S. consumer demand.

According to Trading Economics, official inflation expectations include a drop to 7% for Q2 of 2022, 5.8% for Q3, and 4.3% for Q4.

Employment data.

According to ADP, private-sector (non-farm) payrolls rose by 247,000 in April, falling short of expectations. That number follows a solid increase of 479,000 private payroll additions in March but was significantly lower than the 383,000 April forecast.

The leisure and hospitality segment was somewhat surprising, leading the way with 77,000 new jobs in April – but coming in with less than half of its March number.

Professional and business services added 50,000 jobs in April, followed by education and health services with 48,000.

According to the ADP report, small businesses (49 or fewer employees) lost 120,000 payrolls last month, while medium (46,000) and large (321,000) companies gained.

Of course, the Labor Department’s official jobs report due out tomorrow usually adds context and widely revises these numbers.

Recession outlook.

Hopes for a soft landing for our economy post-Covid are dwindling. Despite Fed Chairman Jerome Powell’s assertion that a soft landing is “more likely than not” as recently as March 2022, investors are bleak on the prospects – but increasingly forecasting a recession.

According to a Bloomberg Market Live survey that was conducted between March 29th and April 1st this year, 48 percent of investors polled expect the U.S. economy to enter a recession within the next year. Another 21 percent of respondents expect us to fall into a recession in 2024, and 15 percent see the recession coming as soon as the later part of 2022.

History backs up their forecasts. In fact, since 1955, whenever inflation has surpassed 4 percent and unemployment dropped below 5 percent, the U.S. economy has sunk into a recession within two years.

Currently, inflation is at 8.5 percent and unemployment around 3.6 percent.

Mortgage rates.

Mortgage rates have climbed at a sharp rate over the past few months, with the average 30-year-fixed national rate from just 3.22% the first week of the year to 5.10% for the week closing April 28th, the fastest increase since 1994.

And while that’s a head-spinning quick increase, it even factors in that over the final week of April, mortgage rates actually fell for the first time in eight weeks.

While that is sure to cause ripples in the housing market and cool buyer demand (as well as affordability), it’s no reason for alarm.

Historically speaking, rates are still favorable. Consider that the previous peak before our current increase was an average of 4.94% in November of 2018, not too far off the current mark, and as recently as 2008, the average mortgage rate was 6.03%, 7.44% in 1999, and 8.38% in 1994.

Quote

“Consumer spending is the aircraft carrier in the middle of the ocean — it just keeps plowing ahead.” -Jay Bryson, chief economist at Wells Fargo

G.D.P. growth.

In the first quarter of 2022, Gross Domestic Product fell by 0.4 percent when adjusted for inflation, or -1.4 percent on an annualized basis, according to the Commerce Department.

That was a sharp slowdown from the 1.7 percent growth we saw through Q4 of 2021.

However, when not adjusted for inflation – in actual dollar terms – our GDP grew by 1.6 percent in Q1 of 2022, following strong 3.5% actual dollar GDP growth in Q4 of 2021.

Consumer spending.

Consumer spending – a key metric to gauge our economy – increased by 0.7 percent in Q1 of 2022.

That represents a healthy increase considering that the economy suffered the slings and arrows of Omicron waves, supply chain woes both home and abroad, and war in Europe.

Consumers are still spending despite inflation, although some economists wonder how long this rampant demand for goods and services can continue as prices increase.

According to iconic analyst firm Oxford Economics, the expectation for gross domestic product growth has been downgraded to 3.1 percent for 2022. While that’s just a forecast, it displays the pace of slowing compared to 2021’s 5.7 percent GDP increase.

However, it’s 2023 that they believe will be problematic, with Oxford Economics forecasting only 2 percent GDP growth.

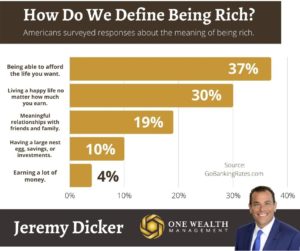

How do we define being rich?

According to surveys, being rich includes some money metrics, such as being able to afford the life you want.

But it’s not just about money. Only 4% of respondents say earning a lot of money makes you rich, and only 10% say it’s about having plenty of savings or investments.

According to the responses, considering yourself rich is more about having the financial freedom to live the life you want, including 30% who say happiness makes you rich and 1 in 5 who point to healthy and meaningful relationships.