The Stock Market.

As February waned, news of increasing conflict in Ukraine upended markets both home and abroad. For the month:

The Dow Jones Industrial Average -3.53%

Standard & Poor’s 500 Index -3.14%

Nasdaq – 3.43%

However, despite initial swoons upon the news of Russia’s invasion, stocks rebounded and have exhibited manic volatility throughout the end of February and the first days of March.

Wall Street Falls into Correction Territory.

The last three years have seen a windfall on Wall Street, with robust gains for investors. In fact, the S&P 500 saw returns of 31.49% in 2019, 18.4% in 20202, and 28.71% in 2021 (according to Morningstar Direct).

However, we have already entered correction territory, loosely defined as the period when a stock index falls at least 10% off its recent high mark.

So far in 2022 (approximately up to March 1st), the DOW is down 8.38%, NASDAQ is down 13.5% – both firmly in correction territory – and the S&P 500 has dropped 9.65%.

Biggest Winner.

In February, every industry sector saw stock losses across the board except Energy. In fact, the Energy sector as a whole rose 7.07% for the month.

Meanwhile, sectors across Communications Services (-7.44%), Consumer Staples (1.41%), Financials (-1.38%), Health Care (-0.97%), Materials (-1.27%), Real Estate (-4.80%), Technology (-4.88%), and Utilities (-1.91%) all saw losses.

Inflation.

The official inflation numbers for February 2022 aren’t released until March 10th at 8:30 am.

But we do know that in January 2022, the U.S. inflation rate rose to 7.5%, the highest level since February of 1982. With receding Covid numbers, supply chain work-outs, and the forecast of Fed rate increases to help curb inflation, there was some cautious optimism in early February that January’s lofty inflation rate may represent a high-water mark.

However, the Russian invasion of Ukraine caused far-reaching and total volatility in the global markets, sending energy prices and oil soaring, contributing to the specter of still-rising inflation.

Jobs and Unemployment.

The labor market continued to exceed expectations in February, adding a strong 678,000 new jobs, while economists had predicted an addition of 440,000 jobs.

That also far surpasses January strong addition of 481,000 new jobs.

Those just released labor numbers signal a quickening of the economy recovery, sinking the unemployment rate to 3.8% from its January level of 4%.

It’s important to note that February’s meteoric job numbers occurred during Omicron surges across the country, bolstering confidence that we expect to recover job numbers to pre-pandemic levels by the end of 2022.

The Fed.

The Fed has remained steadfast in signaling that a rate hike is coming at their March 15-16 Federal Open Market Committee (FOMC) meeting on March 15–16. That much is almost a foregone conclusion, and the only debate is whether Fed Chief Powell and co. will raise their short-term benchmark rate by the expected 25 basis points or 50 basis points.

It’s largely believed that war in Eastern Europe dashed the more drastic measure of a 50-basis point hike in March, but all messaging points to the Fed remaining fluid and focused on leading, not reacting.

Either way, it is to be one of several federal fun rate hikes in 2022, as our central bank carefully walks a tightrope between inflationary pressures, supply chain woes, global crisis, and managing economic growth.

GDP Growth Revised.

Real gross domestic product (GDP) gains for the 4th Quarter of 2021 were initially posted at 6.9%, up since revised to an even higher 7%. That follows a disappointing gain of only +2.3% in Q3 of 2021.

For the year, GDP growth rate (not Real GDP, a different indicator) were:

Q1 +3.1%

Q2 +2%

Q3 +1.8%

Q4 +2.5%

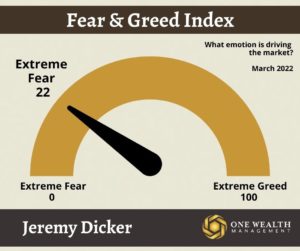

What Drives Markets? Fear and Greed.

At their core, the movement of markets is simple: they’re driven by the very human and often flawed human elements of fear and greed.

That’s why I find it interesting to check in with one of several available Fear & Greed Indexes, which reveal what emotion (and to what degree with an assigned numerical value) is currently driving the market.

One year ago, we registered “Neutral – 52” on the Fear & Greed Index. One month ago, in January 2022, we registered “Fear – 34.”

However, with the Russian-Ukraine crisis powder keg moment, that index worsened to “Extreme Fear – 25” one week ago.

And this week, the full reality of the conflict sunk in, leading to an “Extreme Fear – 24” rating for the market.

Mortgage Rates.

After a run of record-low mortgage rates last year, we’ve seen rates increase steadily in the first two months of 2022. That’s not unexpected, as rates are expected to inevitably rise as pandemic-era stimulus and controls are transitioned out.

But even as the Fed is set to implement periodic increases to their short-term benchmark rate starting at their mid-March meeting, home loans have come down to earth slightly due to inflation and worries about the Ukraine crisis.

While the window may be closed on 2020/2021’s record-low mortgages, rates are still extremely favorable if you look from a historical perspective, with the average 30-year fixed loan well below 4% and far less for 15-year or adjustable ARM loans.

Home Sales.

Our national – and local – housing markets have proven incredibly resilient, even as mortgage rates increase. Nationally, the median home sale value is up 10% year-over-year and even greater in many parts of Greater Los Angeles and California.

In fact, record-low listing inventory (active listings are down 24% Y-O-Y nationally) and pent-up buyer demand are driving a hot housing market more than just low rates, although we do expect a gradual normalization from an extreme seller’s market to more of a balanced market this year.

Notable Quote.

“We are not facing an inflation crisis. [The economy is] not likely to have the type of wage-price inflation that we had in the 1970s.”

-Nobel-winning economist Joseph Stiglitz