One Wealth Management can automate the process of reviewing a tax return to uncover potential opportunities by:

- Reading the tax return using advanced OCR technology

- Delivering a customized report with specific tax impact observations

Inside the customized report, it promises to deliver:

- A tailored tax report for the tax filer(s)

- Turnkey PDF to email or print

- A pre-filled scenario analysis screen

Your Tax Report is the tax return analysis. Nothing else on the market compares to this feature. Your best alternative is the compare a tax return to a 1040 checklist.

We are able to highlights 5 quick wins from the tax report:

- Back solve for what the client spent last year

- Capital gains/loss review

- Charity tactics

- Roth Conversion in Lower Tax Years

- Any opportunities on Schedule B

One Wealth Management can automate the process of reviewing a tax return to uncover potential opportunities by:

- Reading the tax return using advanced OCR technology

- Delivering a customized report with specific tax impact observations

Inside the customized report, it promises to deliver:

- A tailored tax report for the tax filer(s)

- Turnkey PDF to email or print

- A pre-filled scenario analysis screen

Your Tax Report is the tax return analysis. Nothing else on the market compares to this feature. Your best alternative is the compare a tax return to a 1040 checklist.

We are able to highlights 5 quick wins from the tax report:

- Back solve for what the client spent last year

- Capital gains/loss review

- Charity tactics

- Roth Conversion in Lower Tax Years

- Any opportunities on Schedule B

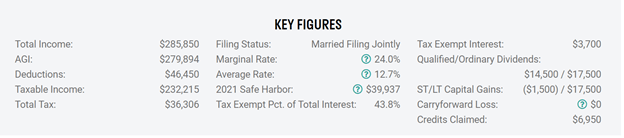

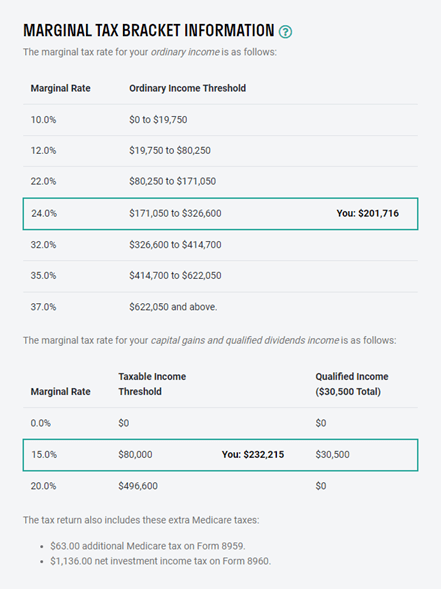

Below that you will find the Marginal Tax Bracket information section. This breaks down your tax brackets.

This section is critical because your tax bracket isn’t based on the “Taxable Income” line on Form 1040. Your tax bracket is made up of the Ordinary Taxable Income and Capital Gain Taxable Income. Ordinary Taxable Income determines Capital Gain Taxable Income.

The report can also show a section for Medicare Part B/D premiums.

Tax Analyzation

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

Tax Analysis

ONE Tax Planning Analysis

Tax Report – Summaries

The Tax Report shows a few other summaries for the most popular schedules of the tax return. These schedules are:

- A – Itemized Deduction Summary

- B – Interest and Dividends

- C – Business Income

- D – Capital Gain/Loss

- E – Rental real estate and Royalty

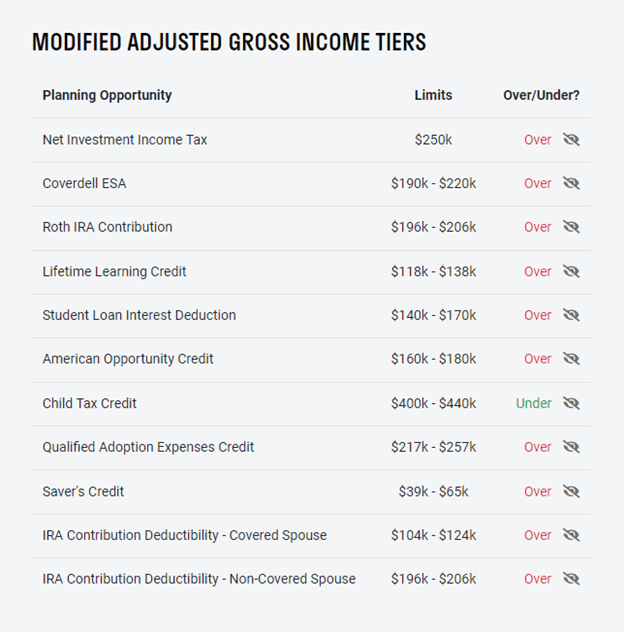

The report also outlines when a taxpayer is over/under the limit of various these tax provisions:

Security:

We understand the importance of securing your data. The tax return analysis physical infrastructure is hosted and managed by Amazon Web Services (AWS). AWS continually manages risk and undergoes recurring assessments to ensure compliance with industry standards to protect personal data. AWS’s network and infrastructure also have multiple layers of protection to protect against denial-of-service attacks.

In addition to using a best-in-breed cloud service provider, all documents uploaded to our application are encrypted, at rest and in transit, with 256-bit TLS. User credentials are salted and hashed before being stored.

While we recognize the tax return contains personal identifying information (PII), we do not store the taxpayer’s Social Security number(s) or home address in our database. One Wealth Management has the ability to delete the return once they have used the software and all PII data will be permanently deleted from the server.

Tax Report – Summaries

The Tax Report shows a few other summaries for the most popular schedules of the tax return. These schedules are:

- A – Itemized Deduction Summary

- B – Interest and Dividends

- C – Business Income

- D – Capital Gain/Loss

- E – Rental real estate and Royalty

The report also outlines when a taxpayer is over/under the limit of various these tax provisions:

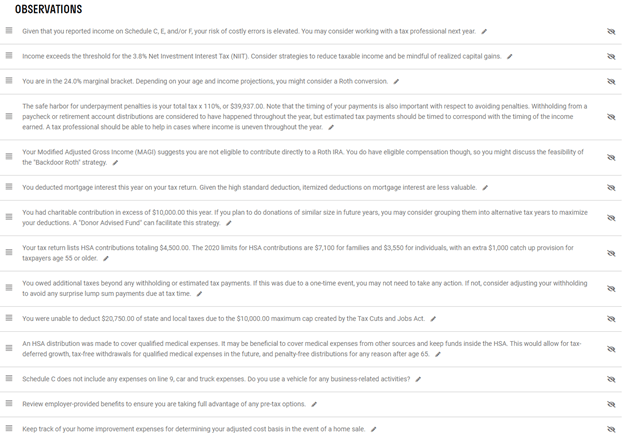

Tax Report – Observations

- The last section of the Tax Report are Observations.

- This is where the most value is added. It’s another conversation enhancer. It also identifies planning pointers. This is what leads you to pay less tax!

Security:

We understand the importance of securing your data. The tax return analysis physical infrastructure is hosted and managed by Amazon Web Services (AWS). AWS continually manages risk and undergoes recurring assessments to ensure compliance with industry standards to protect personal data. AWS’s network and infrastructure also have multiple layers of protection to protect against denial-of-service attacks.

In addition to using a best-in-breed cloud service provider, all documents uploaded to our application are encrypted, at rest and in transit, with 256-bit TLS. User credentials are salted and hashed before being stored.

While we recognize the tax return contains personal identifying information (PII), we do not store the taxpayer’s Social Security number(s) or home address in our database. One Wealth Management has the ability to delete the return once they have used the software and all PII data will be permanently deleted from the server.