Stock Market

Wall Street brushed off fears of a government shutdown on Tuesday, the final trading day of the month, with the Dow rising to a record high.

It was an unusually strong September for the stock market, with all three major indices posting solid gains:

- S&P 500: +3.5%

- Dow: +1.9%

- Nasdaq: +5.6%

This marked a sharp reversal for the S&P 500, which has averaged a 4.2% decline over the past five Septembers.

To close out Q3, the S&P 500 gained nearly 8% for the quarter, the Dow rose more than 5%, and the Nasdaq climbed more than 11% since June.

Sources:

https://www.cnbc.com/2025/09/29/stock-market-today-live-updates.html

https://www.marketwatch.com/story/the-s-p-500-and-nasdaq-are-set-for-their-best-september-in-over-15-years-can-the-momentum-last-through-year-end-26512858

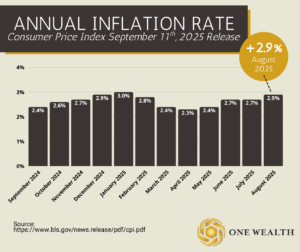

Inflation

U.S. inflation ticked higher in August, with the Consumer Price Index (CPI) for All Urban Consumers rising 0.4% month-over-month and 2.9% year-over-year, up from 2.7% in July.

Shelter costs were the largest contributor to the monthly increase, climbing 0.4%, while food rose 0.5% and energy advanced 0.7%. Within food, grocery prices rose 0.6%, while dining out was up 0.3%. Gasoline surged 1.9% in the month. Core inflation, which strips out food and energy, rose 0.3%, led by higher airline fares, vehicle prices, and apparel, though medical care and recreation costs fell.

The acceleration in prices has been partly attributed to the impact of tariffs, as U.S. companies pass along higher import costs to consumers. Despite inflation running above the Federal Reserve’s 2% target, weakening labor market data has shifted expectations toward a potential rate cut at the Fed’s September 17 meeting. Economists note that while tariffs are contributing to price pressures, slowing job growth and household strain are likely to outweigh inflation concerns in the Fed’s decision-making.

Sources:

https://www.bls.gov/news.release/cpi.nr0.htm

https://www.cbsnews.com/news/cpi-report-today-august-2025-tariffs-inflation/

Rates and Fed Watch

The Federal Reserve approved a widely expected quarter-point interest rate cut this week, bringing the benchmark lending rate down to a range of 4.00%–4.25%.

In an 11-to-1 vote, officials signaled that two additional cuts are likely before year-end, reflecting growing concerns about a weakening U.S. labor market despite inflation remaining a factor.

At his post-meeting press conference, Fed Chair Jerome Powell noted the unusual slowdown in both the supply of and demand for workers, emphasizing that risks to employment have increased.

Powell also described the move as shifting monetary policy toward a “more neutral” stance, rather than the moderately restrictive position seen in recent months. The Fed’s latest “dot plot” projections showed a wide range of views, with most policymakers favoring two more cuts.

Overall, the Fed’s actions highlight a balancing act between supporting the labor market and keeping inflation under control. Investors and consumers alike will be watching closely in the coming months as policymakers navigate these competing pressures.

Source:

https://www.cnbc.com/2025/09/17/fed-rate-decision-september-2025.html

GDP

The U.S. economy showed stronger momentum in the second quarter than initially reported, with GDP revised upward to a 3.8% annualized growth rate—the fastest pace in nearly two years.

The upgrade was largely driven by robust consumer spending and solid business investment. Business demand for equipment also surged in August, fueled in part by an artificial intelligence spending boom.

While these trends underscore the economy’s underlying strength, analysts caution that growth may begin to slow as the impacts of tariffs and ongoing policy uncertainty filter through.

Source:

https://www.reuters.com/business/us-second-quarter-gdp-growth-revised-sharply-higher-2025-09-25/

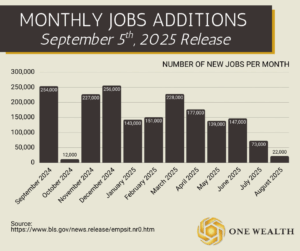

Jobs & Unemployment

The U.S. labor market showed little progress in August, with nonfarm payrolls increasing by just 22,000 jobs, according to the Bureau of Labor Statistics. The unemployment rate held at 4.3%, representing 7.4 million unemployed individuals.

Health care and social assistance added nearly 47,000 jobs, offsetting declines in federal government (-15,000), manufacturing (-12,000), construction (-7,000), and energy-related industries.

Revisions to prior months’ data revealed 21,000 fewer jobs than initially reported, including a 13,000 decline in June—the first monthly job loss since late 2020. So far in 2025, monthly job growth is averaging under 75,000, compared with 168,000 per month in 2024 and more than 400,000 during the 2021–2023 recovery. Economists note that hiring momentum has cooled significantly amid slowing demand and lingering effects of past interest rate hikes.

Sources:

https://www.bls.gov/news.release/pdf/empsit.pdf

https://apnews.com/article/jobs-economy-unemployment-trump-firing-f686eab61f7d6b702ca10b12b0250498

Real Estate & Mortgage Market

The U.S. housing market is showing signs of balance as 2025 progresses. According to Realtor.com’s August Housing Market Trends Report, active listings have grown for 22 consecutive months, surpassing 1 million for the past four months.

In August alone, more than 20% of homes saw price reductions, while the median time on market climbed to 60 days, above pre-pandemic norms for the second month in a row. This extra time on the market is giving buyers more options and pressuring sellers to make discounts.

At the same time, mortgage rates have remained lower than the highs seen in recent years. Over the past 12 months, 30-year rates ranged from a low of 6.08% in late September to a high of 7.04%, with rates staying below 7% in recent weeks. The Federal Reserve’s September 17 rate cut supported this downward trend, though mortgage rates had already been easing since late May.

Notable Quote

“When you invest in something, you are not merely buying a thing, but a stream of decisions, each of which carries the risk of breaking with the past.”

-Peter Bernstein