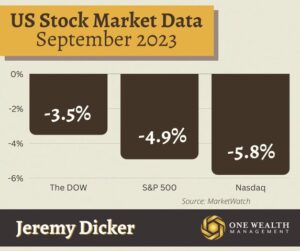

Stock Market

Inflation uncertainty and the specter of an imminent government shutdown drove markets in what turned out to be a shaky September for stocks.

For the month, the market’s three major indices performed as follows:

The Dow -3.5%

S&P 500 -4.9%

Nasdaq -5.8%

The Nasdaq and S&P posted their worst performing month of the year in September and the worst since December 2022, while the Dow saw its worst month since February.

For the quarter (Q3), the three major indices performed as follows:

The Dow -2.6%

S&P 500 -3.7%

Nasdaq -4.1%

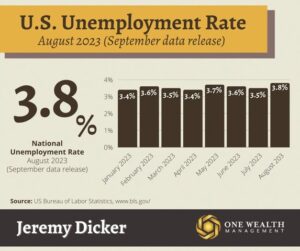

Jobs and Unemployment

According to the U.S. Labor Department, nonfarm payrolls rose by 187,000 in August. That exceeded economists’ expectations of 170,000 new jobs for the month, following a 157,000 increase in July.

For August, the unemployment rate increased to 3.8%, up significantly from 3.5% in July, as job openings dropped to the lowest in almost 2 ½ years.

Additionally, revisions to June and July’s employment data showed that 110,000 fewer jobs were created than previously reported.

For the past three months, the U.S. economy has added an average of 150,000 new payrolls, down significantly from the previous three-month period when the economy added an average of 238,000 jobs.

Before June-August, monthly job growth stayed below 200,000 for 29 straight months.

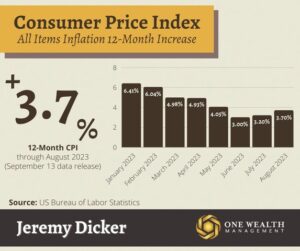

Inflation

The annual inflation rate rose to 3.7% in August (September data release), which was up from 3.2% in July and higher for the second month in a row after 12 consecutive months of lower inflation.

The Consumer Price Index increased 0.6% for the month after a 0.2% bump in July.

A spike in gasoline prices was the biggest culprit for higher all-items inflation, consuming more than half of the monthly increase. Aside from gas prices, shelter costs rose again for the 40th consecutive month, and the food index rose marginally. For the month, prices for used cars and furniture trended down.

But there was some marginally better news in the tail days of September, as the Personal Consumption Expenditures Price (PCE) Index, which strips away food and energy costs and is the Fed’s preferred measure of inflation, grew 0.1% for the month, coming in lower than 0.2% expectations.

The Fed and Rates

At their September 20th meeting, the Federal Reserve opted to keep their benchmark interest rate unchanged at a range of 5.25%-5.5%.

While that rate stays steady at a 22-year high, it does display that the Fed believes they are on course to control inflation, although more work is yet to be done.

Fed Open Market Committee (FOMC) members also signaled another rate hike may be needed later this year to cool the economy further and bring inflation down to their 2% target rate. (The vote among FOMC members was split 12-7 on whether to hike rates one more time or maintain at current levels.)

“It’s more about stronger economic activity, if I had to attribute one thing,” said Fed chair Jerome Powell when asked about the potential for additional rate hike this year. “Broadly, stronger economic activity means we have to do more with rates.”

Is the cost of college worth it?

Paying for higher education is more expensive than ever, as some of you sending kids off to college know all too well.

In fact, the cost of admission for the typical Ivy League school is now almost $90,000 per year, adding up to an astonishing $360,000 for a four-year degree.

Even the price tag to attend less prestigious (but popular) schools is astronomical, like the University of Michigan ($76,300 annually for out-of-state tuition) and the University of Virginia ($76,700).

A recent Wall Street Journal poll found that 56% of Americans surveyed don’t feel the cost of a four-year degree at most colleges is even worth it these days, considering graduation with a mountain of student loans and lack of specific job skills, etc.

Conversely, just 42% of respondents think the cost of college is worth it these days – numbers that were almost reversed just ten years ago.

Mortgage and Housing

Mortgage rates continue to cripple the housing market, with the national average 30-year fixed home loan pushing through 7% in August and now at 8.1% as of the 29th of September.

Affordability woes and record-low inventory are leading to sharp declines in home sales, with the only exception being a notable uptick in new home sales.

Looking at the home price forecast through the end of 2023, estimates from four credible industry organizations predict a range of price increases from +3.9% to -0.6%, with an average forecast of +0.7%.

With value growth essentially staying flat, we’re seeing paltry inventory keeping home prices from falling significantly despite the highest mortgage rates since 2000.

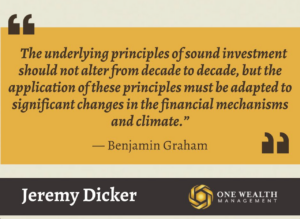

Notable quote

“The underlying principles of sound investment should not alter from decade to decade, but the application of these principles must be adapted to significant changes in the financial mechanisms and climate.”

-Benjamin Graham