Stock Market

Through September, the stock market performed as follows:

S&P500 -9.34%

DOW -8.84%

Nasdaq Composite -10.5%

In September, the S&P 500 and Dow Jones Industrial Average experienced their biggest one-month loss since March of 2020. For both stock indexes, it was their worst-performing September since 2002.

September swoons

September swoons are somewhat typical for the stock market.

Going back to 1928, the S&P 500 has dropped 7% or more at least 11 times. Likewise, the Dow has declined by 7% or more 13 times going back to 1928. And with the tech-heavy Nasdaq Composite, we only need to go back to 1986 to see six declines of 9% or more.

According to data in the Stock Trader’s Almanac spanning back to 1950, September has been the worst-performing month of the year for the S&P 500 and Dow Jones Industrial Average, and the worst month for the Nasdaq since 1971.

Bouncing back

Looking at data back to 1950, in the three years following a 20%+ decline in the S&P 500, the index saw an average gain of 29%. Across the broader market, stocks have increased 26% within just two years of a 20% drop, according to Keith Lerner, Chief Market Strategist at Truist.

Of course, past results are not an indicator of future performance.

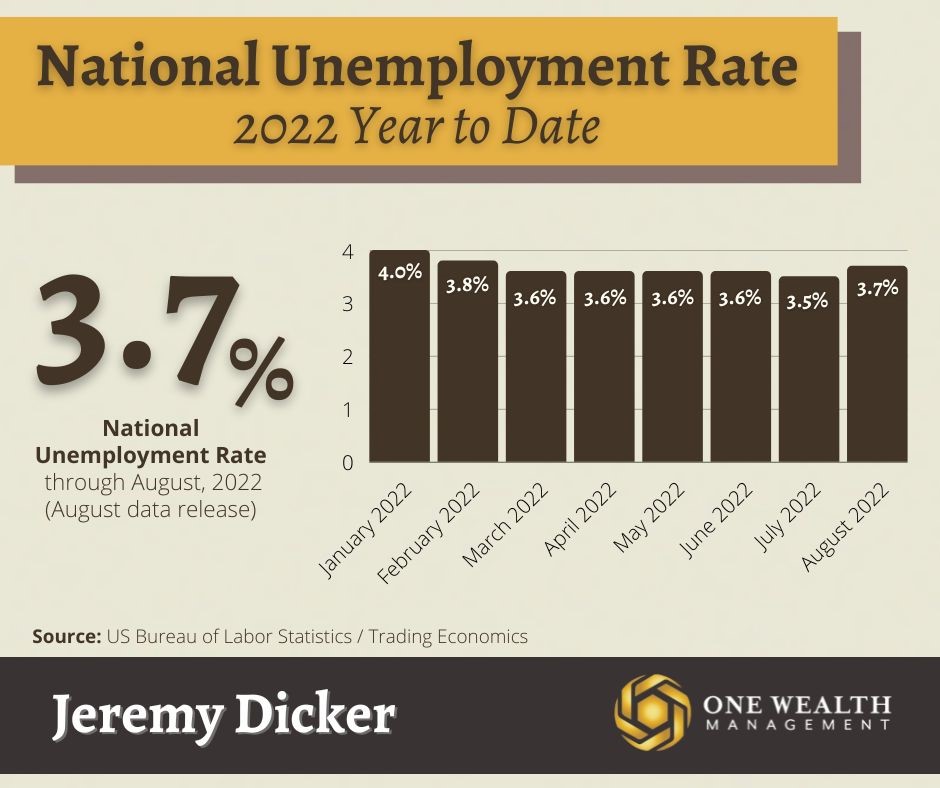

Jobs and Unemployment

Nonfarm payroll employment rose by 315,000 in August, the latest data until September’s numbers are released on October 9th. The employment market saw the largest gains in the professional and business service, healthcare, and retail trade sectors.

According to the U.S. Bureau of Labor Statistics, the unemployment rate increased to 3.7% in August. At the tail end of September, unemployment claims fell to the lowest levels since April of 2022.

There are still roughly two job openings for every person who is unemployed, a record high.

GDP

According to the latest numbers by the Bureau of Economic Analysis, our real gross domestic product (GDP) fell by 0.6 percent in Q2 of 2022 based on an annualized comparison. That follows a Q1 2022 GDP dip of 1.6%, equating to two successive quarters of economic contraction, one of the common definitions of a recession.

Others rebuke the notion that the U.S. is in the midst of a recession by pointing to strong job numbers, sound manufacturing, and high consumer spending. Of course, the real judgment on whether we’re in a recession lies with a panel of National Bureau of Economic Research economists and will come much later.

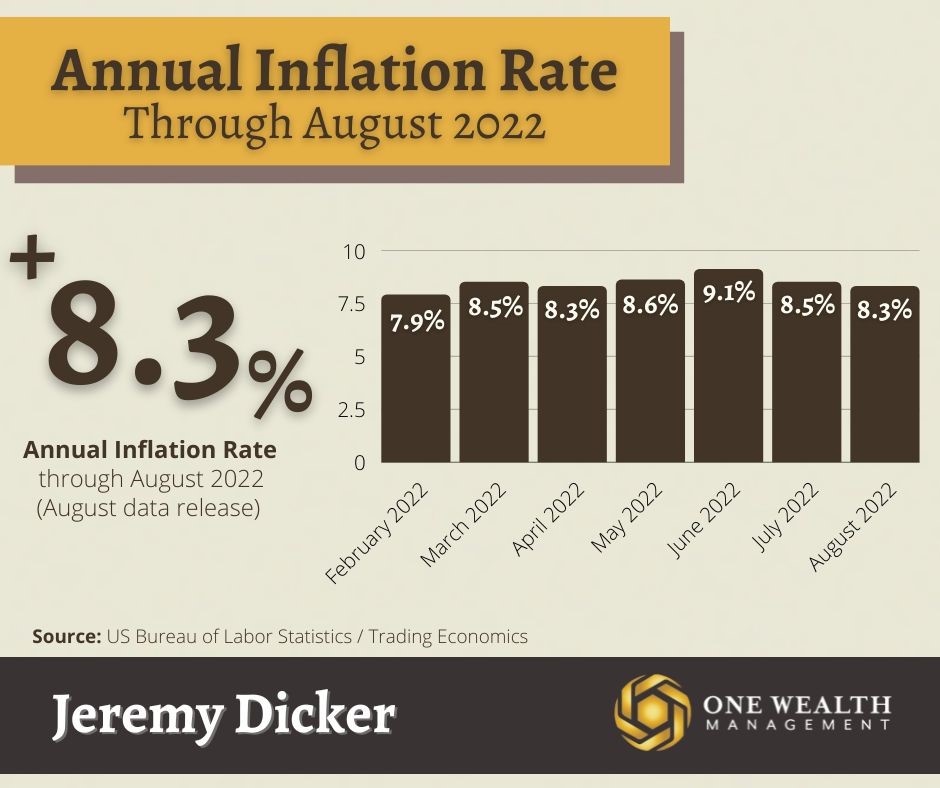

Inflation

The annual inflation rate was 8.3% in August, only a slight drop from July’s 8.5% annual inflation increase and not a far departure from June’s 9.1% annual inflation, a 40-year high. However, that does mark the fourth straight month of inflationary easing.

The Consumer Price Index (CPI), a core measure of inflation, increased 0.1% in August compared to July. Despite falling gas prices, sharp increases in costs for food, shelter, and medical care pushed the CPI higher.

In fact, food prices rose 11.4% in August, shelter costs increased 6.2%, electricity was up 15.8%, and the cost for used cars and trucks jumped 7.8% for the month.

The PCE (personal consumption expenditures price index), the Fed’s preferred measure of inflation, climbed 0.3% in August and is now up 6.2% compared to the same period last year.

The next Consumer Price Index report is due to be released on October 13th, an important milestone since the Federal Reserve will dictate further rate increases and tightening of monetary policy based on their capacity to slow inflation.

Consumer spending

Despite high prices and higher interest on credit cards, mortgages, etc., U.S. consumers are still spending at a robust rate. In August 2022, consumer spending increased by 0.4%, exceeding forecasts.

Accounting for more than two-thirds of all U.S. economic activity, consumer spending rose by nearly half a percent in August after dropping 0.2% the previous month.

Consumer debt

U.S. consumer debt just hit an all-time high at the end of Q2 2022 according to the Federal Reserve Bank of New York’s Quarterly Report on Household Debt and Credit. In fact, household (consumer) debt now sits at $16.5 trillion, up 2% since Q1 2022 and $2 trillion more than pre-pandemic levels.

Credit card debt rose by $46 billion in Q2 2022 alone, a 5.5.% month-over-month increase and 13% more than the same period of 2021 – the biggest balance increase in twenty years.

Americans now have more than 500 million general purpose credit cards, the highest number ever and the first time we’ve collectively topped 500 million cards.

Auto loan debt grew by $33 billion in Q2 of 2022 as well, the largest quarterly increase since 2011.

Fed watch

At their mid-September meeting, the central bank increased the federal funds rate by 75 basis points, the third straight meeting with a 75-basis point increase. The federal funds rate now lies between 3% and 3.25%.

In a survey of 83 leading U.S. economists, 70% thought that the fed funds rate would see another three-quarter-point increase at the central bank’s November meeting, which would be the fourth straight month with that same increase.

They also predicted a 50-basis point increase at the Fed’s December meeting, bringing the federal funds rate to 4.25%-4.50% by the end of the year.

In that same poll, a majority of those economists (54%) anticipate the fed funds rate peaking at 4.50%-4.75% in Q1 of 2023.

Mortgage and housing

As the fed funds rate increases, the mortgage market responds in kind, with mortgage rates soaring in the final week of September. In fact, according to Freddie Mac, the average 30-year fixed home loan across the U.S. is now 6.7%, previously unimaginable considering that rates were at 3% to start the year.

Of course, this is leading to a monumental slowdown in home sales and a seismic shift to a buyer’s market after a decade of hot home price growth.

Fed chief Jerome Powell acknowledges that a “difficult correction” is underway, needed to bring home affordability under control.

It’s important to note that while we are likely to see significant price drops to end 2022 and well into 2023, this is nothing like the complete market collapse of 2008.

For one, banks have instituted conservative lending standards since then, issuing predominantly stable, fixed-rate loans. Homeowners also have record equity after a decade of price gains, as well as near-record-high credit scores, meaning we’re unlikely to see a wave of defaults and distressed sales like we did during the mortgage meltdown 14 years ago.

Notable quote

“The Fed reinforced their commitment to whatever it takes to get inflation under control, even if that means causing some pain in the economy.”

-Justin Weidner, U.S. economist at Deutsche Bank