Stocks

Historically known for some of the stock market’s biggest one-day drops, October instead delivered solid gains this year. The S&P 500, tech-heavy Nasdaq, and the Dow Jones Industrial Average all ended the month with positive gains.

For the Dow, it was the sixth consecutive monthly advance, its longest winning streak since 2018.

For October, the stock market’s three major indices performed as follows:

S&P 500 2.3%

The Dow 2.5%

Nasdaq 4.7%

Source:

www.cnbc.com/2025/10/30/stock-market-today-live-updates.html

The Fed and Rates

The Federal Reserve cut U.S. interest rates by a quarter point this week, lowering the benchmark rate to a range of 3.75%–4%. However, Fed Chair Jay Powell cautioned that another rate cut at the December meeting is “not a foregone conclusion,” emphasizing the central bank’s desire to keep its options open.

Economists noted that Powell’s tone signaled caution rather than commitment, suggesting the Fed will remain data-dependent in its next moves.

Complicating matters is the ongoing federal government shutdown, which has disrupted access to key economic data. Powell compared the situation to “driving in the fog,” saying policymakers may need to “slow down” until clearer indicators emerge. As the Fed navigates between economic weakness and political pressures, its December decision will likely hinge on what limited data remains available in the coming weeks.

Source:

https://www.ft.com/content/dd938de1-f8c3-4e5f-b58b-412ac80579fd

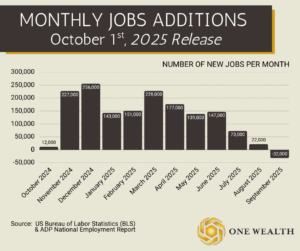

Jobs and Unemployment

In its latest update encompassing September data, the ADP National Employment Report revealed that U.S. private-sector employment fell by 32,000 jobs, following a preliminary rebenchmarking that adjusted the figure downward by 43,000 compared to the pre-benchmark data.

The net decline signals that hiring momentum is continuing to cool across most industries, despite relatively strong economic growth earlier in the year.

Job losses were most pronounced among small (-19,000) and medium-size employers (-11,000), while large firms actually added 33,000 jobs. On the industry front, sectors such as leisure & hospitality (-19,000), professional & business services (-13,000), and financial activities (-9,000) saw cuts, while education & health services added 33,000 jobs and natural resources & mining contributed modest gains of 4,000.

Source:

https://adpemploymentreport.com/

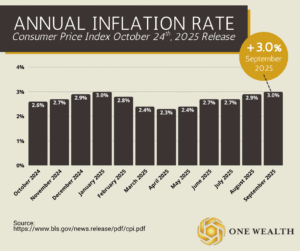

Inflation

The latest Consumer Price Index (CPI) report from the Bureau of Labor Statistics showed inflation cooling slightly in September, with prices rising 0.3% for the month and the annual inflation rate at 3.0% – both below expectations. Economists had forecasted increases of 0.4% monthly and 3.1% annually.

When excluding food and energy, core CPI rose 0.2% on the month and 3.0% year-over-year, also lower than projections of 0.3% and 3.1%. This marks a slowdown from the 0.3% monthly gains recorded in both July and August.

This CPI report was released despite the ongoing government shutdown, as it serves as a key benchmark for Social Security cost-of-living adjustments (COLA). All other federal data releases remained suspended.

The softer-than-expected inflation figures kept the door open for the Federal Reserve to consider another interest rate cut in the coming week.

Source:

https://www.cnbc.com/2025/10/24/cpi-inflation-september-2025.html

Examining American Manufacturing

American manufacturing is undergoing a quiet but meaningful transformation. After decades of offshoring and the rise of a service-driven economy, national security concerns, supply chain risks, and political momentum are now reshaping where and how critical goods are produced. The result isn’t a full return to mid-century industrial dominance, but a strategic resurgence focused on the technologies and infrastructure that will define future economic strength.

In fact, American manufacturing has steadily declined for decades, dropping from 35 percent of private sector jobs in the 1950s to just 9.4 percent today. Rising affluence shifted spending toward services, while globalization and trade agreements like NAFTA and China’s 2001 entry into the WTO accelerated the offshoring of lower-cost production to Asia and Latin America.

Supply chain disruptions during Covid-19 and growing geopolitical tensions have sparked a political push to reshore critical industries. U.S. construction spending on manufacturing hit a record $108 billion back in 2022, with investment heavily concentrated in semiconductors and pharmaceuticals.

However, reshoring faces economic limits. Low-value manufacturing such as textiles is unlikely to return meaningfully due to higher U.S. labor costs. Economists argue the most efficient path is to focus on high-value, national-security-critical production while still benefiting from lower-cost imported goods.

The reshoring trend represents more than factory construction and job creation. It signals a long-term investment in innovation, resilience, and global competitiveness. American manufacturing may never resemble its mid-century peak, but targeted strategies are expected to sustain a resurgence in strategic sectors.

Source:

https://www.crystalfunds.com/insights/from-offshoring-to-onshoring-american-manufacturing

Real Estate & Mortgage Market

When it comes to the real estate market, the latest forecasts suggest a stagnant year ahead for home values, with 2025 expected to finish roughly where it begins before growth picks up in 2026. Annual appreciation is projected to reach nearly 1.9 percent by August 2026. Home sales remain similarly soft, with National Association of Realtors Existing Home Sales now forecast at 4.07 million for 2025, only a 0.3 percent increase from 2024 and slightly below prior expectations. New listings continue to outpace sales, helping rebuild inventory after years of pandemic-era shortages.

Meanwhile, mortgage rates are offering a glimmer of relief. In October, the average 30-year fixed rate declined for the third straight week to 6.19 percent, its lowest level since October 2024, and down from 6.54 percent a year earlier. Fifteen-year rates also dipped to 5.44 percent.

While lower borrowing costs have boosted refinances, applications remain modest, and rates will likely need to fall below 6 percent to attract a broader pool of homeowners.

Sources:

https://www.pbs.org/newshour/nation/average-long-term-mortgage-rate-drops-to-lowest-level-in-more-than-a-year

https://www.zillow.com/research/home-value-sales-forecast-33822/

Notable Quote

“The real key to success in the markets is not intellect, but emotional discipline.”

– Daniel Kahneman