Stocks

A steep downturn on the last trading day of the month led Wall Street’s major indices to a losing month amid heightened anxiety about the U.S. election and an AI hangover.

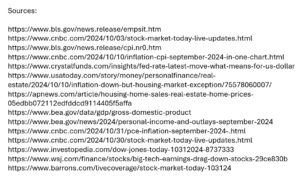

For the month of October, the stock market’s three major indices performed as follows:

The Dow -1.3%

S&P 500 -1.0%

Nasdaq -0.5%

The Dow and S&P 500 both snapped five-month winning streaks in October, while the Nasdaq saw its two-month run of positive gains come to an end.

Jobs & Unemployment

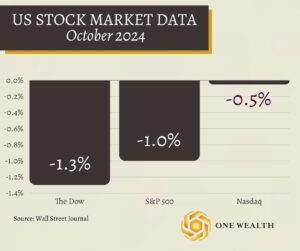

In September, the U.S. economy added 254,000 new jobs, shattering the Dow Jones economist poll forecast of 150,000 new hires. According to the U.S. Bureau of Labor Statistics, the unemployment rate ticked down slightly to 4.1% for the month.

Key sectors driving this growth included food services, health care, government, social assistance, and construction. The stronger-than-expected job data initially boosted stocks, signaling resilience in the labor market, and will have interesting repercussions for future Fed rate adjustments as they maintain a data-driven approach.

Inflation

The Consumer Price Index (CPI) for all Urban Consumers rose 0.2% in September, consistent with the increases in July and August but slightly higher than Wall Street estimates. Over the last 12 months, the overall index grew by 2.4%, the smallest 12-month rise since February 2021.

Through the month of September, shelter costs increased by 0.2% while food prices rose a troubling 0.4%, combined accounting for over 75% of the monthly inflation.

With the October 31st key PCE inflation report, we saw inflation rise modestly, approaching the Federal Reserve’s 2% target. The personal consumption expenditures (PCE) price index, the Fed’s preferred inflation measure, increased by 0.2% on a seasonally adjusted basis, with the year-over-year rate hitting 2.1%, aligning with expectations.

While the overall rate reflects progress towards the Fed’s inflation goal, core inflation – which excludes food and energy – was slightly higher at 2.7%, up 0.3% monthly and matching August’s annual rate.

As markets anticipate potential rate cuts at the Fed’s upcoming meeting, the central bank remains cautious; it recently cut its short-term rate by half a percentage point, a rare move during an economic expansion.

GDP

In Q3, real gross domestic product (GDP) rose at an annual rate of 2.8%, according to the U.S. Bureau of Economic Analysis, following a 3.0% increase in the second quarter.

This growth, driven primarily by higher consumer spending, federal expenditures, and net exports, helped alleviate concerns about a potential economic downturn as the Federal Reserve considers further interest-rate cuts.

Economists surveyed by FactSet had predicted a growth rate of 2.6%, while Bloomberg forecasted 2.9%. The economy had previously expanded by 1.6% in the first quarter of the year.

The U.S. Dollar’s Decline and Global Monetary Dynamics

The U.S. dollar has been on a downward trend since the third quarter of 2022, following the Federal Reserve’s halt to its rate hike cycle. The Fed’s recent rate cut in September 2024 has reinforced bearish sentiment toward the dollar, with expectations of further declines. Diverging central bank policies, particularly between the U.S., Japan, and Europe, have complicated the dollar’s trajectory.

The “Dollar Smile” theory explains the dollar’s historical strength during periods of U.S. economic growth or global crises, where it acts as a safe haven. However, the dollar began weakening in late 2022, reflecting global economic moderation and expectations of a more dovish Federal Reserve stance. This smile pattern has faded, indicating a shift away from the conditions that typically bolster the dollar.

The Federal Reserve’s rate cut in September 2024, the first since 2021, signaled a significant shift in U.S. monetary policy. The dollar weakened as markets anticipated the move, reflecting bearish sentiment. Other central banks, such as the Bank of Japan and the European Central Bank, have taken contrasting approaches, further complicating the global outlook for the dollar.

The U.S. dollar’s decline is not straightforward, as global economic uncertainties and diverging central bank policies continue to influence its future. While downward pressure remains, the dollar’s role as a global reserve currency and varying policy approaches across economies suggest that it will remain resilient in the face of these challenges.

Real Estate & Mortgage Market

In October, the U.S. housing market remained an exception to the broader trend of declining inflation. Shelter costs rose 4.9% over the past year, and mortgage payments have surged despite recent relief.

Looking at the latest data, the average monthly payment for homeowners hit a record $2,070 in August, a 7.2% increase from last year. Current buyers are facing mortgage payments of over 30% of their income – the standard barometer for affordability in most markets.

Yet despite falling sales, home prices continued to rise for the 14th consecutive month, with the median price up 3.1% year-over-year to $416,700, the highest on record for August.

With many homeowners locked into lower rates, housing supply is stagnant, and experts suggest mortgage rates must fall to around 5% for significant market movement. But despite a welcomed dip in rates in early autumn, they’ve since continued their volatility – bad news for a struggling market.

Notable Quote

“If there is one common theme to the vast range of the world’s financial crises it is that excessive debt accumulation, whether by the government, banks, corporations, or consumers, often poses greater systemic risks than it seems during a boom.”

-Carmel Reinhart