Stock market recap

The markets made a comeback in October, snapping two months of losses for all major indexes.

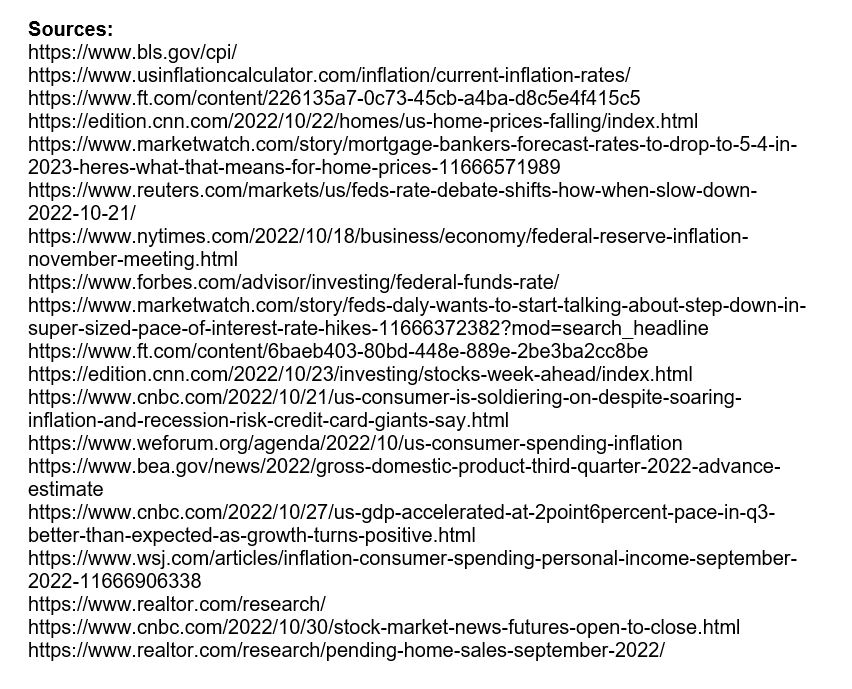

For the month, the three major indexes performed as follows:

Dow Jones Industrial Average +13.96%

S&P 500 +7.99%

Nasdaq Composite +3.90%

For the Dow, it was the best month for returns since 1976.

The next two weeks will be pivotal to see how the markets respond going forward. A Fed meeting that’s surely to see another big rate hike (Nov. 1-2), the CPI (inflation) report (Nov 10), jobs/unemployment report (Nov. 4), and even midterm elections (Nov. 8) all will be closely watched by investors and Wall Street.

Inflation

The annual inflation rate rose to 8.2% for the twelve-month period through September 2022, according to US Labor Department data. That represents only a minimal decline from August’s 8.3% annual inflation rate.

Additionally, the Consumer Price Index (CPI) rose +0.4% in September, a number that is sure to concern the Fed after the CPI climbed only 0.1% in August.

The largest monthly price increases came in the categories of food (+0.8%), shelter, and medical care, while gasoline fell by 4.9%, and the broader energy sector fell by 2.1% for the month.

The next official inflation report comes on November 10th, offering an update on annual inflation over the previous 12 months ending through October 2022.

The Fed

At their November 1-2 policy meeting, the Federal Open Markets Committee (FOMC) is fully expected to increase the fed funds rate by .75 to a range of 3.75% to 4%.

A three-quarter percent rate hike will match forecasts and represent four consecutive three-quarter percent hikes by the Fed.

However, at their next December 13-14 meeting, the final of the year, there is some uncertainty if the Fed will continue its aggressive push against inflation. The possibility for tapering down with a half-point increase, for instance, is on the table.

“The time is now to start talking about stepping down. The time is now to start planning for stepping down,” said San Francisco Fed President Mary Daly.

GDP

GDP rose unexpectedly by 2.6% in Q3 of 2022 according to advanced estimates released by the Bureau of Economic Analysis. That 2.6% growth surpassed estimates of 2.3% growth and bucked the Q1 (-o.6%) and Q2 (-1.6%) trend of negative GDP growth.

The report of positive GDP growth in Q3 also addresses some concerns that we’re in the midst of a recession, although the common definition that a recession is at least two successive quarters of negative GDP growth is not comprehensive.

According to the Bureau of Economic Analysis report, the sound Q3 growth is in part thanks to increases in consumer spending, government outlays, and a shrinking trade deficit.

However, a swooning housing market proved to be the biggest anchor on GDP growth.

Consumer Spending

In September (most recent data), consumer spending increased by just 0.6% (seasonally adjusted), according to the Commerce Department. That follows August’s equal 0.6% increase in consumer spending, revised upward from previously reported 0.4% and negative 0.2% consumer spending in July.

For Q3 2022 as a whole, the pace of consumer spending slowed, increasing just 1.4% for the quarter and down from 2% in Q2.

For the month, consumers spent more on food, clothing, prescription medications, recreational goods, and especially motor vehicles. Likewise, price tags for housing, utilities, and transportation ran higher.

Consumer spending accounts for more than two-thirds of all US economic activity.

Unemployment and job growth

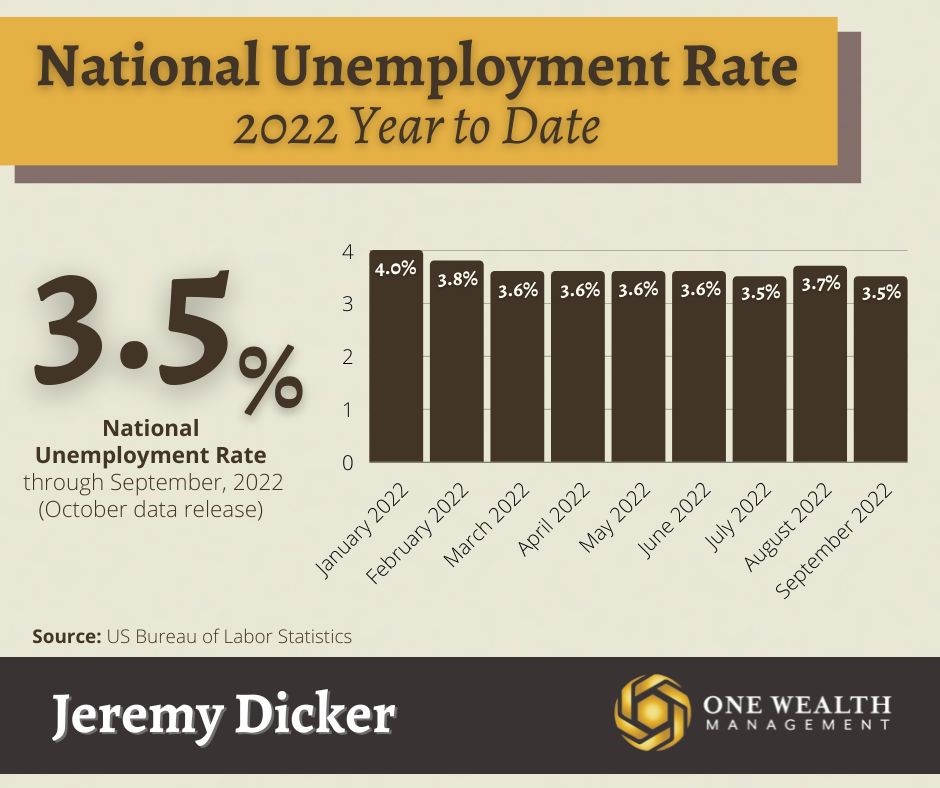

In September, the US unemployment rate unexpectedly fell to 3.5%, matching the 2022 monthly low. A 3.5% unemployment rate is also noteworthy because it equals a pre-pandemic low.

Low unemployment numbers contrast with a slight slowing in job growth, as the number of Americans who are currently employed (or looking for a job) fell off in September. For the month, the US economy added 263,000 new jobs, according to the Bureau of Labor Statistics, a significant drop from the 315,000 jobs created in August and 537,000 new jobs in July.

Through September (October’s job report is due out the first Friday of November), the US economy has averaged 420,000 jobs per month, down from the torrid 562,000 monthly average of job growth through 2021.

Statistic spotlight

0% to 20%

Over the past 50 years, the federal funds rate has ranged from 0% all the way up to 20%.

In 1980, the Fed hiked rates to a mind-boggling 20% as they wrestled with double-digit inflation. The fed funds rate has hit lows of 0% twice over the last 50 years, once in 2008 as the Fed looked to revive the economy during the Great Recession, and again in 2020 in response to the economic shock of the Covid-19 pandemic.

Housing Market

The big news in the housing market is mortgage rates, which continue to rise in response to Fed rate hikes. According to the National Association of Realtors, the average 30-year fixed mortgage surpassed 7% in late October, the highest mark for borrowers since 2001. As expected, that’s causing a glacial slowdown in the housing market, with new mortgage applications at their lowest volume since 1997.

Pending home sales were down 10.2% from August to September, the fourth straight month of declines. Pending home sales, a good measure of how many real estate transactions are underway as well as sales volume, is now at its lowest level since June of 2010 and down 31% since the same month in 2021.

However, thanks to a few years of momentum and hot price appreciation, average home sale prices are still +8.4% higher than the same month last year. Another key metric, months of available inventory, are still up 0.8 from September of 2021, but extremely low compared to historical standards.

Notable quote

“Money’s greatest intrinsic value – and this can’t be overstated – is its ability to give you control over your time.”

-Morgan Housel, The Psychology of Money