Stock Market

Equities finished November mixed, with major indices showing only modest movement amid a volatile month.

For the month, the market’s three major indices performed as follows:

S&P 500: +0.1%

The Dow: +0.32%

Nasdaq: –1.5%

The month began with a notable pullback—particularly in the Nasdaq—but a strong late-month rebound helped recover a large portion of those early losses.

Despite the rally, the Nasdaq still declined nearly 2% for the month, ending its seven-month winning streak. Concerns over elevated tech valuations weighed on risk appetite, contributing to the underperformance.

In contrast, both the S&P 500 and the Dow posted slight gains, extending their own winning streaks to seven consecutive months.

During the holiday-shortened final week of November, all three major indexes moved higher on growing optimism that the Federal Reserve may begin cutting interest rates at its December meeting.

Sources:

https://www.reuters.com/world/china/global-markets-wrapup-1-2025-11-28/

https://apnews.com/article/ai-japan-korea-us-holiday-bd0f4a4a6032381ae7751f9fc52ce011

https://www.investing.com/indices/us-30-historical-data

Inflation and the Fed Decision

The U.S. Bureau of Labor Statistics (BLS) announced it has canceled the release of October’s Consumer Price Index (CPI) after the recent government shutdown prevented data collectors from conducting required in-person and phone-based surveys.

While some nonsurvey data sources can be gathered retroactively, the BLS noted that full reconstruction of the index is not possible. As a result, October CPI values will only be published for a limited number of series—and only once November 2025 data is released on December 18, eight days later than initially planned.

The shutdown also disrupted several other major economic reports. The October employment report was canceled, and although the BLS will publish October nonfarm payrolls alongside the November employment report on December 16, the October unemployment rate will never be known because it relies on household surveys that could not be retroactively collected.

These disruptions leave the Federal Reserve without critical inflation data ahead of its December 10 interest-rate decision. The Fed was already navigating what Chair Jerome Powell called a “data fog” following the October quarter-point rate cut. Powell emphasized the need for while acknowledging the risk of operating with incomplete information.

With both CPI and PCE reporting delayed, Fed officials are preparing to set policy with less clarity than usual, relying on alternative data sources and emphasizing caution until the full suite of economic indicators becomes available again.

Sources:

https://www.reuters.com/world/us/us-cancels-release-cpi-report-october-because-government-shutdown-2025-11-21/

https://www.cnbc.com/2025/11/21/fed-wont-get-key-inflation-data-before-next-rate-decision-as-bls-cancels-october-cpi-release.html

Jobs and Unemployment

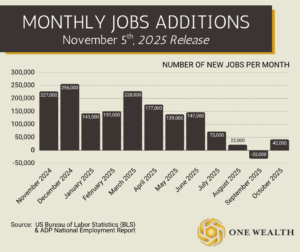

Private employers added 42,000 jobs in October, marking the first monthly gain since July, according to the ADP National Employment Report produced with Stanford’s Digital Economy Lab.

Hiring was modest and concentrated in education, health care, and trade, transportation, and utilities. Meanwhile, sectors like professional and business services, information, and leisure and hospitality continued to shed jobs, signaling uneven recovery across industries.

Wage growth held steady, with year-over-year pay up 4.5% for job-stayers and 6.7% for job-changers, a sign that wage pressures are flattening as supply and demand in the labor market find their balance. ADP’s Chief Economist Dr. Nela Richardson noted that pay growth has been largely unchanged for over a year, suggesting a cooling but stable environment for employers and workers alike.

The Bureau of Labor Statistics has not released its official data due to a government shutdown, leaving the ADP report as a key snapshot of current labor conditions.

Sources:

https://www.nbcnews.com/business/economy/adp-jobs-october-trump-rcna242070

https://adpemploymentreport.com/

Tallying the Cost of the Government Shut Down

The federal government shutdown, which began on October 1 and stretched past 40 days, is now the longest in U.S. history — and economists are working to quantify its true cost. While some economic activity will resume once operations fully restart, a significant share is permanently lost. Industries such as air travel saw revenue vanish from canceled flights, and key federal data releases — including the October jobs and inflation reports — were delayed or disrupted, creating challenges for policymakers and institutions like the Federal Reserve. The shutdown’s ripple effects extend across markets and households, amplifying uncertainty at a time when reliable economic data is essential.

Current estimates suggest roughly $11 billion in permanent GDP loss tied directly to the shutdown. In addition, about 900,000 federal workers were furloughed, while another two million continued working without pay, intensifying both financial strain and operational disruption. Economists note that some activity will rebound in the coming weeks, but much of the broader economic impact — from stalled spending to delayed government services — will not be fully recovered. As agencies work through backlogs and data reporting normalizes, the lingering effects of the shutdown will continue to influence markets, consumer sentiment, and fiscal decision-making.

Source:

Real Estate & Mortgage Market

Real estate sentiment this quarter is being driven by expectations for lower mortgage rates. The latest CNBC Housing Market Survey shows the average 30-year fixed mortgage rate has eased to 6.17%—its lowest level in a year. Nearly three-quarters of real estate agents say their buyers expect rates to fall even further, prompting many to wait on the sidelines instead of transacting now. Despite this sense of optimism, affordability remains the top barrier to action, as buyers balance current borrowing costs with economic uncertainty.

Market activity also reflects a growing disconnect between buyer expectations and seller behavior. While 44% of agents report that home prices are declining in their areas, most sellers are still pricing as if it’s a strong seller’s market. This standoff has led buyers to pursue strategies like interest-rate buydowns, adjustable-rate mortgages, borrowing from family, or compromising on home size and location. On the other side, sellers are increasingly making adjustments: 89% of agents had at least one seller reduce their asking price, and nearly a third reported that more than half their sellers made price cuts. Some homeowners are even delisting properties altogether, hoping for better conditions ahead.

Inventory is improving but remains historically tight, particularly for affordable homes. Looking ahead, most agents expect home sales to hold steady or improve slightly next quarter. Markets that overheated during the pandemic are seeing the sharpest slowdowns, while more affordable regions continue to show resilient demand.

Source:

https://www.cnbc.com/2025/10/23/housing-market-survey-buyers-expect-mortgage-rates-to-drop.html

Notable Quote

“Asset allocation explains more than 90% of the variability in portfolio returns.”

— Roger G. Ibbotson & Paul D. Kaplan (Financial Analysts Journal)

Source: