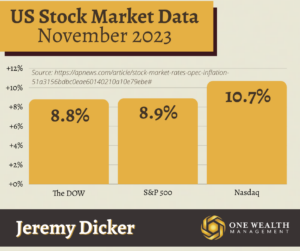

Stock Market

Markets rallied in November on the basis of a stronger-than-anticipated economy, resilient consumer, tempered inflation, and the realization that the Fed will likely pause rate hikes.

For the month, Wall Street’s three major indices performed as follows:

The Dow +8.8%

S&P 500 +8.9%

Nasdaq +10.7%

In November, both the S&P 500 and the Nasdaq Composite saw their biggest monthly gains since July 2022, and the Dow broke its three-month losing streak in bold fashion.

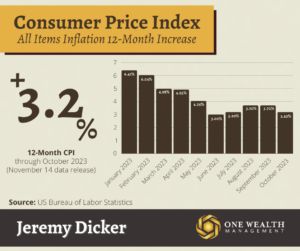

Inflation

November’s highly anticipated Consumer Price Index report revealed the cost of goods and services remained flat from October, with annual inflation increasing 3.2%. Both of those measures were below estimates (0.1% and 3.3%, respectively), and it was the slowest CPI increase since July 2021.

Likewise, late November’s Personal Consumption Expenditures (PCE) Index (the Fed’s preferred gauge of inflation) came in at 3% year-over-year, down from 3.4% annual PCE the previous month and the lowest level since 2021.

Both inflation reports were well received by Wall Street, reinforcing that inflation has cooled enough for the Fed to pause its rate hike cycle.

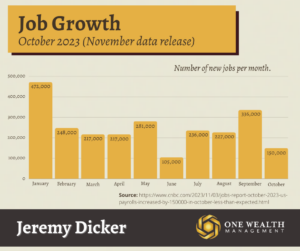

Jobs & Employment

Nonfarm payrolls rose by 150,000 in October, further evidence that the employment boom has come to a close. New hires came in lower than the consensus forecast of 170,000 new jobs, a significant slowdown in the labor market after September’s 297,000 new payrolls.

Along with the new data, the unemployment rate rose to 3.9%, higher than the forecast of 3.8%, and is now at the highest mark since January 2022.

GDP

According to the newly released second estimate, real gross domestic product (GDP) increased by 5.2% in the third quarter of 2023, demonstrating a resilient U.S. economy driven by healthy consumer spending.

That revised Q3 mark stands in stark contrast to the 2.1% GDP increase in Q2, surpassing the 5% initial estimate for third-quarter growth. Stronger-than-expected business investments and government spending also drove economic growth this past quarter.

The Fed and Rates

When the Federal Open Market Committee (FOMC) meets December 12-13, the consensus opinion is that they will opt to keep rates unchanged at their current range of 5.25% to 5.5%. Currently, the market gives only a one in twenty chance of another rate hike at the December meeting, according to the CME FedWatch Tool.

With data-driven evidence that inflation is cooling and rates already at restrictive levels, it’s likely the Fed will allow some time for rates to do their work, with no hike at the final meeting of 2023 – and no plans to cut rates in the near term until inflation drops to their 2% target rate.

Is there really a recession coming?

Over the past few months, the market has been in chaos because of the U.S. Treasury yields. Last month, the 10-year Treasury yield surpassed 5% for the first time since 2007, adversely affecting the stock market.

What’s more, a volatile Treasury negatively impacts consumers (i.e., mortgage rates, personal loans, credit card debt, etc.). When the Treasury yields rise, the cost of borrowing just about anything increases. This could be the last leg that catapults us into a world where a recession appears imminent.

So, what does that mean for investors or you?

Here’s what is directly affected when a recession hits:

- Borrowing costs increase.

- The housing market takes a hit.

- Bond prices fall.

- The stock market declines for the worse.

To read more, click here.

Tax changes for 2024 and beyond

The Internal Revenue Service recently announced that there are more than 60 new tax provisions and annual inflation adjustments for tax year 2024. Most notably, those provisions include a 5.4% increase in the standard deduction and a bump to 410(k) contribution limits.

For instance, in 2024, the standard deduction for married couples filing jointly will rise to $29,200, a jump of $1,500 from tax year 2023.

And for tax year 2024, the top tax rate will remain at 37% for individual single taxpayers who report income of at least $609,350 (or $731,200 for married couples filing jointly).

That drops to 35% for incomes over $243,725 ($487,450 for married couples filing jointly), 32% for incomes over $191,950 ($383,900 for married couples filing jointly), and 24% for incomes over $100,525 ($201,050 for married couples filing jointly).

Remember that many of these adjustments won’t apply to income tax returns until 2025. So, contact your CPA or tax planner for details, and you can reference all of the changes in IRS Notice 2023-75 by clicking here.

Mortgage & Housing

Mortgage rates finally saw relief in November, dropping up to a half point in recent weeks, the first significant prolonged decline in months. As of November 30, the average 30-year fixed rate mortgage was 7.22% across the U.S., down from 7.66% just a few weeks prior.

Still, elevated mortgage rates are stalling the housing market, with existing home sales down 14.6% year-over-year, their lowest levels in 13 years.

However, higher rates and an affordability crunch have not dinged home prices so far, with the median national sales price at $391,800 in October, up 3.4% from a year before.

Notable Quote

“Successful investing is anticipating the anticipations of others.”

~ John Maynard Keynes