Stocks

Bolstered by a banner last day of November, the markets posted positive gains for the month. Through November, the major indices performed as follows:

+5.3% Dow Jones

+4.6% S&P 500

+3.3% Nasdaq

Those returns technically pulled us out of a bear market, closing 20.4% higher than the recent low on September 30th of this year. The late rally was largely a reaction to remarks by Federal Reserve Chairman Jerome Powell, who signaled a 50-basis-point rate hike at the central bank’s December meeting.

Inflation

For October (latest data), the Consumer Price Index registered a 7.7% increase over the previous twelve months, as well as increasing 0.4% in the month since September’s CPI report.

Both of those numbers show slower inflation growth than estimated, a hopeful sign that inflation may be moderating. Economists had forecast a +7.9% CPI gain for October. The actual +7.7% inflation metric is the slowest rate of increase since January of 2022 and a noticeable easing from June’s +9.1% and September’s +8.2% CPI readings.

Core inflation readings decelerated to 6.3% annually, slowing from a forty-year high in previous months.

Despite the encouraging initial inflation report in October, household staples such as food, housing, and energy are still climbing at a concerning pace. Shelter costs, in particular, increased 0.8% just last month, the highest rate of increase since 1990.

The Bureau of Labor Statistics next CPI report will be released on December 13th, revealing November’s inflation data.

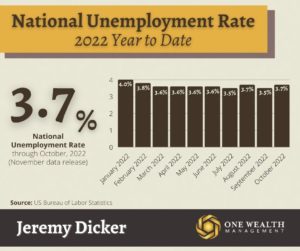

Jobs and Unemployment

According to the latest report by the U.S. Labor Bureau, the economy added 261,000 jobs in October.

The unemployment rate nudged higher from the previous month to 3.7%. While that is an increase, it’s only slightly higher than a 50-year low, and there are still almost two available jobs for each job seeker.

Over a three-month period, job growth climbed by an average of 289,000 new jobs per month. And since January 2021, the U.S. economy has averaged more than 200,000 additional new jobs every month.

However, weekly jobs data reveals that layoffs are still relatively low across the U.S. economy, despite mass layoffs across the technology sector. In October, employment grew most in the manufacturing and healthcare sectors.

Fed officials have expressed that the unemployment rate would need to climb to the 4% mark or beyond before exerting a cooling influence on demand-driven inflation.

The next jobs, payroll, and unemployment report will be released on December 2nd and carefully scrutinized by the Fed and Wall Street.

The Fed

At its November meeting, the Federal Reserve hiked interest rates another three-quarters of a point in an effort to choke inflation, their fourth consecutive three-quarter-point rate hike. That pushed the central bank’s benchmark rate to a range of 3.75% to 4%, its highest level in 15 years.

The Fed meets one more time in 2022 from December 13-14. Anticipation among economists evolved from another 0.75% increase to a likely half-point rate hike, largely based on encouraging inflation data.

In a recent Reuters poll, 78 out of 84 economists surveyed said the Fed would raise the federal funds rate by half a percentage point at their December meeting to a range of 4.25%-4.50%.

That sentiment was cemented by Federal Reserve Chairman Jerome Powell when, during a November 30th speech, he said that the Fed was ready to start tapering interest rate increases as soon as December.

One potential scenario includes a .50% rate hike in December and again at their next meeting in February 2023, then pausing rate hikes as soon as March 2023 at the peak of around 5%.

Of course, the Fed will be closely watching inflation, employment, and a host of other economic data in advance of its December meeting.

GDP

In the third quarter of 2022, U.S. Gross Domestic Product rose by 2.6%, according to advanced estimates from the Bureau of Economic Analysis. And as of November 30th, that figure was updated even higher to 2.9%.

That marks a solid turnaround after GDP declined the first two quarters of the year. While negative GDP in Q1 (-1.6%) and Q2 (-0.6%) meets one basic definition of a recession, economic expansion in Q3 reversed that momentum.

The official determination on recessions is handed down by the National Bureau of Economic Research, gauging a deeper array of factors. Still, in a September poll by Cinch Home Services, 76 percent of Americans surveyed felt that the U.S. economy was already in a recession, among other polls with similar results.

GDP increases were pushed by jumps in exports and consumer spending during Q3, while a drop in housing investments was the biggest detractor.

Housing Market and Mortgages

After pushing past the 7%-mark last month, mortgage rates have come back to earth, falling by almost half a percentage point through the second half of November.

According to Freddie Mac’s mortgage survey, the average 30-year-fixed loan is at 6.58% right now (as of Thanksgiving), a welcome development after rates essentially doubled since the beginning of 2022.

As expected, homebuyers are facing sticker shock when purchasing a property, causing a cooling of demand. Through October and based on the latest data from the National Association of Realtors, home sales declined for the ninth straight month, slowing by 5.9% from September to October alone and down 24.8% year-over-year.

While sales volume and purchase activity are down, the housing market still stands on a strong foundation of record-high homeowner equity, paltry inventory, and the fact that an overwhelming majority of homeowners now have safe, low-rate, fixed mortgages.

Today’s mortgage rates are also not unfavorable based on historical averages, so look for home prices to continue to cool in 2023 – but without a meltdown or crash as we saw in 2008.

Consumer Debt

Certain facets of consumer debt are rising at an alarming pace. In fact, household debt increased at its fastest rate in the past 20 years, reaching a record $16.5 trillion. The increase is in large part due to spikes in credit card balances and mortgage debt.

From Q3 2021 to Q3 2022, U.S. credit card balances rose 15%, according to the New York Federal Reserve, now totaling $930 billion. From July to September 2022 alone, total household debt skyrocketed $351 billion, the quickest quarterly increase since 2007.

According to Fed researchers, that concerning spike in credit card debt “towers over the last eighteen years of data.”

While a good portion of that increase was mortgage borrowing (especially with HELOCs as homeowners tapped into record equity), the rise in credit card debt, personal loans, and the like can be blamed on “a combination of robust consumer demand and higher prices,” according to Fed officials.

Notable Quote

“It makes sense to moderate the pace of our rate increases as we approach the level of restraint that will be sufficient to bring inflation down. The time for moderating the pace of rate increases may come as soon as the December meeting.”

-Federal Reserve Chairman Jerome Powell during a speech on November 30th