Stock Market

Despite early declines on the final trading day of the month, the U.S. stock market closed out a volatile yet impressive month of May.

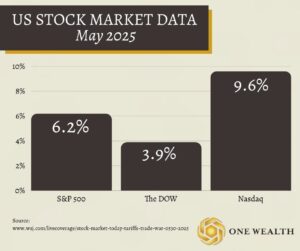

For the month, the market’s three major indices performed as follows:

S&P 500 6.2%

The Dow 3.9%

Nasdaq 9.6%

For the S&P 500, it was its strongest May performance since 1990 and its best overall month since November 2023, while the tech-heavy Nasdaq soared nearly double digits, driven by strength in the technology sector.

Investors weighed tariff concerns alongside encouraging signs of easing inflation, as seen in the Fed’s preferred price measure. Despite trade-related headwinds, all three major indexes ended the month solidly in positive territory.

Sources:

https://www.wsj.com/livecoverage/stock-market-today-tariffs-trade-war-0530-2025

https://finance.yahoo.com/news/live/stock-market-today-sp-500-marks-best-may-in-30-years-as-wall-street-bets-on-tariff-relief-200502633.html

GDP

In the first quarter of 2025, real GDP declined at an annual rate of 0.2%, following a 2.4% increase in the fourth quarter of 2024, according to the second estimate from the U.S. Bureau of Economic Analysis. The decline was driven by a rise in imports and a drop in government spending, partly offset by gains in investment, consumer spending, and exports. GDP was revised slightly upward by 0.1 percentage point due to stronger investment, though consumer spending was revised downward.

Real gross domestic income also fell 0.2%, reversing a strong 5.2% gain in the prior quarter. Corporate profits declined by $118.1 billion, following a $204.7 billion increase in Q4. Meanwhile, inflation indicators showed modest downward revisions, with the PCE price index excluding food and energy rising 3.4%.

Source:

The Fed and Rates

The Federal Reserve appears unlikely to cut interest rates at its upcoming meetings in June and July, according to recent comments from Fed officials. This marks a significant shift from earlier expectations—just a month ago, markets were pricing in a 90% chance of a rate cut by July. Now, that probability has dropped to just 29%, per CME Group’s FedWatch tool.

The Fed is maintaining higher interest rates as it closely monitors the effects of ongoing tariffs and economic uncertainty. Policymakers are caught between two conflicting pressures: a weakening job market could justify a rate cut, while persistent inflation might require keeping rates elevated. Tariffs further complicate the outlook, as they could both slow growth and push prices higher.

Source:

Inflation

In April, the Consumer Price Index (CPI) rose 0.2% month-over-month—slightly below expectations of 0.3%—marking a modest rebound after a 0.1% decline in March. Year-over-year, inflation came in at 2.3%, the smallest 12-month increase since February 2021 and just shy of the Federal Reserve’s 2% target. Core inflation, which excludes food and energy, rose 0.2% month-over-month and 2.8% year-over-year, both matching expectations.

Shelter costs led the monthly increase, rising 0.3% and accounting for more than half of April’s gain. Energy prices also edged up 0.7%, driven by higher natural gas and electricity costs despite a dip in gasoline prices. Meanwhile, food prices declined slightly, with a 0.4% drop in groceries offsetting a 0.4% rise in dining out. While airfare and used car prices fell, service inflation (excluding energy) accelerated to 0.3% in April, suggesting the Fed may continue its cautious stance on interest rate cuts.

Source:

https://www.bls.gov/news.release/pdf/cpi.pdf

Jobs and Employment

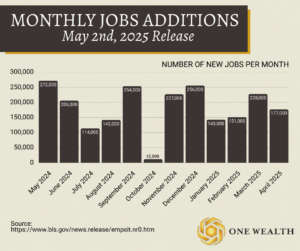

The U.S. economy added 177,000 jobs in April, exceeding expectations of 138,000, though prior months saw downward revisions totaling 58,000.

Key job gains were observed in healthcare, transportation and warehousing, financial activities, and social assistance. Transportation and warehousing posted their strongest growth since December, possibly reflecting tariff-related demand shifts. Meanwhile, federal government employment declined for the third consecutive month, losing 9,000 jobs in April and 26,000 since January, amid ongoing workforce reduction efforts.

The unemployment rate held steady at 4.2%, where it has remained since May 2024. The overall report suggests a stable, resilient labor market that supports continued consumer spending, though a slowdown in broader economic growth is still anticipated.

Source:

https://www.bls.gov/news.release/pdf/empsit.pdf

Recession Watch

Recession signals are mounting: borrowing is costlier, spending is slowing, and global risks are rising.

Recently, the 10-year U.S. Treasury yield surpassed 5% for the first time since 2007, driving up borrowing costs across mortgages, credit cards, and loans. As a key benchmark, the rising yield reflects investor sentiment and influences rates nationwide. This spike has pressured both consumers and markets, leading to declines in stock and bond prices and shifting investor strategies toward more conservative, income-generating assets.

The yield increase stems from factors like inflation, Fed rate hikes, and global instability. The Federal Reserve’s aggressive efforts to control inflation have tightened financial conditions, making debt more expensive and reducing affordability—especially in the housing market. These dynamics weigh on economic growth, as higher costs discourage both consumer spending and business investment.

Source:

https://www.crystalfunds.com/insights/is-a-recession-really-coming-heres-what-we-know

Real Estate and Mortgage Market

Mortgage rates surged past 7% in May after Moody’s downgraded the U.S. credit rating, driving up bond yields, which mortgage rates typically follow. The average 30-year fixed loan rate hit 7.04%, its highest since April. That earlier April spike had already slowed the housing market, pulling down pending home sales by 3.2% year-over-year and reducing homebuilder sentiment to its lowest since 2023. Although mortgage demand showed signs of life in early May when rates hovered below 7%, any rise above that level has significantly dampened buyer activity, especially as it prices some consumers out of the market entirely.

Despite continued high home prices—still 39% above March 2019 levels—inventory is slowly improving, though not where it’s most needed. Affordability remains a major issue, with households earning $75,000–$100,000 annually affording just 21.2% of listings in March 2025, down from nearly 49% pre-pandemic. Those earning $50,000 or less face even tougher odds, with only 8.7% of listings within their budget. In contrast, high-income buyers ($250,000+) have access to 80% or more of available homes. While inventory gains are helping, they’re not evenly distributed and are mostly concentrated in the Midwest and South, leaving many regions and income groups still struggling with limited affordable options.

Sources:

https://www.nbcnews.com/business/real-estate/mortgage-rates-cross-back-7-us-credit-downgrade-rcna207780

https://www.nbcnews.com/business/real-estate/exactly-unaffordable-todays-housing-market-s-getting-worse-rcna207007

Notable Quote

“To understand the market, one must think not as a rational man, but a natural man, with all his unreasoning emotions and instincts.”

– George Soros