Stock Market

Stocks gave up ground in March, posting steep losses to follow up on the previous month’s decline. For the month, the market’s major indices performed as follows:

The Dow -4.2%

S&P 500 -5.8%

Nasdaq Composite -8.2%

It was the S&P 500’s largest decline since December 2022, while the Nasdaq had its worst month since September 2022.

Looking at the stock market through the first quarter of 2025, the S&P 500 has dropped 4.6%, the Dow is off 1.3%, and the Nasdaq has nosedived more than 10%.

Inflation

Inflation in the U.S. slowed in February for the first time since September, offering some relief to consumers and policymakers. According to the latest Labor Department report, the Consumer Price Index (CPI) rose 2.8% year-over-year, down from 3.0% in January. More notably, core inflation – which excludes volatile food and energy prices – dropped to 3.1%, its lowest level since April 2021.

On a monthly basis, inflation rose just 0.2%, a sharp decline from January’s 0.5% increase. Economists had expected a smaller decline, making this slowdown a positive surprise.

Several factors contributed to February’s inflation slowdown. Airfare saw a notable 4% drop, offering some relief to travelers. Rental price increases also decelerated, easing the financial strain on tenants. Grocery prices, while remaining steady overall, presented a mixed picture – most items held their prices, but eggs surged by 10.4% in February alone, making them nearly 60% more expensive than a year ago.

Despite this progress, inflation remains above the Federal Reserve’s 2% target, and economic uncertainty looms. Many economists anticipate that price pressures will persist as new tariffs take effect later this year. The Fed will likely weigh these developments when making future policy decisions.

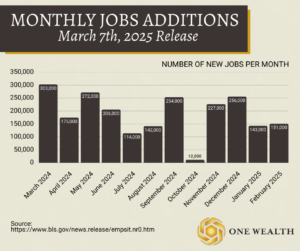

Jobs and Unemployment

The U.S. labor market showed modest growth in February, with nonfarm payroll employment rising by 151,000. This figure fell short of the anticipated 170,000 increase, reflecting a slower pace of job creation. The unemployment rate edged up slightly to 4.1%, continuing its range between 4.0% and 4.2% since May 2024.

Employment gains were led by the health care sector, which added 52,000 jobs. Other industries also saw growth, including financial activities with 21,000 new jobs, transportation and warehousing with 18,000, and social assistance with 11,000. However, federal government employment declined by 10,000 as part of ongoing workforce reductions.

While job creation remains positive, the slower-than-expected pace and ongoing federal workforce reductions suggest potential challenges ahead.

Source:

https://www.bls.gov/news.release/empsit.nr0.htm

The Fed and Rates

The Federal Reserve maintained its benchmark lending rate following its two-day policy meeting ending March 20. At the same time, it lowered its GDP growth forecast and raised its near-term inflation outlook.

As expected, the Fed kept the Federal Funds Rate within the 4.25% to 4.5% range, aligning with analyst predictions. The central bank also reaffirmed its expectation of two quarter-point rate cuts before the end of the year, following its most recent reduction in December.

However, the Fed adjusted its 2025 GDP growth projection downward, now anticipating a 1.7% increase—down from its previous estimate of 2.1% in December.

Gross Domestic Product

The U.S. economy demonstrated resilience in the fourth quarter of 2024, with real Gross Domestic Product (GDP) growing at an annualized rate of 2.4%, according to the Bureau of Economic Analysis (BEA). This marks a slight deceleration from the 3.1% growth observed in the third quarter.

The fourth-quarter expansion was primarily driven by robust consumer spending, which surged at a 4% annual rate, and increased government expenditures. However, business investment faced challenges, notably an 8.7% decline in equipment investment, highlighting ongoing uncertainties in the corporate sector.

For the entirety of 2024, the economy expanded by 2.8%, a modest dip from the 2.9% growth recorded in 2023.

Examining our National Debt

The U.S. national debt has been a constant presence in the country’s history, starting with the need to fund the Revolutionary War. In the early days, the debt was seen as the price of liberty, as Alexander Hamilton noted in his First Report on the Public Credit in 1790. Over the centuries, the debt has grown due to wars, economic crises, and government spending on various programs, such as the COVID-19 stimulus measures.

The debt spiked particularly after the Great Financial Crisis in 2007-2008, when government intervention through large-scale bailouts became necessary. This, combined with the ongoing rise in government expenditures (e.g., defense, social programs, and infrastructure), has led to a steadily increasing national debt. The pandemic’s economic impact also caused the government to inject trillions of dollars into the economy, which further pushed the debt upwards.

As of today, the national debt exceeds $35 trillion, reflecting the ongoing challenges of balancing government spending with revenue generation. This large and growing debt raises concerns about long-term economic stability, inflation, and the sustainability of government programs, but it also underscores the complex relationship between government action and economic health.

Real Estate and Mortgage

While we all focus on home prices and other trends, zooming out, a lack of supply may be driving our housing market more than any other factor.

In fact, despite growth in home supply, particularly in Florida and Texas, the nation is still short by 3.8 million housing units.

This ongoing shortage, coupled with rising home prices and high mortgage rates, presents a bleak outlook for potential homebuyers.

While construction has picked up, with 1.4 million housing units started last year—the first time since 2016 that new builds outpaced household formations—homebuilders face challenges. Single-family home starts rose by 6.5% in 2024, totaling 1.01 million, though total housing starts dipped to 1.36 million, due to a decline in multifamily construction. The National Association of Home Builders anticipates slight growth in single-family home construction in 2025 due to persistent housing shortages and favorable economic conditions.

Meanwhile, mortgage rates continue to decline nominally, fueled by economic uncertainty and expectations of potential rate cuts by the Federal Reserve later this year. As of early March, the average rate on 30-year fixed home loans dropped to 6.63%, a significant decrease from 6.88% a year ago.

Notable Quote

“The market is a pendulum that forever swings between unsustainable optimism and unjustified pessimism.”

– Howard Marks