Stock Market

In what was an eventful month on Wall Street, revised tariff policies and lackluster Big Tech earnings saw the stock market edge lower in the last days of July, muting earlier gains. While there is further consternation about the latest jobs report, a bullish long-term forecast remains.

Through the month of July, the stock market’s three major indices performed as follows:

S&P 500 +2.2%

DOW +0.1%

Nasdaq +3.7%

Source:

https://www.cnbc.com/2025/07/31/stock-market-today-live-updates.html

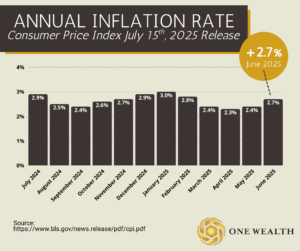

Inflation

Inflation ticked up in June, with the Consumer Price Index for All Urban Consumers (CPI-U) rising 0.3% on a seasonally adjusted basis, following a 0.1% increase in May, according to the U.S. Bureau of Labor Statistics. This pushed the annual inflation rate to 2.7%, its highest level since February, and in line with analyst expectations. Core inflation, which excludes volatile food and energy prices, rose 0.2% for the month and 2.9% over the past 12 months.

The primary driver of June’s monthly increase was shelter, which rose 0.2%. Food prices climbed 0.3%, while energy prices increased 0.9%, including a 1.0% rise in gasoline. Notably, some categories impacted by tariffs showed upward pressure: apparel prices increased 0.4% and household furnishings jumped 1.0%. Meanwhile, prices for new vehicles dropped 0.3%, and used cars and trucks declined 0.7%, contributing to a mixed picture of how tariffs are influencing overall inflation.

Despite earlier fears that tariffs would rapidly push prices higher, inflation had generally slowed since January, when the annual CPI stood at 3.0%. However, June’s data suggests that trade policies may now be beginning to ripple through specific sectors, signaling potential inflationary pressure ahead.

Sources:

https://www.bls.gov/news.release/cpi.nr0.htm

https://www.cnbc.com/2025/07/15/cpi-inflation-report-june-2025.html

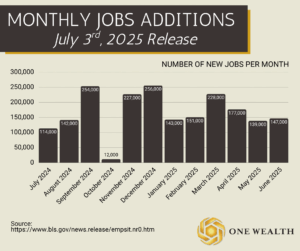

Jobs & Unemployment

In June, total nonfarm payroll employment rose by 147,000, while the unemployment rate held steady at 4.1%, according to the U.S. Bureau of Labor Statistics. Job gains were primarily seen in state government and health care, while federal employment continued to decline.

The number of unemployed people remained at 7.0 million, and unemployment rates stayed within a narrow 4.0%–4.2% range since May 2024. Labor force participation remained at 62.3%, with the employment-population ratio unchanged at 59.7%.

Source:

https://www.bls.gov/news.release/pdf/empsit.pdf

GDP

The U.S. economy grew at a significantly stronger pace than expected in the second quarter, with gross domestic product (GDP) rising 3%, surpassing the Dow Jones estimate of 2.3% and reversing a 0.5% decline in the previous quarter. This rebound was driven by a sharp turnaround in the trade balance and a resurgence in consumer spending. Specifically, consumer spending increased 1.4%, compared to just 0.5% in Q1.

Although exports declined by 1.8% during the period, imports plummeted by 30.3%, a dramatic shift from the 37.9% surge in the first quarter. The drop in imports, which subtract from GDP calculations, played a key role in the overall economic acceleration. The data, released by the Commerce Department, reflects seasonally and inflation-adjusted figures for April through June and signals renewed momentum across the broader U.S. economy.

Source:

https://www.cnbc.com/2025/07/30/gdp-q2-2025-.html

Fed Watch

In a closely watched decision, the Federal Reserve voted 9-2 on Wednesday to keep its benchmark interest rate unchanged at a range of 4.25%–4.5%, despite growing pressure from President Donald Trump and internal dissent.

Governors Michelle Bowman and Christopher Waller opposed the move, marking the first time since 1993 that multiple Fed governors cast dissenting votes on a rate decision. While the federal funds rate primarily dictates what banks charge each other for overnight lending, it also has wide-reaching effects on interest rates throughout the economy.

Source:

https://www.cnbc.com/2025/07/30/fed-leaves-interest-rates-unchanged-as-expected.html

Mortgage and Real Estate Market

The U.S. housing and mortgage landscape remained challenging in July, with affordability and buyer sentiment still weighed down by high borrowing costs. The average 30-year fixed mortgage rate hovered around 6.75%–6.78%, marking the second consecutive weekly increase by mid-month. Mortgage applications slowed to their weakest pace since May, indicating that many potential buyers are staying on the sidelines. A recent survey suggested that a drop to 6% could bring over 500,000 new buyers into the market, but rates remain too high for many to comfortably enter or move within the housing sector.

On the supply side, single-family housing starts fell to an 11-month low, and builder confidence remained pessimistic, according to the NAHB. In response, nearly 40% of builders cut prices in July and over 60% offered aggressive incentives, including mortgage rate buydowns and closing cost concessions.

Sources:

https://www.reuters.com/business/us-single-family-homebuilding-hits-11-month-low-building-permits-slump-2025-07-18/

https://www.reuters.com/world/us/us-homebuilders-head-into-back-half-2025-with-rising-costs-tariff-uncertainty-2025-07-21/

https://www.marketwatch.com/story/builders-are-pessimistic-about-the-housing-market-throwing-out-outrageous-incentives-to-reel-in-buyers-bd798026

Notable Quote

“When you invest in something, you are not merely buying a thing, but a stream of decisions, each of which carries the risk of breaking with the past.”

-Peter Bernstein