Stock Market

January’s solid gains were upended on the final day of the month with Fed Chairman Jerome Powell’s comments that a March rate cut was “probably not the most likely case.”

On that news, U.S. stocks logged their biggest daily drop of 2024. The S&P 500 fell 1.6% for the day, and the Nasdaq Composite saw its largest single-day decline since December 2022.

But tempered hopes for a March rate cut didn’t spoil the entire month’s gains after the markets entered all-time high territory multiple times in January, still ending positive.

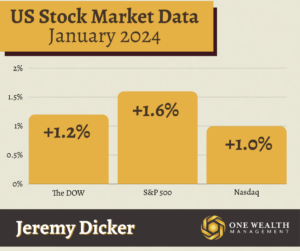

For the month of January, the stock market’s major indices performed as follows:

The Dow +1.2%

S&P 500 +1.6%

Nasdaq +1%

Jobs & Unemployment

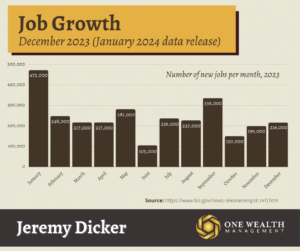

Total nonfarm payrolls increased by 216,000 in December 2023, according to U.S. Labor Bureau Statistics, revealing an unexpectedly resilient job market that seems to have found its equilibrium through a turbulent 2023.

In December, some of the industries with the largest job gains included government (+56,000), health care (+38,000), social assistance (+21,000), and construction (+17,000).

The unemployment rate remained unchanged at 3.7% in December, with about 6.3 million people out of work across the U.S.

Interestingly, the employment picture was similar to a year earlier in December 2022 when the unemployment rate was 3.5% and 5.9 million people were out of work.

Inflation

The outlook for inflation started January as somewhat of a disappointment but turned positively rosy by the end of the month.

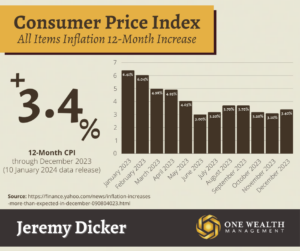

Early January’s data revealed that in December, the Consumer Price Index rose 3.4% on an annualized basis after November’s 3.1% gain, with the CPI nudging 0.3% higher than the previous month. Both annual and monthly price increases bucked economist estimates.

But in the latter days of the month, the Federal Reserve got the glowing inflation reading it was hoping for, as the Personal Consumption Expenditures Index (PCE) came in at 2.9% for December, exceeding forecasts.

It was the first time PCE came in below 3% on an annual reading since March 2021, and core PCE inflation fell to 1.9% on a six-month basis for the second month in a row.

With glowing inflation data to end the month, the Federal Reserve now has the core PCE reading below their 2% target it’s been looking for.

The Fed and Rates

Investor jubilance faced a reality check on the last day of January with Fed Chairman Jerome Powell’s comments that March would probably not be the “best case” for when the central bank started cutting rates.

At their January 30-31 meeting, the Fed opted not to drop their benchmark interest rate, as expected. But strong cautionary statements from Powell recalibrated expectations for a March cut, sending shockwaves through the stock market.

“Based on the meeting today, I would tell you that I don’t think it’s likely that the committee will reach a level of confidence by the time of the March meeting to identify March as the time [for its first rate cut],” Powell said. “But that’s to be seen.”

Revised Fed funds futures now gauge a 37.5% probability of a rate cut at least 25 basis points in March, down from 40.4% before the Fed’s meeting and Powell’s hawkish comments.

GDP

In Q4 2023, real gross domestic product (GDP) grew at an annual rate of 3.3% based on advance estimates released by the Bureau of Economic Analysis. In contrast to Q3’s 4.9% GDP increase, the U.S. economy cooled noticeably, but without losing all of its momentum.

That marks the sixth straight month when the economy grew by an annual pace of 2% or more, as American consumers are still spending freely and with confidence despite high interest rates, a job market that’s come back to earth, and sticky price inflation.

Recession Watch

While many predict a soft landing for the U.S. economy in 2024, the risk of a recession remains. Economists polled about the prospects for 2024 predict 1.2% U.S. GDP growth on average, so they foresee a relatively mild and shallow downturn, if at all.

Here is the takeaway for our chances to see a recession this year according to some notable financial institutions (per their 2024 outlooks):

Goldman Sachs: Limited risk

Deutsche Bank: Mild recession in H1

JP Morgan: Risk of a recession

Morgan Stanley: Little recession risk

Real Estate and Mortgage

Home prices continued to defy affordability woes and high mortgage rates to finish 2023, extending a 10th straight month of record highs in 20 of the largest U.S. metro markets. However, we saw a slight (-0.2%) dip in the S&P CoreLogic Case-Shiller index in December, the first drop since January of 2023, bringing U.S. home prices to a respectable annual gain of 5.1%.

Thankfully, mortgage rates came back to earth to the mid-6’s, down from nearly 8% just a few months earlier, with more on the horizon. Major industry players see rates continuing to decline through 2024, adding a much-needed spark to an otherwise stalled housing market.

Notable Quote

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.”

– Peter Lynch