Stocks

Stocks rallied on the last day of January to finish off a banner month.

Through January, the major stock indices performed as follows:

Dow 2.8%

SP 500 5.8%

Nasdaq 10.7%

For the tech-heavy Nasdaq Composite, that was its best January showing since it gained 12.2% in 2001.

***

The S&P 500 Index, Down Jones and NASDAQ are market indexes generally considered representative of the stock market as a whole. The index focuses on the large-cap segment of the U.S. equities market. Indices are unmanaged, and one cannot invest directly in an index. Past performance does not necessarily predict future results.

Inflation

It took all year and painful rate increases by the Fed, but inflation finally cooled substantially in December 2022.

As of the latest inflation report released on January 12th that encapsulates December’s data, the Consumer Price Index rose 6.5% year-over-year. The C.P.I. actually fell 0.1% since the previous month.

Core inflation – taking out volatile food and energy costs – shows that prices rose 5.7% year-over-year and 0.3% for the month.

While nowhere near the Fed inflation target of 2%, it is a significant improvement over June’s 9.1% price increase and the most recent 7.1% inflation reading in November.

In fact, U.S. Bureau of Labor Statistics data shows that prices fell for U.S. consumers for the first time since May 2020.

For the month, gas prices fell 9.4%, while shelter costs saw the largest gain with an 0.8% increase.

Those inflation numbers matched economist forecasts but still give us reason for cautious optimism as the Fed continues its campaign to dampen inflation heading into 2023.

The next C.P.I. report is set for release on February 14, 2023, illuminating January’s inflation data.

Jobs and Unemployment

In December 2022, non-farm payrolls rose by 223,000 across the U.S., a solid showing that also surpassed estimates of 200,000 new jobs.

That brought the unemployment rate down from 3.6% in November to 3.5%, or just 5.7 million Americans out of work. Since March 2022, the unemployment rate has hovered between the 3.5% to 3.7% range and now sits at 1960s lows.

The biggest employment gains last month occurred in the sectors of hospitality & leisure (+67,000 jobs), healthcare (+55,000), and construction payrolls (+28,000).

Wall Street and the Fed found some solace in that payroll wage growth slowed by the largest margin in two years, a sign that the job market may be easing in response to Fed rate hikes.

Interest Rates and the Fed

At their February 1st meeting, the Federal Reserve hiked short-term interest rates by a quarter percentage point, delivering as largely expected. That 25-basis point increase brings the Fed’s benchmark interest rate to the 4.50% – 4.75% range, a high not seen since 2007.

The first Fed decision of 2023 continues their rate tapering after an aggressive campaign to curb inflation, following a 50-basis point hike in December 2022 and four 75-basis point increases at their four meetings from June through November.

Despite the ramp-down of rate hikes, Fed Chairmen Powell and his committee remain hawkish, maintaining their commitment to decrease inflation and the work left to do for the nation’s economy.

The next Federal Open Market Committee meetings are scheduled for March 15-16 and May 3-4.

Gross Domestic Product

In the fourth quarter of 2022, United State GDP rose at a 2.9% annual rate, according to the Commerce Department. That October-through-December pace of gross domestic product beat the 2.8% GDP increase anticipated by economists in a Dow Jones survey.

Consumer spending, which makes up approximately 68% of the GDP reading, rose 2.1% over Q4, which was down slightly from its 2.3% pace in Q3.

Conversely, the World Bank downgraded its outlook for global economic growth in 2023, estimating a 1.7% worldwide GDP instead of their earlier 3% projection. The World Bank anticipates that global GDP will be 2.7% in 2024.

Housing Market

Many of you who live in California may see your home values dip in 2023. However, according to the California Association of Realtors (NAR), the decline should be less than double-digits and a move towards housing market normalization after white-hot equity gains over the last few years.

How will home prices fare on a national level in 2023? According to Lawrence Yun, chief economist and senior vice president of research at the NAR, median home prices across the nation will actually increase in 2023, albeit by a minuscule 0.3%.

“Half of the country may experience small price gains, while the other half may see slight price declines,” said Yun. “However, markets in California may be the exception, with San Francisco, for example, likely to register price drops of 10–15%.”

Still, falling mortgage rates and a noticeable uptick in loan volume are signaling that the real estate market may see only a gentle correction this year.

Tax Time

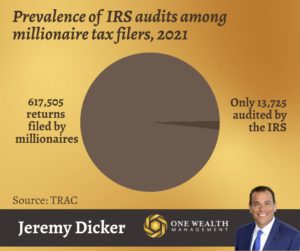

According to research by Transactional Records Access Clearinghouse (TRAC), tax filers who earn a million dollars or more are more likely to be audited by the Internal Revenue Service.

That being said, the prevalence of IRS audits is still relatively low, including for millionaire filers.

TRAC notes that in 2021, there were 617,505 millionaire tax returns filed in the U.S., but only 13,275 were audited, or 2.14%.

In 2019, for reference, the IRS audited 0.2% of all tax returns, but that rate tripled to 0.6% for those who made $1 million to $5 million, 1% for those earning $5 million to $10 million, and 2% for those filing a return of $10 million or more.

It’s widely reported that these are the most common causes for IRS audits, or “red flags” for filers:

- Missing income, such as absent 1099s.

- Deductions that are too high (the IRS actually uses algorithms to determine if your deductions make sense.

- Foreign accounts or assets above a certain threshold.

- High earnings.

- Child dependent errors (if more than one person claims the same child as a dependent).

- Business expenses (round numbers, more deductions than profits, too many years of losses, etc.).

Notable Quote

“A lot of people with high I.Q.s are terrible investors because they’ve got terrible temperaments. You need to keep raw, irrational emotion under control.”

— Charlie Munger