Stock Market

The stock market capped off its fourth straight month of gains in February. For the month, the market’s three major indices performed as follows:

The Dow 2.22%

S&P 500 5.17%

Nasdaq 6.12%

The S&P 500 and the Nasdaq showed their best returns for any February since 2015. Looking at the first two months of the year as a whole, the S&P 500 and the Dow have registered their best start since 2019 (+6.8% and + 3.5%, respectively), with the tech-heavy Nasdaq surging 7.2% over the first two months of 2024.

February’s rally was relatively broad, spilling out among more than just tech or the Magnificent Seven, with 11 of the large-cap index’s sectors finishing in the green for the month.

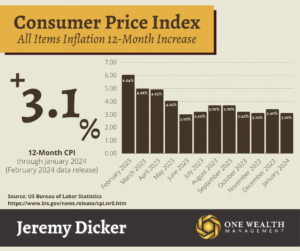

Inflation

Despite optimism that inflation was free-falling, early February’s Bureau of Labor Statistics release told a more complicated story. The Consumer Price Index rose 0.3% in January, with prices increasing after December’s 0.2% month-to-month inflation reading.

Shelter costs continued to be the culprit, and the index for all items less food and energy rose 0.4% in January.

However, inflation dropped to 3.1% on an annual basis, down from December’s 3.4% annual inflation rate.

Released on the 29th day of February, the Personal Consumption Expenditures (PCE) index (the Fed’s preferred gauge of inflation) told a similar story. PCE rose only 2.8% in January year-over-year, logging its lowest annual increase since March 2021.

However, core PCE did increase 0.4% since the previous month after rising only 0.1% in December 2023, exhibiting the largest monthly uptick in prices since January 2023.

February’s conflicting inflation numbers dashed hopes for a linear decline, impacting markets and refocusing investor outlook as a Fed rate hike in March may now be off the board.

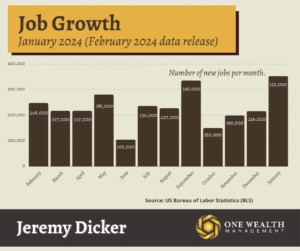

Jobs & Employment

In January, employment gains blew past expectations with 353,000 new non-farm payrolls, according to the February 2nd Bureau of Labor Statistics report. Those glowing job numbers doubled expectations of 176,500 new hires, leaving many analysts scratching their heads as the employment market continues to show resilience.

The strongest job gains occurred in the sectors of professional and business services, health care, and retail.

Unemployment stayed at 3.7% for the third month in a row, according to January’s data release. Since December 2021, U.S. unemployment has remained stable with a rate between 3.4% and 3.9%.

The Fed and Rates

Expectations for a fed rate drop have sobered as we eagerly await the decision on interest rates at the next Federal Open Market Committee (FOMC) on March 19-20.

What seemed like a near-certainty as 2024 began is now a longshot, as the fed is on record that they’re concerned with cutting interest rates too soon, signaling they will likely stay patient at their March meeting.

Minutes from the Federal Reserve’s most recent meeting confirm that the Fed is hesitant to cut rates from their 23-year high while inflation may flare up again, looking for further evidence that prices have stabilized.

According to February meeting minutes, “Most participants noted the risks of moving too quickly to ease the stance of policy and emphasized the importance of carefully assessing incoming data in judging whether inflation is moving down sustainably to 2%.”

Financial markets are now betting that the first rate hike of 2024 will come at the June FOMC meeting instead of in March.

GDP

Second estimates released by the Bureau of Economic Analysis reported that real gross domestic product (GDP) increased by 3.2% on an annual basis in the fourth quarter of 2023. That reading of the economy’s health was downwardly revised from 3.3% based on the first estimate, reflecting updated data.

The slight downward revision is due to clarifications in private inventory investments, although state and local spending, as well as consumer spending, rose for the quarter.

U.S. Debt

Is the U.S. government writing checks it can’t cash?

According to the Treasury’s Fiscal Service office, U.S. debt rose to $33.2 trillion in fiscal year 2023. Not only is that $2.2 trillion higher than in 2022, but interest alone on that debt cost us $875.5 billion. Treasury borrowing reached an estimated $1 trillion in 2023 and is expected to double in 2024, with government debt on pace to surpass $34 trillion this year.

Why is our government in the red like never before? After years of tax cuts, stimulus spending, and falling revenues – all exacerbated by the pandemic – the bill has come due.

It makes sense that U.S. government debt is the largest of any country in the world by sheer dollar volume, but the percentage of GDP is a better indicator of fiscal policy. And based on that gauge, we’re near historic levels, too. The federal deficit rose to 6.3% of GDP in 2023, up from just 5.4% of GDP in 2022, a troubling trend that’s continued in 2024.

To read more, click here.

Notable Quotation

“If there is one common theme to the vast range of the world’s financial crises, it is that excessive debt accumulation, whether by the government, banks, corporations, or consumers, often poses greater systemic risks than it seems during a boom.”

— Carmen Reinhart, economist and Harvard professor