Stock Market

Strong market headwinds pushed stocks higher through December, continuing November’s rally and nearing record highs before falling just short on the last trading day of the month – and the year.

In all, the S&P 500 closed just 0.6% below its record high of 4,796.56 on January 3, 2022. The index rose for a ninth straight week to end December, Q4, and 2023, the S&P 500’s most substantial quarterly gain since Q4 of 2020.

Wall Street’s three major indices all finished December positive, adding to their strong gains in 2023. The Nasdaq climbed a remarkable 40%+ over the year, the S&P 500 almost 25%, and the Dow was up double-digits.

For the year, “Magnificent Seven” companies – Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, and Tesla – together accounted for nearly two-thirds of all S&P 500 gains.

Market fears driven by sticky inflation and geopolitical events were swept aside by evidence that the Fed will achieve a soft landing, with three rate cuts largely anticipated in 2024.

In December, the stock market’s three major indices performed as follows:

The Dow +3.9%

S&P 500 +4.4%

Nasdaq +4.8%

In 2023, the stock market’s three major indices performed as follows:

The Dow +13.7%

S&P 500 + 24.2%

Nasdaq +43.4%

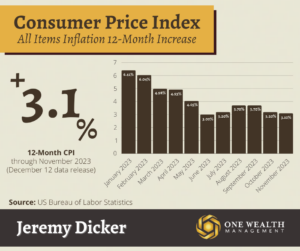

Inflation

Inflation nudged lower in November based on falling gas prices, although price increases remain stubbornly high across several other categories.

The Consumer Price Index (CPI) increased 0.1% from October to November on a seasonally adjusted basis, with annual inflation coming in at 3.1% after October’s 3.2%. The inflation data surely influenced the Fed’s decision on December 13 to maintain its benchmark rate.

Late December’s personal consumption expenditures (PCE) price index data brought more good news. The Fed’s preferred gauge of inflation saw prices fall 0.1% for the month, pushing annual inflation below 3%. It was the first PCE price index decline since April 2020, more than 3 ½ years ago.

While it appears the Fed’s rate hikes and long-standing campaign against inflation is achieving the desired effect, some prices remain too high for comfort, such as shelter, food costs (outside the home), insurance, and more.

The Fed and Rates

At its December 13 meeting, the Federal Reserve opted to maintain its benchmark interest rate at a range of 5.25% – 5.5%, likely cementing the end of its rate hike cycle.

Although rates remain at their highest point in 22 years, promising recent inflation data led the Fed to not only pause a further hike, but signal rate cuts may be coming in the year ahead. Those signs point to a cut of interest rates by 75 basis points, or 0.75%, in 2024.

Projections by the Fed reveal expectations of inflation falling to 2.4% next year and a further drop to 2.2% in 2025, much closer to their ultimate target rate of 2%. According to the respected CME FedWatch Tool, there is a 33% probability that the Fed will cut rates in March 2024 and a 64% chance that the central bank will start easing rates by May.

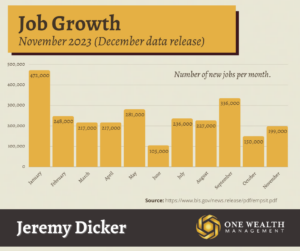

Jobs and Unemployment

Nonfarm payrolls increased by 199,000 in November, demonstrating a job market that continues to normalize after a post-Covid boom. Sub-200k employment growth came in below the twelve-month average of 240,000 new jobs, although it was notably higher than October’s 150,000 payroll additions.

In November, the biggest job gains came in health care (+77,000), government employment (+49,000), as well as manufacturing (+28,000) after striking employees put down their picket signs and returned to work.

In November, the unemployment rate fell slightly to 3.7%.

GDP

U.S. GDP increased at an annual rate of 4.9% in the third quarter of 2023, according to the newly released third estimate. Based on updated data, the new third estimate represents a downturn from earlier estimates of a 5.2% GDP increase, based largely on a revision in consumer spending.

According to the Bureau of Economic Analysis, Q2’s Gross Domestic Product increased by 2.1%.

Recession Watch

Controlled inflation, a strong economy, and a solid job market have many analysts claiming that we have successfully avoided a recession in 2023 – and may continue to stay out of negative economic territory in 2024, essentially sticking a soft landing.

While consumer confidence has shifted to a three-month high, the Conference Board highlights data that urges a more cautious approach. According to that business group’s recession watch survey, two-thirds of respondents said they think an economic downturn is still possible next year.

The leading economic index – a gauge of 10 common recession indicators – dropped 0.5% in November 2023, declining for the 20th straight months and not ruling out the possibility of a recession ahead. With 9 out of 10 of the indicators flat or negative in November (only a stock rally was positive), the Conference Board forecasts the likelihood of a recession in the first half of 2024, although they forecast just a short and shallow downturn.

Gold!

The U.S. dollar has not been tied to gold since 1971, replaced by President Nixon for a new fiat system.

But many investors now see gold as a useful element of their portfolios. Some of the key benefits of investing in gold include liquidity, historical performance, stability, and a relatively low correlation to equities.

The precious metal is also seen as an inflation hedge and safe haven asset. In fact, in 2022 as inflation soared, gold outperformed other notable asset classes (although it posted just a mildly positive return).

While gold thrives during times of geopolitical and market chaos, it also has shown an inverse relationship with interest rates.

Notable Quote

“There are two requirements for success in Wall Street. One, you have to think correctly; and secondly, you have to think independently.”

— Benjamin Graham