Convincing signs that we’re moving closer toward 2% inflation keep adding up.

When October’s PCE inflation data was released, it was very similar to the CPI data earlier in the month. The report revealed headline inflation grew only 0.049%, a welcome revelation compared to expectations of a 0.1% increase. Similarly, core inflation rose only 0.163% versus consensus estimates of a 0.2% increase.

Even stripping out more volatile shelter costs, inflation is running below 2% on an annualized pace over both a three-month and six-month timeframe. Even if we zoom out to the last nine months, we’re looking at annualized inflation of only 2.3%

Year-over-year, headline inflation is now 3.01%, and core inflation is only 3.46%, the lowest price increases we’ve seen since March and April 2021, respectively.

In fact, over the past five months, core PCE is operating at a 2.3% annualized rate.

The data is starting to point toward a pace of inflation that’s a lot more comfortable for the Fed, which holds a 2% target and a checklist of specific benchmarks, all of which we’ve achieved or are on the path to do so. Those include core goods inflation at zero, the housing market in-line for normalization, and supercore services coming back to the mean.

Inflation has dominated the economic conversation for so long, it’s hard to forget it was just a month ago when we all thought a future rate hike may still be in play. But inflation seems to be safely in our rearview mirror, despite the resilience of labor markets and steady economic growth.

Of course, Fed chairman Jerome Powell is keeping the door open for sustaining higher rates for longer if needed, opting for flexibility within his data-driven approach. But others see a string of 3-5 more months of steadily declining inflation prints as ample evidence that their rate cut campaign needs to commence.

To illustrate our point, here are a few notable charts from Bloomberg.com:

Annualized Core PCE sans shelter costs is now operating under 2% over the past six months. The year-over-year numbers will be in mid-2% territory if we see a few more of these similar reports.

Source: Bloomberg

Over the past six months, Core PCE is annualizing at 2.5%.

Source: Bloomberg

We’re actually perched below the Fed’s projection for 2023 year-end core PCE of 3.7%, and it’s highly unlikely we’ll rise above that projection. (In order to miss that mark, we’d need to average a 0.5% inflation increase over the next two months, up sharply from the .188% average increase we’ve seen the past five months.)

Even if we ran with 0.2% inflation, slightly higher than the recent numbers, we would be sinking below the Fed’s 2024 full-year projection for inflation by April!

Source: Bloomberg

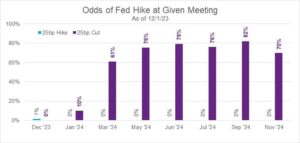

A new cycle of price cuts appears on the horizon. Currently, there are 60% odds for a price cut in March and 75% for May through September.

Source: Bloomberg

Five rate cuts between now and the end of 2024 may be ambitious, especially with forecasts for a resilient economy next year.

However, rate markets essentially gauge the probability of potential economic scenarios, such as a hard landing, soft landing, or even no landing. And the Fed now has more room to operate if aggressive rate cuts are needed.

Source: Bloomberg

To conclude, mounting data points to inflation that is moving towards the Fed’s 2% target.

The landscape is shifting away from policy decisions in restrictive territory to just how soft our landing will be – and the future path of rate cuts in 2024.

As always, if you have any questions or need anything at all, please reach out.

***

One Wealth Management Investment and Advisory Services, LLC and Natixis Investment Managers Solutions are not affiliated.

This is market research that we believe has value, but the views and opinions are the author(s) and not OWM. The information contained herein does not constitute investment advice. It is solely for informational purposes.

One Wealth Management Investment and Advisory Services, LLC is a registered investment adviser. This platform is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advise in rendered by One Wealth Management Investment and Advisory Services, LLC unless a client service agreement is in place.