Stock Market

Wall Street ended August on a down note on concerning inflation data, but still managed to record its fourth winning month in a row.

For the month, the stock market’s three major indices performed as follows:

S&P 500 +1.9%

The Dow +3.1%

Nasdaq +1.6%

While the S&P 500 did reach a new record high in August, September has historically been a losing month. In fact, according to The Stock Trader’s Almanac, September has seen the largest declines of any month for those three indices since 1950.

Source:

https://www.cnbc.com/2025/08/28/stock-market-today-live-updates-.html

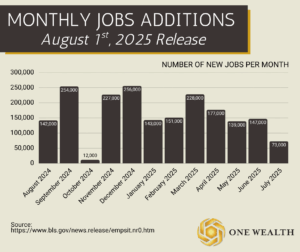

Jobs & Unemployment

The U.S. economy added 73,000 jobs in July, a modest improvement over June’s revised total of just 14,000 but still well below the Dow Jones estimate of 100,000. Notably, job growth in May and June was revised downward by a combined 258,000, signaling deeper labor market weakness than previously reported. The unemployment rate rose to 4.2%, matching expectations.

The majority of July’s job gains came from health care (55,000 jobs) and social assistance (18,000), accounting for about 94% of total growth. Other sectors like retail and finance saw modest increases, while professional services and federal government jobs declined.

The soft labor report, combined with dramatic revisions, is raising concerns about the overall strength of the U.S. economy, especially amid ongoing tariff escalations. Economists and market analysts say the weakening job market may prompt the Federal Reserve to cut interest rates in September, with futures markets placing the odds of a rate cut at 75.5%, up from 40% just a day prior.

Source:

https://www.cnbc.com/2025/08/01/jobs-report-july-2025.html

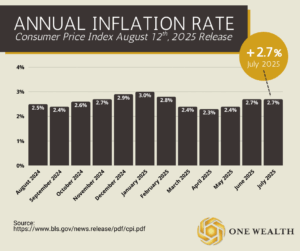

Inflation

U.S. consumer prices rose less than expected in July 2025, with the Consumer Price Index (CPI) up 0.2% for the month and 2.7% year-over-year, according to the Bureau of Labor Statistics (BLS).

Core CPI, which excludes food and energy, rose 0.3% in July — the largest monthly gain since January — and 3.1% annually, its highest since February. The shelter index increased 0.2% and was the primary driver of the monthly gain, while food prices were unchanged and energy costs fell 1.1%, including a 2.2% drop in gasoline. Over the past year, the food index rose 2.9% while the energy index declined 1.6%. Core commodities increased 0.2% in July.

The inflation report came amid heightened political scrutiny of the BLS, with President Donald Trump recently firing the prior commissioner and announcing E.J. Antoni as his nominee for the role.

Sources:

https://www.bls.gov/news.release/pdf/cpi.pdf

https://www.cnbc.com/2025/08/12/cpi-inflation-report-july-2025.html

The Fed & Rates

The latest CME FedWatch Tool readings show the probability of a Federal Reserve rate cut in September has slipped to 71.5%, down from earlier levels, after jobless claims rose to 235,000, above expectations of 225,000.

These projections suggest that while near-term volatility in economic data has cooled confidence slightly, markets still see strong odds of rate relief next month.

The decline reflects increased caution among investors, with concerns that labor market weakness may complicate the Fed’s path forward. While a cut remains the base case, the odds are now less definitive.

The next Federal Reserve (FOMC) meeting on interest rates is September 16–17, 2025.

Sources:

https://www.federalreserve.gov/monetarypolicy/fomccalendars.htm?utm_source=chatgpt.com

https://www.ainvest.com/news/probability-fed-rate-cut-september-drops-71-5-jobless-claims-rise-235000-2508/?utm_source=chatgpt.com

https://www.investopedia.com/federal-reserve-rate-cut-chances-after-inflation-report-11789357?utm_source=chatgpt.com

GDP

The U.S. economy rebounded in the second quarter of 2025, expanding at an annualized rate of 3.3% after contracting 0.5% in the first quarter, according to the Bureau of Economic Analysis. The turnaround was driven largely by a steep 29.8% drop in imports — which had surged earlier in the year as businesses stockpiled goods ahead of new tariffs — adding more than five percentage points to growth. Consumer spending, which makes up about 70% of GDP, rose 1.6% in Q2, up from just 0.5% in Q1.

Underlying economic strength, measured by final sales to private domestic purchasers (consumer spending plus fixed investment), grew 1.9% in Q2, reflecting resilience in household demand despite headwinds. Inflation pressures eased slightly, with the PCE price index up 2.0% and core PCE holding at 2.5%.

Sources:

https://www.bea.gov/news/2025/gross-domestic-product-2nd-quarter-2025-second-estimate-and-corporate-profits-preliminary

https://www.bea.gov/news/2025/gross-domestic-product-2nd-quarter-2025-second-estimate-and-corporate-profits-preliminary

Real Estate & Mortgage Market

U.S. home sales unexpectedly rose in July (latest data), though affordability challenges continue to weigh on the market. Sales of previously owned homes increased 2.0% to a seasonally adjusted annual rate of 4.01 million units, up from 3.93 million in June, according to the National Association of Realtors (NAR). That figure edged 0.8% higher year-over-year, surpassing economists’ forecasts of 3.92 million.

Despite the gain, sales remain sluggish, averaging around 4 million units monthly over the past two years—a pace weaker than during the 2007–2009 recession. The median sales price climbed 0.2% from last year to $422,400, marking the 25th straight annual increase, though down from June’s record high.

Mortgage rates have eased, with the average 30-year fixed falling to 6.58%, the lowest since last fall. First-time buyers represented 28% of sales, down from 30% in June.

Notable Quote

“To invest successfully, you need not only a method, but an understanding of your own limitations and biases.”

-Nassim Nicholas Taleb