Stock Market

Stocks fell on the last trading day of April to cap a losing month. The stock market’s three major indices performed as follows in April:

S&P 500 -4.2%

Nasdaq -4.4%

The Dow -5%

It was the Dow’s worst monthly slide since September 2022, while all three major indices ended five straight months of gains.

Disappointing wage data and a new round of inflation fears capsized markets on the final day of April. But despite a brutal month for equities, the S&P 500 is still up more than 20% from its recent low as of October 2023.

Of course, renewed inflation worries dashed hopes for multiple rate cuts sooner than later, with a recent string of reports influencing the Fed’s rate decision on Wednesday afternoon.

Inflation

In March, the Consumer Price Index increased to 3.5% on an annualized basis, according to the U.S. Bureau of Labor Statistics, a significant increase over February’s 3.2% 12-month inflation reading.

Inflation rose 0.4% for the month of March (on a seasonally adjusted basis), the same increase as in February.

Higher shelter and gasoline costs were the two biggest drivers of higher costs for the month, combining to make up more than half of all increases for the period. Jumps in medical care, car insurance, apparel, and personal care items also pushed the CPI higher.

The latter days of April brought more sobering news, as personal consumption expenditures (PCE) – the Fed’s preferred gauge of inflation which excludes volatile food and energy costs – rose 2.8% since March of last year. This price increase was the same as in February but exceeded the 2.7% PCE increase anticipated by Dow Jones surveys. PCE Inflation rose 0.3% for the month, as expected and in line with February’s increase.

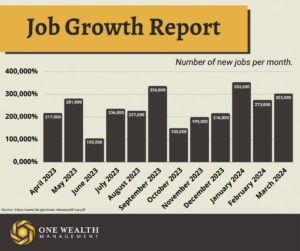

Jobs & Unemployment

Total nonfarm payrolls rose by 303,000 in March according to the U.S. Bureau of Labor Statistics. With more than 300k new jobs, hiring surpassed the average monthly rate of 231,000 over the past 12 months, demonstrating solid growth and unanticipated resilience in our economy.

In March, the most significant job gains occurred in the sectors of healthcare (+72,000), government (+71,000), and construction (+39,000).

For the month, the U.S. unemployment rate remained relatively unchanged at 3.8%.

Is AI the next dotcom bubble?

On March 1, 2024, Nvidia hit a $2 trillion market cap, signaling the start of the AI boom. This frenzy around AI—impacting life, work, and security—parallels the dotcom craze of the late ’90s, where internet companies like Netscape sparked a massive investment boom despite minimal revenues.

The dotcom bubble eventually burst in 2000. By March 2000, the NASDAQ dropped over 75%, erasing over $5 trillion in market value but leaving survivors like Google and Amazon.

Today, as AI technologies like generative AI become mainstream, companies and investors are eagerly jumping in, possibly heralding a new era of speculative investment.

Will the AI boom replay the dotcom burst, or are we witnessing a more sustainable revolution?

GDP

According to recent data from the Bureau of Economic Analysis, the U.S. economy grew at an annualized rate of 1.6% during the first quarter of 2024. This represents the slowest pace of growth in nearly two years and far slower than the 2.5% Q1 GDP growth anticipated by Wall Street.

Economists and the Fed are trying to make sense of the data, which deflates the prevailing narrative that the economy was reaccelerating.

For context, the U.S. economy grew by an upwardly revised 3.4% in Q4 of 2023 based on weaker trade and export data.

The Fed and Rates

At its Federal Open Market Committee (FOMC) meeting on April 30 and May 1, the Fed opted to hold their benchmark rate steady as expected.

Recent inflation data highlighted the need for a “higher-for-longer” approach with the fed funds rate, with a lot more work to be done before they’re satisfied inflation is moving towards their 2% goal for good.

Although we didn’t see a rate cut at this third of the Fed’s eight FOMC meetings this year, markets are betting on a rate cut in July or September, anticipating no rate movement at the June meeting.

Real estate and Mortgage

While the housing market has essentially flat-lined in 2024 due to elevated mortgage rates and affordability woes, there are signs of life as we head towards peak home-buying season. Mortgage giant Fannie Mae predicts an uptick in home sale volume compared to last year, with a slight cooling of hot price increases.

Still, record low inventory and mortgage rates above 7% continue to plague would-be buyers and keep sellers on the fence, as mortgage rates ended the week of April 25th at an unfavorable 7.17% according to Freddie Mac.

Notable Quote

“The market can stay irrational longer than you can stay solvent.”

– John Maynard Keynes