Stock Market

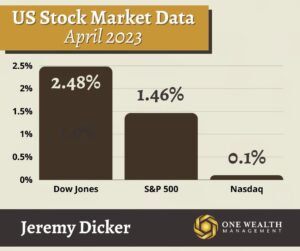

For the month of April, the stock market’s three major indices performed as follows:

Dow Jones Industrial Average 2.48%

S&P 500 1.46%

Nasdaq Composite 0.1%

For the month, the Dow saw its largest monthly gain since January, while the S&P logged its second positive month in a row.

Friday, the last trading day of the month, saw solid gains thanks to a series of strong earnings reports, with the Dow rising 0.8%, the S&P the same, and the tech-heavy Nasdaq Composite jumping 0.7%.

To date, just over 53% of S&P 500 companies have reported earnings. Of those, 79% came in ahead of expectations on earnings per share and 74% have beat revenue expectations.

Inflation

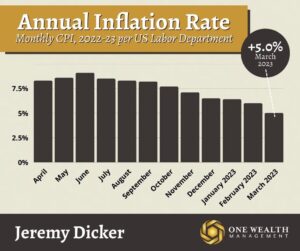

In March, the pace of U.S. inflation cooled as the Fed’s campaign to hike interest rates continued to show results.

For the month, the Consumer Price Index rose just 0.1% on a seasonally adjusted basis, according to the U.S. Bureau of Labor Statistics’ latest report.

That follows a 0.4% monthly CPI increase in February, with all-items inflation rising 5% over the past 12 months.

This latest data represents a welcome slowdown of price increases for the American consumer, the smallest inflation increase since May 2021.

Cutting out volatile food and energy prices, Core CPI rose by 0.4% in March and 5.6% on a 12-month basis, both matching economists’ expectations.

For the 12 months ending March, the energy index fell 6.4%, while it was down 3.5% for the month.

However, a visit to the grocery store is still more expensive than ever, as the food index was up 8.5% since the same time last year.

Shelter costs increased 0.6% for the month, their smallest gain since November 2022 but still up 8.2% annually. (Shelter makes up approximately one-third of the CPI algorithm.)

While we’re still far off the Fed’s target rate of 2% inflation, there is hope that the latest data points to a disinflationary trend, influencing the Fed’s path going forward.

Jobs

In March, the most recent report by the Bureau of Labor Statistics revealed that U.S. employers added 236,000 jobs.

The number of new payrolls came in less than anticipated, serving as evidence that the economy and job market may finally be cooling.

March’s pace of job growth was the slowest monthly gain since December 2019.

Economists had forecast 239,000 new jobs and an unemployment rate of 3.6% for March, but the addition of 236,000 new jobs decreased the unemployment rate to 3.5%.

The Leisure & Hospitality sector added 72,000 new jobs in March, while the Business & Professional sector saw 39,000 new hires. Conversely, the retail sector displayed the most noticeable drop with 15,000 fewer jobs in March.

GDP

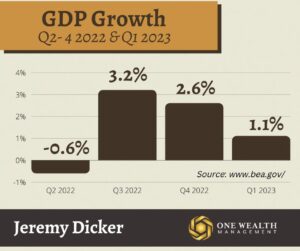

Advance estimates reveal that U.S. Gross Domestic Product rose at a 1.1% annualized rate in Q1 2023. That represents a significant slowdown compared to 2.6% GDP growth in Q4 2022 and a 2.1% increase for the past year.

It’s also well below the 2% GDP growth predicted by economists in a Dow Jones poll, with slumping inventories and private investment pullbacks the main culprits.

Slower economic growth may be a sign of things to come, as interest rate hikes and inflation take hold and are expected to decelerate the economy further in 2023.

The Fed and Interest Rates

The Fed has dropped plenty of breadcrumbs that they plan on raising their benchmark rate once again at their May 2-3 meeting.

Currently, the Fed Funds Rate sits at a range of 4.75-5.00%, but another rate increase may be on the way. The near-consensus among economists is that the Fed will hike rates another quarter-point at their early May meeting this week, with investors pricing in an 88% chance of a 25 basis-point rate hike.

But many anticipate a pause to rate hikes in the second half of the year as the Fed looks closely at emerging economic data.

While inflation is still the main driver of Fed rate hikes, as it has been for nine meetings in a row, our central bank is also closely monitoring the banking situation and ensuring liquidity after the Silicon Valle Bank collapse and spreading banking crisis.

If (and when) the Fed does hike rates for the tenth time in early May to the 5-5.25% range, it may be the last rate hikes we see for the year barring unforeseen circumstances.

Recession Watch

The debate continues if the U.S. economy will fall into a recession in 2023 – or if we’re already in one. Aggressive Fed rate hikes and an inverted yield curve point to an impending economic slowdown. But other data points, such as employment numbers and positive GDP, say otherwise.

According to a recent Wall Street Journal poll, a survey of economists pegs the chances of a recession in the next 12 months at around 61%.

We are now seeing more layoffs and a contraction of the job market, which will surely increase unemployment numbers. But the possibility, extent, and duration of a potential recession remains difficult to gauge with current data.

Real Estate & Mortgage

The median price of an existing home across the U.S. is now $375,700, a drop of 0.9% from a year ago, with some markets seeing more significant price drops than others.

But sales are down almost universally, with existing home sales declining 2.4% in March and down 22% over the past 12 months.

A lack of homes for sale continues to define our market, with only 2.6 months’ supply (the standard measure of inventory) at the end of March. While that is a 1% improvement from February 2023 and 5.4% higher than March 2022, housing inventory now sits well below historical levels.

Mortgage rates have continued their volatile ride as well. After five straight weeks of declines, the average 30-year-fixed rate mortgage closed the week of April 20 at 6.39% nationally.

Time in the market, not timing the market

We’ve all heard that axiom, but why does it still ring so true for investors?

Too often, we respond emotionally to market volatility, dumping our positions in response to sharp market drops or negative economic news.

But that may be the exact time when you want to remain in the market.

According to research by J.P. Morgan Asset Management, the most significant market drops are often closely followed by large gains.

In fact, missing just the S&P 500’s ten best trading days over the last 20 years (2002-2022) would reduce your annual returns by 4.2%.

There are numerous examples and statistical models that demonstrate this concept, but the lesson remains the same: stay the course during times of market volatility.

And as always, please remember that past performance is not indicative of future results.

(Data according to Bloomberg and Stifel Investment Strategy, J.P. Morgan Asset Management, and CNBC.)

Notable Quote

“Economists are often asked to predict what the economy is going to do. But economic predictions require predicting what politicians are going to do– and nothing is more unpredictable.”

~Thomas Sowell