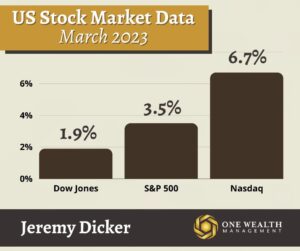

Stock Market

For the month of March, the stock market’s three major indices performed as follows:

Dow Jones 1.9%

S&P 500 3.5%

Nasdaq 6.7%

Stocks rallied on the last day of March to end a volatile month on a high note. The Dow Jones Industrial Average posted a 1.3% gain on the last Friday of the month, with the S&P 500 and Nasdaq posting daily gains of 1.4% and 1.7%, respectively.

For the first three months of 2023, the Nasdaq Composite increased by 16.8%, its best quarterly gain since 2020.

Q1 2023, the Dow posted a 0.5% gain and the S&P 500 rose by 7%.

The Fed

At their March 21-22nd meeting, the Federal Reserve elected to raise its benchmark interest rate by 0.25%, bringing it to a new range of 4.75 – 5%.

While some anticipated a pause to rate hikes, an emerging banking crisis and stubborn inflation led the U.S. central bank to increase the federal funds rate to the highest level since October of 2007.

That followed a 0.25% increase at their previous meeting, down from an 0.50% increase in December and four 0.74% rate hikes throughout 2022.

In their official release, the Fed noted, “Recent developments are likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring, and inflation. The extent of these effects is uncertain.”

As to what rate hikes may be coming, Fed officials are still pointing to peak interest rates in the range of 5 – 5.25% this year, unchanged from their December projections.

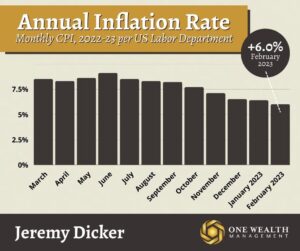

Inflation

The Consumer Price Index (CPI) rose 0.4% in February, largely meeting expectations. That means all-items inflation rose 6% on a 12-month basis, also meeting forecasts.

That data represents a slight drop from an 0.5% inflation increase in January, according to the U.S. Bureau of Labor Statistics.

On a monthly basis, shelter costs rose the most, accounting for more than 70% of the total CPI increase. Food costs rose 0.4% between January and February. Prices for recreation, furniture, airline tickets, and other household operating costs also rose significantly.

The energy index actually fell 0.6 percent for the month, and medical care and used car prices also dropped.

Stripping away volatile food and energy prices, the core Consumer Price Index rose 0.5% in February (and 5.5% on an annual basis), surpassing January’s 0.4% rate of inflation and slightly higher than the forecast of 0.4% price gains.

For all-items inflation, it was the smallest monthly increase since September 2021.

Jobs

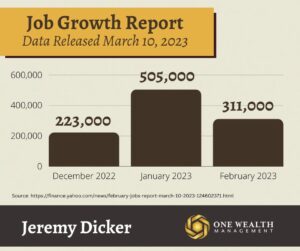

When the highly anticipated jobs report was released on March 10th, it revealed that the U.S. labor market is still hotter than expected, adding 311,000 new jobs in February.

Despite rate hikes and dogged inflation, new jobs outpaced expectations of only 225,000 new jobs last month. However, the unemployment rate did edge higher to 3.6% from the previous mark of 3.4 percent.

While not showing signs of widespread slowing, the job market’s 311,000 new payrolls in February were a significant drop from January’s figure of 504,000 jobs.

The biggest job gains came in restaurant, hotel, and other leisure and hospitality work (+105,000 jobs), and even construction was shockingly strong (+24,000 jobs) despite a stalled housing market and elevated mortgage rates.

Over the last six months, the labor market has added an average of 343,000 jobs monthly, raising eyebrows among economists.

GDP

Mid-February’s latest GDP report by the Bureau of Economic Analysis revealed that Gross Domestic Product increased by 2.7% in the fourth quarter of 2022. That annualized rate of economic growth fell short of +2.9% forecasts. Our latest second estimate of Q4 GDP also shows a slowdown after Q3 2022’s +3.2% GDP increase.

Many are anticipating slower economic growth in 2023 due to the SVB and banking crisis. Goldman Sachs, for instance, just lowered their GDP forecast for 2023 to 1.2% for the year, a 0.3% reduction.

Analysts expect a tightening of bank lending to drag down economic growth, already slowed by inflationary monetary policy, higher rates, and increased caution.

An Advanced Estimate of 2023 Q1’s GDP comes out on April 27th.

Consumer Confidence

U.S. Consumer Confidence unexpectedly decreased in February (latest data), further accelerated by the SVB and banking crisis and the Fed’s tightening monetary policy.

The Conference Board, which tracks household consumer confidence, reported that their consumer confidence index sunk to 102.9 for the month of February, down from January’s 106.0. That’s also a stark divergence from economists polled by Reuters, who had predicted a 108.5 consumer confidence index in February.

While consumers did express optimism about the labor market, those surveyed expressed apprehension about purchasing big-ticket items such as household appliances or cars in the next six months.

Recession Watch

The biggest banking crisis in 15 years has seemingly complicated the chances of the U.S. economy entering a recession. Talk about a hard or soft landing just a few months ago has now turned to the possibility of a “rolling recession.”

As recently as mid-March, Goldman Sachs raised their projected odds of a U.S. recession to 35% over the next 12 months.

Cracks in the banking sector could cause a credit crunch that decreases GDP, dropping growth in the market by a quarter to half a percentage point, according to Goldman Sachs estimates.

Household Debt

Household debt now sits at an all-time high, reaching a record $16.90 trillion by the end of 2022 and continually rising in 2023.

U.S. household debt rose $394 billion in the fourth quarter of 2022 alone, driven by auto loans and exploding credit card debt.

In fact, according to the Federal Reserve Bank of New York, credit card balances increased $61 billion in Q4 2022 alone, surpassing the pre-pandemic high watermark of $927 billion.

According to a recent poll by the Associated Press, 35% of U.S. adults say that their household debt is higher than it was just one year ago. And Bankrate.com reports that 46 percent are carrying debt from month to month, up from just 39% a year ago.

Meanwhile, the average credit card rate (APR) in the U.S. is now 20.5 percent – the highest level since the mid-1980s when average rates were first tracked. Credit card delinquencies are also at the highest levels they’ve been since 2010.

Housing

In February (latest data), the median price of existing home sales across the U.S. fell 0.2% from the same time a year earlier, the first annual decline since 2012. February’s home prices were also down more than 12% since the apex of the hot housing market in June of 2022.

Of course, that’s in large part to mortgage rate increases – collateral damage from Fed rate hikes. Despite existing volatility with mortgage rates and a significant slowdown in sales volume, there are reasons for optimism that the market may be near its bottom.

For instance, the number of sales for existing homes reached 4.58 million in February, up 14.5% from the previous month. While still down from pre-rate-shock levels, those numbers showed the strongest pace of sales since September and exceeded economist forecasts of 4.2 million home sales.

That largest one-month sales surge since 1999 may be a precursor of things to come if mortgage rates settle or drop and a typical seasonal uptick ensues.

Notable Quote

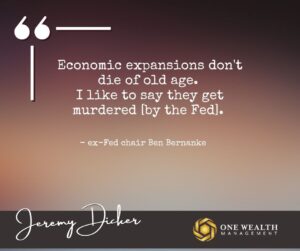

“Economic expansions don’t die of old age. I like to say they get murdered [by the Fed].”

– ex-Fed chair Ben Bernanke