Stock market

In August, the US stock market stumbled to the finish line with a four-day selloff.

For the month, Wall Street’s major indexes performed as follows:

The Dow -3.9%

S&P 500 -4.2%

Nasdaq -4.6%

Year-to-date (as of the conclusion of August 31st), the stock market’s benchmark indexes have performed as follows:

The Dow -13.29%

S&P 500 -17.02%

The Nasdaq -24.47%

The best and worst-performing stocks in August

Despite a mid-month rally, the stock market lost ground by the end of August, with the S&P 500 posting negative 4.2% growth.

For the month, these were the top 5 best-performing stocks:

+23% Constellation Energy (CEG)

+22% EPAM Systems (EPAM)

+19% Cardinal Health (CAH)

+16% Nielsen Holdings (NLSN)

+15% AES (AES)

These five stocks performed the worst in August:

-24% BallCorp (BALL)

-23% SolarEdge Technologies

-23% Match Group (MTCH)

-22% Catalent (CTLT)

-22% DXC Technology (DXC)

Recession Watch

Is the US headed for a recession? That’s the most likely scenario for 2023 according to analysts, as the buzzword for our economy has gone from “soft landing” to “growth recession.”

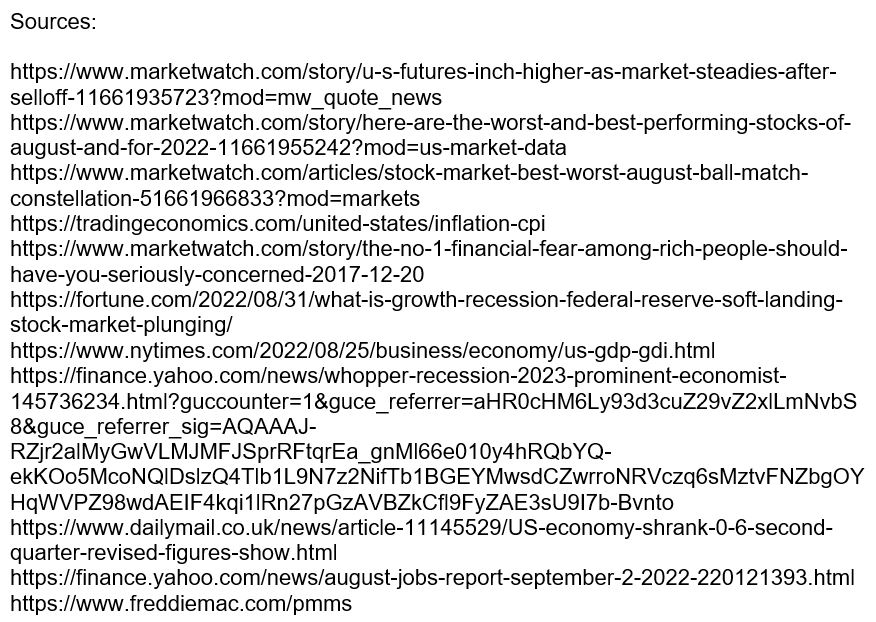

According to a survey published in the Wall Street Journal, nearly half (49%) of economists polled believe the US will see a recession in 2023, and that number is expected to become a majority when August’s data becomes available.

That’s a stark contrast from just a little over one year ago (July 2021), when only 12% of economists surveyed thought the US economy was headed for a recession.

Those fears were stoked recently by Fed Chair Jerome Powell’s speech at Jackson Hole, Wyoming, where he reiterated that the US would likely “experience some pain” as the central bank continues to target inflation through further rate increases.

Inflation

While we eagerly await August’s inflation numbers, set to be released on September 13th, we do know that the latest data showed the annual inflation rate dropping to 8.5% for July.

That brings a modicum of good news after a 9.1% annual inflation rate through June, the highest rate since November of 1981, according to US Labor Department data.

July’s 8.5% annual inflation rate also exceeded market forecasts, which anticipated an 8.7% inflation rate for the month.

Despite the hope that inflation has peaked, big slowdowns in the energy sector, new vehicle prices, and airline fares masked still-higher food and shelter costs, among others. Food prices rose at the fastest rate since May of 1979, and used car prices also saw a big jump for the month.

Overall, the Consumer Price Index (CPI) was unchanged through July at 1.3%, the same as the previous month and still at a 17-year high. Core inflation, the government’s preferred metric, remained steady at 5.9%.

GDP

Revised GDP numbers show that the economy did indeed shrink in Q2 of 2022, but at a slower pace than originally reported. Preliminary reports of -0.9% GDP retraction in Q2 have been amended to a -0.6% drop, a significant improvement.

But that still marks two consecutive quarters of economic retraction, with the period of January through March of this year seeing a 1.6% decline compared to Q4 of 2021.

If we look at those same numbers but adjust for inflation, the GDP fell 0.1% in the second quarter.

Gross Domestic Income, however, rose 0.3% in Q2 of 2022, according to the Commerce Department, which was down from 0.5% growth in Q1 (adjusted for inflation).

Jobs and unemployment

The latest monthly jobs report from the US Labor Department released Friday, September 2nd, revealed as-expected employment numbers for August.

For the month, the US economy added 315,000 non-farm payrolls, slightly exceeding advance estimates of 298,000 new jobs.

That pushed the unemployment rate down to 3.7%, higher than the 3.5% forecast. There are now 6 million unemployed Americans, matching the number of people out of work in February of 2020, pre-pandemic.

Labor force participation also climbed to 62.4% in August, up from 62.1% in July. Participation in the labor force is at a high not seen since March of 2020.

July’s payroll additions were revised slightly lower to 526,000 (down from a reported 528,000). For a three-month average (May-June-July), we’ve seen 378,000 new payrolls added each month, compared to a monthly average of just 164,000 in 2019 for comparison.

Retail Trade (+44,000 jobs), Manufacturing (+22,000 jobs), Financial Services (+17,000 jobs), and Wholesale Trade (+15,000 jobs) were the sectors with the largest expansion of payrolls in August.

Housing and mortgage market

Mortgage rates continued their rollercoaster ride this summer, in large part responding to the Fed’s aggressive monetary policy to counter inflation.

According to Freddie Mac, the current average national rate on a 30-year fixed is now about 5.6%, well ahead of the low-5-percent mark we saw earlier this month. Rates for 15-year fixed (4.98%) and Adjust Rate Mortgages (4.51%) also increased significantly by the end of August.

And while the National Association of Realtors hasn’t published August’s home price data yet, expect a decline in year-over-year price growth. That comes despite overall positive numbers for price increases thanks to a huge headwind of appreciation earlier this year.

But there are plenty of signs that the market is cooling, including waning buyer demand, mortgage application levels that fell off a cliff, and frequent price reductions on listings.

Looking at the big picture, mortgage rates in the mid 5’s are still favorable historically, and a stark inventory shortage means that buyer demand will stay solid, keeping our housing market on pace for a healthy correction – not a crash.

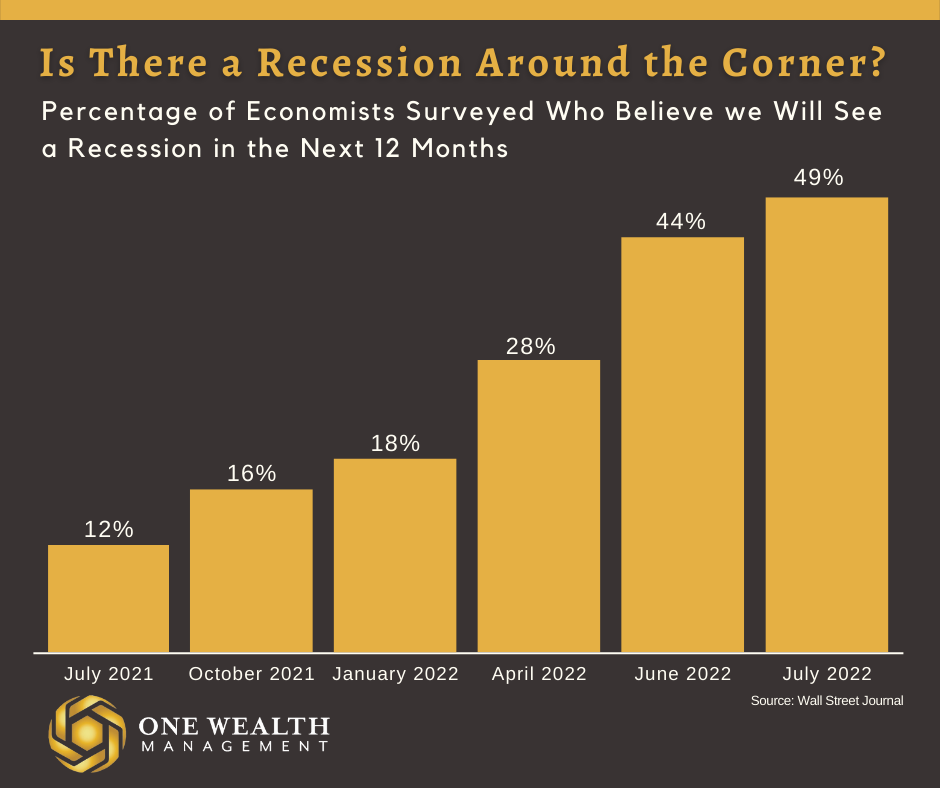

The top concerns of affluent investors

I recently came across a survey that I found interesting and will share with you.

In a poll conducted by Personal Capitol and ORC International, 1,000 affluent Americans were asked about their top financial planning concerns.

Here are a few of the most frequent responses that stood out to me:

51% were concerned about being financially secure in retirement,

42% were worried that their portfolio would not withstand a market downturn,

40% were worried (and rightfully so) that they hadn’t created a long-term estate plan.

Tax planning was also a major concern among these wealthy investors surveyed.

Notable quote

“There has never been sustained inflation in world history – that is inflation above 4% for about two years – that had not been the result of unprecedented growth of money supply, which we had starting with COVID in February of 20220.”

– Steve Hanke, economist and professor at Johns Hopkins University, explains why he sees the US having a “whopper of a recession” in 2023-24.