Wall Street and the stock market

Coming off their best month of the year, the stock market saw significant negative movement at the tail end of November.

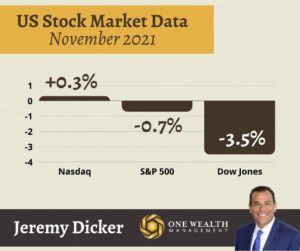

For the month:

The NASDAQ gained 0.3% in November and is up 21.3% YTD.

The S&P 500 lost -0.7% in November and is up 23.2% YTD.

The DOW lost -3.5% in November and is up 14.7% YTD.

Of course, the big trigger for a market swoon was news of the Omicron variant and subsequent anxiety, with the S&P 500 dropping 2.3% on November 24th alone, its biggest one-day drop since February.

To put it in context, November 20201 was the first month in ten years where the S&P 500 ended in the red, and it ended November only down -2.9% from its all-time high.

To end November, the yield on the benchmark 10-year Treasuries saw a sharp decrease, ending the month at 1.48%.

Big Winner:

The news wasn’t all negative coming out of November, as the tech sector bucked the trend and rose 4.3% for the month. In particular, Apple was a huge winner, rising 3.2% on the same day the S&P 500 sank by 2%. For the year, Apple is up 30.1%.

Corporate profits

Corporate profits remained strong throughout November and across Q3, with 82% of listed companies beating their EPS expectations. That pencils out to approximately 10% above expectations for the quarter, exceeding the five-year average of 8.4%

The Dollar

The U.S. dollar reached a 16-month peak of $96.938 on November 24th before receding slightly. Still, for the month of November, the U.S. Dollar Index ended with 1.85% positive gains.

Labor & Unemployment

America is seemingly back to work, with initial unemployment applications falling to lows we haven’t seen since November of 1969, a span of 52 years.

Private payrolls added a solid 534,000 jobs throughout November, according to ADP, exceeding Wall Street’s forecast of 506,000 new jobs. Still, job growth slowed from the 560,000 level in October.

Unemployment sits around 4.5% for November, a slight improvement after a 4.6% rate in October.

Consumer confidence

Consumer confidence fell in November, ending the month at 109.5 from its starting point of 111.6 and falling further analysts’ expectations of 110.

That represents the lowest level in nine months and fourth drop in the past five months as Omicron fears, supply chain issues, and inflation realities all strain confidence in the economy.

Home Prices

The residential real estate market has noticeably slowed, with nearly 40% of all metro areas seeing listing price declines compared to one year ago. According to the latest data by the National Association of Realtors, existing home sale volume is up 0.8% over the last month and down 5.8% since this time last year. However, the actual sales price of existing homes is up 13.1% since this time last year.

With a prolonged period of record price gains spurred by low interest rates, high demand, and low inventory, a cooling of the market is considered a healthy sign at this point.

Inflation

At the time of this writing, we’re eagerly awaiting November’s inflation report. But we do know that October’s 6.22% inflation rate was the highest since 1990.

And as we look for historical parallels to help us navigate this high-inflationary spell in our economy, many are pointing to periods in the 1970s or 1980s when prices soared and we experienced profound stagflation.

However, economists think our current inflation looks more like the post-WWII era in the 1940s, when supply chain problems, price controls, and extraordinary pent-up demand fanned the flames of double-digit inflation until the late 1940s.

The Hawkish Fed

To usher in December, the markets reacted to Fed Chairman Jerome Powell’s statements that the central bank will accelerate their plan to taper their bond-buying program, which currently sits at least $120 billion a month. Of course, the Fed already started tapering earlier last month, reducing that bond-buying program by $15 billion monthly.

The Fed Chairman also indicated that we could remove the word “transitory” from any mention of inflation, so all signs point to a rate increase at their December 14-15 policy meeting, as the federal-funds rate will inevitably rise from its current rock-bottom 0%-0.25% range.

On the news and Omicron concerns, Fed Fund Futures are setting the odds at 27% for another rate hike in March and 59% in May.

Quote

“The recent rise in COVID-19 cases and the emergence of the Omicron variant pose downside risks to employment and economic activity and increased uncertainty for inflation.”

-Fed Chairman Jerome Powell

Looking ahead

Heading into the final month of 2021, we expect Omicron fears and news to dictate the pace and direction of the markets.

Even before the emergence of this new variant, analysts tempered expectations that Wall Street may not be as meteoric in 2022 as it was in 2021.

While some anticipate a long-overdue correction, others just point to an unlikely repeat of double-digit stock market growth.

Factor in at least one Fed interest rate hike, a drying up of stimulus, and continued inflation woes, and Wall Street may shift to a bear market.

However, the historical trend is on our side, at least for December. According to data from Yardeni Research, the S&P 500 has recorded positive gains 73% of the time if we look at every December since 1928.