Stock Market

May brought the sixth winning month in seven for the market’s major benchmarks.

For the month, Wall Street’s three major indices performed as follows:

The Dow +2.3%

S&P 500 +4.8%

Nasdaq +6.88%

All three indices set records for the month of May; the Dow had its best May performance since 2020, while the S&P 500 and Nasdaq haven’t had a better May showing since 2003.

Inflation

May’s Consumer Price Index (CPI-U) report revealed that prices rose 0.3% in April, according to data from the U.S. Bureau of Labor Statistics. On a 12-month basis, the Consumer Price Index rose 3.4%, a slight respite from volatile inflation numbers in months prior.

For comparison, the CPI rose 0.4% in March, while March’s annually adjusted CPI was 3.5%.

Core inflation – which strips away volatile food and energy prices – rose 3.6% in April, down from a 3.8% price hike in March. That was the lowest annual core inflation increase since early 2021.

Late in the month the Fed’s favored measure of inflation, the personal consumption expenditures price index (PCE), was released. The PCE index rose 2.7% in April on a 12-month basis, which matched March’s PCE and also met economists’ forecasts. But Core PCE – which takes away volatile food and energy prices – rose a tick faster than expected at 2.8%.

The Fed and Rates

Incoming jobs and inflation data revealed the economy isn’t slowing down as much as anticipated, indicating it’s less likely the Fed will drop their benchmark interest rate this summer. According to the CME’s FedWatch tool, there is just a 10% probability of an interest rate adjustment at the FOMC’s June 11-12 meeting.

Earlier this year, the Fed predicted three quarter-point rate cuts by the end of 2024. However, the tone has changed to a “higher for longer” approach as the Fed looks for sustainable inflation and economic data consistent with its goals.

Goldman Sachs now predicts the first rate cut of the year to occur in September, although they still anticipate two rate cuts by the end of the year. However, 60% of economists polled see only one rate cut on the horizon.

Since July 2023, the federal funds target rate has maintained at 5.25% to 5.5%.

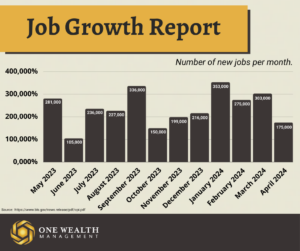

Jobs & Unemployment

According to the most recent Labor Department report, new payrolls increased by only 175,000 in April, a far cry from the 240,000 new hires predicted by Dow Jones estimates.

The largest job gains in April were in the fields of health care (+56,000), social assistance (+31,000), transportation and warehousing (+22,000), and retail (+20,000).

In April, the U.S. unemployment rate nudged higher to 3.9%, surpassing expectations that it would remain stable at 3.8%. The economy’s jobless rate was at its highest level since November 2021.

GDP

According to the second estimate of real gross domestic product (GDP), the economy grew by 1.3% in the first quarter of 2024 according to the Bureau of Economic Analysis. That came in significantly lower than advanced estimates of 1.6% GDP growth, based on lower-than-expected private inventory investments.

It also represents a noticeable slowdown of U.S. economic growth since last year, as the fourth quarter real GDP increased 3.4%.

Debt and Delinquency

U.S. household debt reached a new record high of $17.7 trillion in the first quarter of 2024, according to the Federal Reserve Bank of New York’s Quarterly Report on Household Debt and Credit. Household debt is up 1.1% since the fourth quarter of 2023, a real dollar increase of $184 billion.

Credit card debt alone now stands at $1.12 trillion, up an alarming 25% since Q1 of 2020. Post pandemic, U.S. consumers have racked up $3.4 trillion in additional debt – and it’s worth noting that much of it is at unfavorable interest rates, costing consumers far more.

Delinquency rates on credit cards and other forms of debt are also on the rise. As of March, a full 3.2% of outstanding debt was in some stage of delinquency.

Housing and Mortgage

U.S. home prices have now hit a record high. The median U.S. home sale price rose to $433,558 in April, up 6.2% year over year.

Our head-scratching housing market continues, with low inventory, rising prices, and stubbornly high mortgage rates. The average 30-year fixed mortgage was 6.99% in April, up from 6.82% in March 2024 and 6.34% a year earlier in April 2023.

However, there are signs that the housing bottleneck is easing. Housing supply is inching up and no longer at historically low levels, reaching a four-year high. Active listings climbed to the highest level since December 2020, and 18% of homes for sale in April saw a price reduction, a leading indicator of softening prices.

Notable Quote

“Empty pockets never held anyone back. Only empty heads and empty hearts can do that.”

— Norman Vincent Peale