Stock Market

Stocks rallied in the final hour of trading on March 28th, the last session of the month thanks to markets being closed for Good Friday, propelling the S&P 500 to an all-time high.

For the month, the market’s three major indices performed as follows:

Nasdaq 1.8%

The Dow 2.1%

S&P 500 3.1%

March marked the fifth straight winning month for all three major averages.

Recapping a glowing first quarter of 2024, the three major indices registered these gains for the three-month period:

The Dow 5.6%

Nasdaq 9.1%

S&P 500 10.2%

For the Nasdaq, it was the first record high since November 2021, while the S&P 500 saw its best start in five years since 2019.

Inflation

Inflation continued its bumpy ride last month, with the Consumer Price Index increasing 3.2% on an annual basis in February, up from January’s 3.1% 12-month increase. According to the US Labor Department release, CPI also rose 0.4% on a monthly basis after January’s 0.3%, undermining the Fed’s campaign to cool price increases after CPI rose as high as 9.1% in June 2022.

Fuel costs were the main culprits for February’s disappointing inflation numbers, with prices at the pump keeping inflation elevated. Rent prices also rose, while food prices remained relatively flat.

PCE (personal consumption expenditures) inflation minus food and energy costs registered a 2.8% increase on a 12-month basis and up 0.3% from the previous month. Core PCE was up 2.5% on an annual basis, with both readings matching Wall Street estimates and confirming a wait-and-see approach for the Fed.

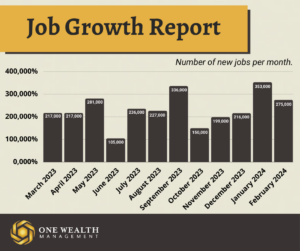

Jobs and Unemployment

Total nonfarm payrolls climbed by 275,000 in February, slightly more than the 12-month average of 230,000 new hires per month.

In February, the biggest job gains were seen in the sectors of health care, government (+52,000), food services (+42,000), social assistance (+24,000), and transportation and warehousing (+20,000).

But the bigger story was the unemployment rate, which rose to 3.9% in February according to the US Bureau of Labor Statistics. That was an increase of 0.2% since January, or 334,000 people without employment, bringing the total to 6.5 million in our economy – a notable increase from a year prior, when unemployment was only 3.6%.

The Fed and Rates

At their Federal Open Market Committee meeting on March 20th, the Fed opted to hold rates steady at a current range of 5.25% to 5.5%, as expected. However, Federal Reserve officials signaled the likelihood of three possible rate cuts by the end of 2024 as inflation likely subsides.

As of last month, Fed policymakers have been working to quell hot price gains for a full two years, fighting inflation that reached as high as 9% last summer. But although the Fed doesn’t want to drop rates too quickly – ruining their chances of sticking a soft landing for the economy – they are on record that the Fed Funds rate may end at 4.6% by the end of this year, ostensibly signaling three quarter-point cuts.

“The risks are really two-sided here: We’re in a situation where if we ease too much or too soon, we could see inflation come back,” said Fed chair Jerome H. Powell in a March 20th news conference. “If we ease too late, we could do unnecessary harm to employment.”

After the Fed announced that it would leave its benchmark rate unchanged, markets were pricing at a 60% chance of a rate cut in June, up from 55% the previous day.

Real Estate and Mortgage

The familiar way we buy and sell homes may be a thing of the past thanks to the fallout from a monumental lawsuit in March. The National Association of Realtors agreed to a $418 million settlement after it was ruled that the system of commissions was essentially rigged to benefit agents and brokerages. According to early reports, the settlement means home sellers will no longer be responsible for paying commissions for both the buyer and seller agents, a monumental change in the industry.

The new system that may emerge will include home buyers paying their own commissions, and those commissions being fully negotiable. Expect a range of new models and discount services to emerge to serve the demand, as it is unclear who will be the true beneficiary and will save the most, but the new normal in real estate will evolve later this year.

Analyzing the growth of investing in legal sports betting

With March Madness, major league baseball in full swing, the NBA nearing its playoffs, and much more, it’s a great time to be a sports fan. But legal betting on sports is big business, too, and a growing number of investors are taking notice.

So, I thought you might enjoy this article that analyzes the growth of investing in legal sports betting.

Notable Quote

“The best way to measure your investing success is not by whether you’re beating the market but by whether you’ve put in place a financial plan and a behavioral discipline that are likely to get you where you want to go.”

– Benjamin Graham