Stock Market

Despite regaining ground on the last day of the month, October proved subpar for the equity markets on fears of war in the Middle East, surging bond yields, and shaky earnings from Big Tech.

For the month, Wall Street’s three major indices performed as follows:

The Dow -1.4%

S&P 500 -2.2%

Nasdaq -2.8%

It was the third-straight losing month for both the Dow and S&P 500, the first three-month negative streak since March 2020. Likewise, the tech-heavy Nasdaq saw its third consecutive losing month.

The previous Friday saw the S&P 500 officially enter correction territory, defined as 10% off its recent high three months ago. The Dow Jones Industrial Average has stumbled as well as of late, erasing 2023 gains since the summer.

GDP

In the third quarter, Gross Domestic Product grew more than expected, climbing by 4.9% at an annualized rate. That proved the U.S. economy was hotter than expected, as economist surveys anticipated just 4.7% GDP growth for the quarter. Q3’s broad economic growth also came in significantly higher than Q2’s 2.1% GDP.

Economic growth from July to September was bolstered by strong consumer spending despite high interest rates, inflationary pressures, and global unrest.

Fed and Rates

At their November 1st meeting, the Fed opted to pause rate hikes, keeping their benchmark interest rate at a range of 5.25% to 5.5%. This is the second meeting in a row where the Federal Open Market Committee decided to suspend their campaign of rate increases, following 11 straight rate hikes.

The latest Fed decision effectively allows more time for the economy to absorb higher borrowing costs, with Fed Chairman Jerome Powell reiterating that the FOMC will carefully monitor economic data to see if inflation is on pace to decline towards their target rate of 2%.

Investors turn to reading more subtle signs for a possible rate hike at the Federal Reserve’s next meeting December 12-13, if it’s the last rate hike in this cycle, and how long rates may stay elevated into 2024.

Jobs & Unemployment

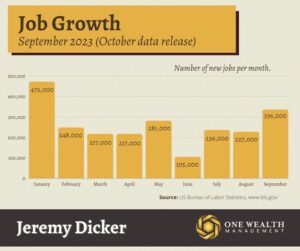

In September, the U.S. economy added 336,000 new jobs, nearly doubling the number economists forecast, which was 170,000 new payrolls for the month. Additionally, hiring data for August and July was upwardly revised by 119,000 jobs, according to the Bureau of Labor Statistics.

While September’s job numbers stoked concerns that the labor market is hotter than expected and the Fed has more work to do, the unemployment rate remained at 3.8%, the same as the previous month. September’s 336,000 new hires were the strongest monthly totals since January of this year.

Inflation

In September (latest data), consumer prices rose more than expected, upending the Fed’s mission to sink inflation towards their target 2% rate. For the month, the Consumer Price Index increased 3.7% on an annual basis, which came in higher than economist estimates of 3.6% inflation. On a monthly basis, inflation rose 0.4%, which also surpassed estimates of 0.3% monthly price gains.

Gas prices and shelter costs were the main culprits of pushing inflation higher than expected, according to data from the Bureau of Labor Statistics. Shelter costs alone accounted for 70% of the monthly core inflation increase.

Stripping away volatile energy and household costs, core CPI was up only 4.1% on an annual basis and 0.3% monthly, cooling for the sixth month in a row.

Housing market & mortgage

Homebuyers saw no relief when it came to affordability in October, with mortgage interest rates continuing their volatile ride, pushing towards 8% by the end of the month.

While rates will likely remain elevated through 2023 and into early 2024, relief is on the horizon. The Mortgage Bankers Association predicts that rates will fall to 6.6% in the first half of 2024 and settle at 6.1% by the end of 2024.

Until then, our housing market is plagued by high prices (home prices have actually risen for seven consecutive months), affordability hurdles for buyers, and the lowest home sale volume since the Great Recession.

Charitable Giving

Charitable giving reached $499.33 billion in 2022, with private individuals comprising 64% of all donations, or $319 billion.

While 2022 did see a significant decline in how philanthropic Americans were feeling, that comes after record-high years for donations in 2020 and 2021.

Altruistic citizens made up the majority of donations in 2022, but mega-gifts from donors accounted for 5% of all donations, and both foundations (+2.5%) and corporations (+3.4%) saw an uptick in charitable contributions.

Notable Quote

“Waiting helps you as an investor and a lot of people just can’t stand to wait. If you didn’t get the deferred-gratification gene, you’ve got to work very hard to overcome that.”

-Charlie Munger