Stock Market

In May, stocks ended mixed as the Nasdaq was sparked by AI stocks, debt ceiling worries wiped out earlier S&P gains, and the Dow dropped thanks to double-digit losses by Nike, Disney, Walgreens, Chevron, and more.

For the month of May, the three major stock indices ended as follows:

Nasdaq Composite +5.8%

S&P 500 +0.3%

The Dow -3.5%

Debt Ceiling

Speaker Kevin McCarthy and President Biden struck an agreement in principle to suspend the nation’s borrowing limit over Memorial Day Weekend. The controversial debt ceiling bill then passed the House on May 31st and now must pass the Senate – which is not assured because of timing issues and the potential for dissention.

At the core of the deal is a two-year suspension of the debt ceiling, which limits the total funds the government can borrow.

The debt ceiling – or debt limit – places a hard cap on the total amount of funds the federal government can authorize via U.S. Treasury securities to keep up with its enormous budgetary deficits and obligations. The current debt ceiling was hit on January 19th, with the Treasury Department taking “extraordinary measures” since to ensure the U.S. could pay its bills and not default.

The debt ceiling is currently capped at $31.4 trillion but is set to run out of funds on June 5th if a new debt ceiling deal is not enacted, according to the Treasury.

Instead of setting a new debt limit, the proposed deal suspends the borrowing limit until January 2025. During that period (and effectively a few months past the deadline), the Treasury Department can borrow with impunity to fund the government and pay the nation’s debts.

There will be much analysis and debate about the measures on both sides that were cut or added in order to come to an agreement. But for now, all eyes are on the Senate to pass the bill before June 5th, avoiding economic catastrophe at the 11th hour.

The Fed and Rates

Wall Street is ready for a respite from the Federal Reserve’s aggressive rate hike cycle, and we’ll find out if that comes to fruition when the Federal Open Market Committee meets on June 13-14.

At their previous meeting in early May, the FOMC increased their benchmark overnight interest rate by 25 basis points to a range of 5.00% – 5.25%, the highest in sixteen years after ten straight rate hikes since March 2022.

But is that high enough to cool the economy?

“We’re closer, or maybe even there,” said Fed Chairman Jerome Powell at his May press conference. “We’re possibly even at that level. We will make that determination meeting by meeting, based on the totality of incoming data and their implications for the outlook for economic activity and inflation.”

Have we finally hit the “terminal rate,” as it’s known? Perhaps not.

Powell and the Fed are keeping their options open, most recently signaling a rate hike “skip” in June, or a “hawkish pause,” as it’s being called.

Many analysts now expect a pause to rake hikes in June, but Fed economists remain hyper-alert to evolving inflation and economic data. The central bank is on record that they’re not opposed to further rate hikes in 2023 and into 2024 if needed.

And while the stock market would cheer rate cuts, there is only a small probability that will happen as soon as the Fed’s July meeting, with stubborn inflation and a stronger-than-anticipated economy, including historically low unemployment.

Inflation

In April, inflation slowed for the tenth straight month, with the Consumer Price Index rising 4.9% on an annual basis. That was down from 5% in March, and a nominal decrease from the 5% CPI economists predicted.

According to the Labor Department, April’s inflation data showed the smallest annual increase since April 2021. The CPI was below 5% for the first time in two years, a significant improvement since June 2022’s 9.1% inflation rate.

On a monthly basis, prices rose 0.4% in April, following an 0.1% increase in March.

Core Inflation (excluding volatile food and energy costs) rose 5.5% on an annual basis, down from the previous month’s 5.6% and up 0.4% since March.

In April, the cost of medical care, airfare, and new cars dropped, while gas prices and rents continued to escalate.

While inflation data is trending in the right direction, it’s nowhere near a comfort level for the Fed, which has outlined a target 2% inflation rate. To slow soaring inflation, the Fed has rolled out a campaign of rate hikes not seen since the 1980s, bringing the Fed’s benchmark lending rate to a range of 5% – 5.25%.

The next consumer price report will be released on June 13th, leaving only one day for the Fed to decide on a rate hike or pause before the conclusion of their June 14th meeting.

Jobs and Unemployment

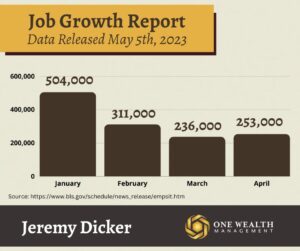

In April, job growth proved stronger than expected, despite a spreading banking crisis and a decelerating economy.

With the April jobs report released by the U.S. Labor Department in early May, we saw that nonfarm payrolls swelled by 253,000 for the month, outpacing Wall Street estimates of only 180,000 new jobs.

That also brought the national unemployment rate to 3.4%, significantly lower than the estimated 3.6% unemployment rate and tied with the lowest rate on record since 1969.

Average hourly earnings climbed by 0.5%, which was higher than expected and elevated wages by 4.4% over a 12-month period.

For the month, professional and business services saw the most new hires (+43,000), while health care (+40,000), hospitality (+31,000), and social assistance (+25,000) also saw notable gains. Additionally, finance jobs (+23,000) increased at a solid rate despite the banking crisis, and there were +23,000 new government hires.

Despite the stronger-than-expected April jobs report, labor numbers from past months saw downward revisions. March’s nonfarm payroll additions were cut by 71,000 jobs, while February’s numbers were slashed by 78,000 payrolls.

The next U.S. Labor Report comes out June 2nd, encompassing May’s hiring data.

Consumer Debt

According to research by the Federal Reserve Bank of New York, total U.S. credit card debt has now reached $986 billion, the highest tally on record since the Fed started tracking debt numbers in 1999.

Our near-trillion-dollar national credit card balance is unchanged since the fourth quarter of 2022 with one distinction. Even though credit card debt has not risen in Q1 2023, American consumers are paying far more every month thanks to rising interest rates.

Total consumer debt now sits at $17.05 trillion, also an all-time high and an increase of $150 billion during the January-March period of 2023.

Notably, mortgage originations – including refinances – sat at just $323 billion in Q1 thanks to higher rates and a stalled housing market, the lowest level since Q2 of 2014.

However, student loan debt rose to $1.6 trillion and auto loans to $1.56 trillion during Q1 2023.

The Housing and Mortgage Market

In April, U.S. existing home prices experienced the largest yearly decline since January 2012, now down to a median of $388,000. The latest housing market data revealed existing home sales fell to 3.4% to an annual rate of 4.28 million, the second month in a row of declines.

Record-low inventory and a roller coaster of mortgage rates continue to impede the market, as the median price of existing homes across the U.S. fell 1.7% compared to April 2022.

However, it’s not all bad news for the real estate picture, with 7.2% more homes for sale in April compared to a year earlier. When priced correctly, homes are still selling quickly, with an average of only 22 days on market compared to 29 days to sell the average home in March.

Mortgage rates may be poised to fall as inflation cools but remained volatile in May based on concerns about the debt ceiling and a resilient economy. With the average 30-year mortgage hovering at or below the mid-6 % mark nationally and 15-year home loans just under 6%, a sizable number of potential buyers are being priced out of the market.

Just as significant is the number of homeowners who are reluctant to sell, unwilling to lose their favorable rate after buying or refinancing in the previous few years.

Notable Quote

“Skipping a rate hike at a coming meeting would allow the (Federal Open Market) Committee to see more data before making decisions about the extent of additional policy firming.”

-Fed Governor and vice chair nominee Philip Jefferson