Stock Market

In July, stocks continued their favorable run, turning bear to bull in 2023.

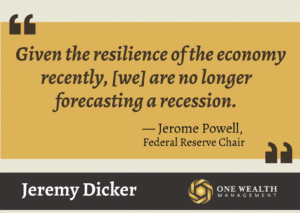

For the month, the market’s three major indices performed as follows:

S&P 500 3.1%

The Dow 3.4%

Nasdaq Composite 4.1%

For the S&P 500 and Nasdaq Composite, July marked the fifth-straight month of gains, the longest green streak in approximately two years.

Year-to-date (through July 31st), the market’s major indices have performed as follows:

The Dow 7.3%

S&P 500 19.5%

Nasdaq 37.1%

Through the first seven months of 2023, the S&P 500 registered its best start of any year since 1997, while the Nasdaq saw its highest-gaining first seven months since 1975.

The Fed and Rates

At its July 26th meeting, the Federal Reserve raised its benchmark interest rate by 0.25%, a widely anticipated move.

The rate hike comes after a pause at the central bank’s previous meeting, bringing the key overnight lending rate to a range of 5.25% – 5.5%, the highest level in 22 years.

According to Fed remarks, certain facets of inflation remain stubbornly high despite consumer price declines for 12 straight months, leading them to the decision.

The Fed has now raised its federal funds rate in 11 of its last 12 meetings, on record that they are aiming for a target 2% inflation rate before they can ease their hawkish stance.

Many economists now expect one more rate hike in 2023 before a prolonged pause as the Fed closely monitors inflation data going forward.

Jobs

In June, U.S non-farm payrolls rose by 209,000. That’s lower than previous forecasts of 240,000 new jobs, pointing to a significant cooling of a torrid job market.

June’s jobs numbers also brought the unemployment rate down to 3.6%, a drop of 0.1% from the previous month.

According to the latest U.S. Labor Department release, June’s job numbers represent a nearly 100,000 drop from May’s downwardly revised total of 306,000 new payrolls. June was the slowest month for job creation since December 2020, when 268,000 new payrolls were added to the U.S. workforce.

For the month of June 2023, government hiring led the way (+60,000 jobs), with other notable employment increases in healthcare (+41,000), social assistance (+24,000), and construction (+23,000) as well.

The leisure & hospitality industry saw the biggest slowdown for the month, adding just 21,000 jobs to a sector that has cooled in 2023. The retail sector (-11,000) and transportation & warehouse sector (-7,000) saw the largest job losses for the month.

For the month, wages rose 4.4% compared to a year ago, and average hourly earnings were up 0.4%.

Considering downward revisions by the Bureau of Labor Statistics for the past months, the six-month average for job gains now sits at 278,000, significantly slower than the 2022 average monthly job gains of 399,000.

However, despite the lower-than-expected job additions for June, economists note that the data paints a picture of a job market that is strong, well-balanced, and at sustainable levels.

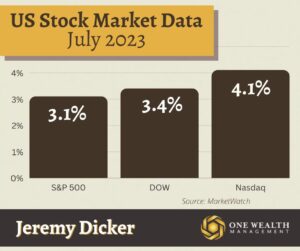

Inflation

Inflation continued to cool in June, slowing to just 3% on an annual basis, according to the latest data from the Bureau of Labor Statistics, a significant reduction compared to May’s 4% annual inflation.

For the month, the Consumer Price Index (CPI) rose 0.2%, which was a slight increase from May’s 0.1% price gain.

In fact, consumer prices increased at the slowest rate since March of 2021, exceeding economists’ forecasts of a 3.1% annual increase or 0.3% month-to-month.

Shedding volatile food and energy costs, prices rose 0.2% in June over the previous month, or 4.8% on an annual basis.

Some of the biggest price decreases included airfares (-8.1%), used cars (-5.2%), and the energy index (-16.7%) on an annual basis.

Prices for auto insurance (+1.7%), apparel costs (+0.3%), and recreation and personal care goods increased in June. The food index rose 5.7% annually but just 0.1% from May to June.

Since headline CPI inflation peaked at 9.1% in June 2022, the Fed’s campaign of aggressive rate hikes has cooled the economy and slowed price increases, with June’s 3% a new low for 2023.

However, the Federal Reserve points out that there is still work to be done before we hit their target of 2% inflation, and some sectors like housing and food still see “sticky” price growth, leading to the possibility of a further rate hike later this year.

Gross Domestic Product

Advanced estimates for second quarter Gross Domestic Product were released in the final days of July, providing a strong assessment of the American economy.

Real gross domestic product (GDP) rose at an annual rate of 2.4% in Q2 of 2023, according to the Bureau of Economic Analysis. That represents a surprisingly robust economy after 2.0% GDP growth in the first quarter of 2023.

For the latest three-month period, GDP increased in part due to an uptick in consumer spending, state and local government spending, nonresidential fixed investments, and private inventory investments.

Exports and residential fixed investments saw decreases for the quarter.

Disposable personal income came in at 5.2% for Q2, down from a 12.9% increase in Q1, while the personal savings rate increased marginally from $840.9 billion to $869.5 billion from Q1 to Q2.

Q2’s GDP numbers will be refined as more accurate data is unveiled, with a new data release scheduled for August 30th.

Consumer Confidence

U.S. consumer confidence continued its ascent in July, rising to its highest level since July 2021. The latest date shows two straight months of gains to the Consumer Confidence Index, climbing to 117.0 from 110.1 in June.

Based on Americans’ expectations of both the labor market and business conditions, the latest release shows faith in an economy with downward inflation, despite rising interest rates.

Gauging the labor market, 46.9% of consumers reported that jobs were “plentiful” in July versus 45.4% in June, and only 9.7% of consumers said jobs were “hard to get” compared to 12.6% in June.

However, assessments of current business conditions were slightly lower in July than in June.

Housing

As we covered last month, many homeowners are opting not to sell because they don’t want to surrender their low mortgage rate, which is being called the “lock-in effect.”

In fact, through the mid-point of 2023, just 1% of residential homes have changed hands, one of the slowest paces for home sales on record.

But despite paltry inventory levels, the housing market is exhibiting some resilience.

After seven straight months of declines, home prices have increased four months in a row in 2023, according to the Case-Shiller U.S. National Home Price NSA Index.

In May 2023 (latest data), national home prices rose 1.2% – a solid increase – after also increasing in February, March, and April.

For the month, we saw the second-highest median price on record ($410,200), according to the National Association of Realtors.

Aside from low inventory, mortgage rates have not helped the American homebuyer. According to Freddie Mac’s weekly mortgage rate survey, the average 30-year fixed is now 6.81% across the country, with 15-year loans averaging 6.11% for the week.

Notable Quote

“Given the resilience of the economy recently, [we] are no longer forecasting a recession.”

-Jerome Powell, Federal Reserve Chair