The Stock Market

August is often a turbulent month for Wall Street, and August 2023 was no exception.

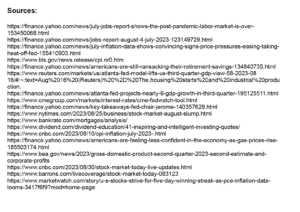

For the month, the three major stock market indices performed as follows:

S&P 500 -1.77%

Nasdaq Composite -2.17%

The Dow -2.36%

A strong close to the month – including four winning days for the S&P 500 and the Dow and five consecutive positive days for the Nasdaq Composite – couldn’t keep the stock market out of the red.

In August, the tech-heavy Nasdaq saw its worst monthly losses for 2023 and worst month since December 2022, while the S&P 500 saw its first negative month since February.

However, the market is still riding a wave of momentum in 2023, with the Dow and S&P 500 booking their best start of the year since 2021 and the Nasdaq going all the way back to 2003.

Jobs & Unemployment

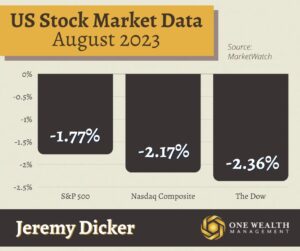

In July, the U.S. economy added 187,000 new jobs, according to the Bureau of Labor Statistics, which economists say may signal the end of the post-pandemic labor market boom. July’s 187,000 new hires fell well short of the 200,000 job gains economists had expected, representing the lowest monthly employment addition since December 2020.

July’s lower-than-expected job numbers dropped the unemployment rate to 3.5%, down from the 3.6% economists anticipated and the same percentage the month prior.

Year to date (through July 2023) the economy has added 1.8 million new jobs. While that represents a solid job market, it’s down from 6.3 million new jobs in 2022 and 4.13 million in 2021.

But the biggest evidence that the job market is softening came towards the end of August, when data revealed that U.S. job openings slipped below 9 million the previous month, the first time they fell below that mark since March 2021.

Inflation

After a respite from price growth, inflation reaccelerated in July, the first time it’s done so in 13 months. Annual inflation increased to 3.2% for the month, according to the Consumer Price Index (CPI) report, after rising 3% in June.

Increases in shelter costs attributed to more than 90% of the monthly inflation index, with vehicle insurance and the food index also rising.

When stripping away volatile food and energy costs, core inflation, the Fed’s preferred gauge of price growth, increased 4.7% year-over-year in July. That is a decrease from 4.8% in June and 5.9% in July 2022, the slowest pace of inflation since October 2021.

But despite July’s uptick, the Fed is pointing to signs that their campaign against inflation is on track, such as with the most recent data on a softening job market. Still, the Fed remains hawkish about future rate hikes if inflation doesn’t continue to sink toward their 2% target and will closely monitor all new data in advance of their September 20th FOMC meeting.

Gross Domestic Product

The U.S. economy may be hotter than previously thought, at least according to the Atlanta Federal Reserve. Based on their GDPNow forecast model, the economy will grow at a 5.8% annualized rate for the third quarter of 2023.

However, it’s worth noting that the GDPNow forecast model is often off the mark, especially early on, as economic data refine their estimates with time. But if the economy does end up growing by 5.8% in Q3 of 2023, it would be the hottest GDP growth since the fourth quarter of 2021.

Second estimates for 2023’s second quarter GDP told a different story: a GDP that rose by only 2.1%, according to the Bureau of Economic Analysis. Based on more concrete data, this second estimate came in significantly lower than the first estimate of 2.4% GDP growth and follows a 2% GDP increase in Q1 2023.

Consumer confidence also stalled last month, with the Consumer Confidence Index coming in at 106.1 in August, notably lower than the 116 economists had predicted and a drop from July’s 114 rating.

The Fed and Rates

The Federal Open Market Committee (FOMC) meets next on September 20th to dictate interest rate policy.

According to the CME Fed Watch Tool, interest rate traders anticipate the likelihood of the Federal Reserve Bank raising or lowering their benchmark interest rate. Currently (as of August 30th), they assess an 88.5% chance that the Fed will keep their target rate unchanged at 5.25% – 5.5% at September’s meeting.

Traders are pricing in an 11.5% chance that the Fed will raise rates to a range of 5.5% – 5.75% on September 20th.

Of course, the CME Fed Watch forecasts move up and down daily, per the latest economic and market data.

Housing & Mortgages

Mortgage rates climbed again in August, surpassing the 7% mark and landing at 7.36% for the average national 30-year fixed loan. The last time home loan rates climbed that high was December 2000.

(It’s worth noting that since 1953, the average annual 30-year-fixed mortgage rate is 7.18% based on data from Freddie Mac.)

Of course, high rates are deterring buyers from purchasing, seriously cramping affordability. While home prices have not plummeted as some anticipated thanks to record-low inventory, expect a pronounced slowdown in home sale volume until mortgage rates come down to earth.

Notable Quote

“The stock market is the story of cycles and of the human behavior that is responsible for overreactions in both directions.”

-Seth Klarman

Billionaire investor, hedge fund founder and CEO